Written by

Peter Sempelmann

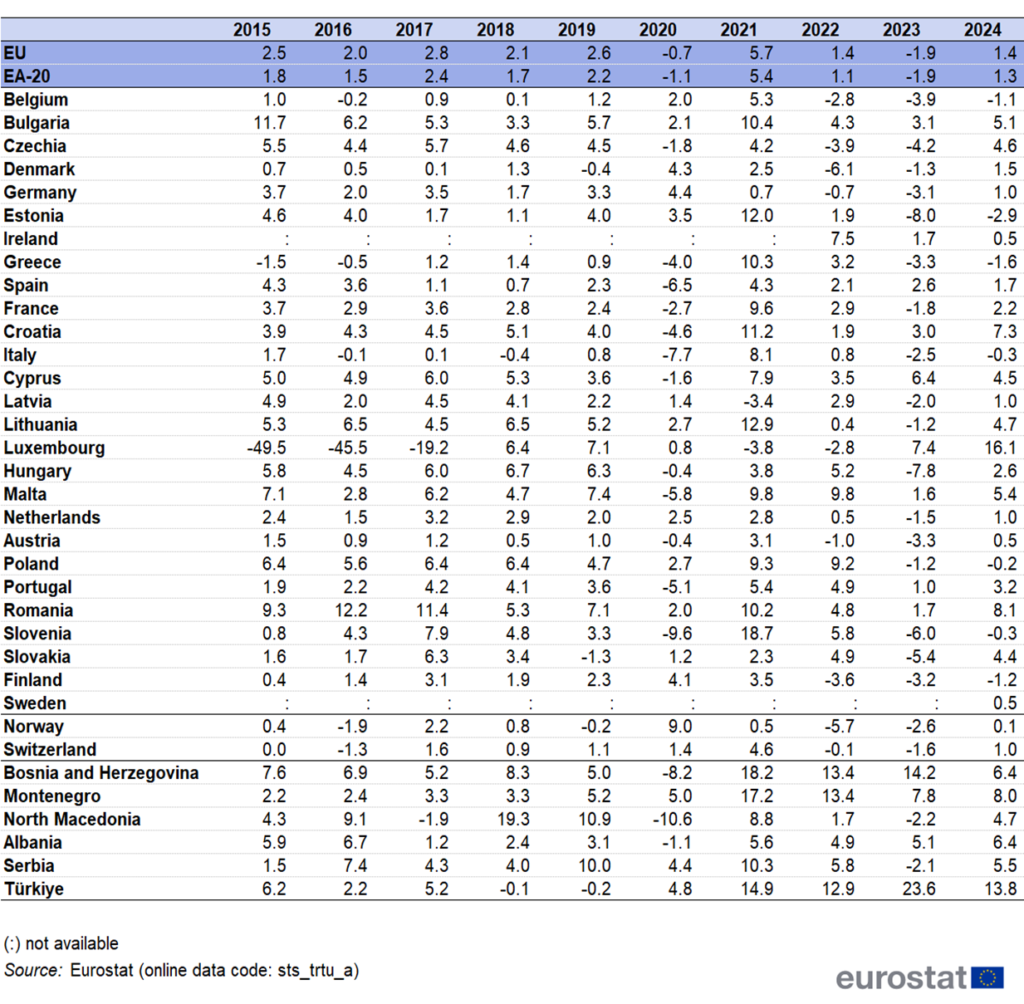

Over the last decade, retail trade volume has generally increased across EU Member States, but with substantial differences in magnitude, as data delivered by the statistical office of the European Union, Eurostat shows. Based on the observed trends, 2026 is likely to see continued divergence in national retail performance rather than uniform growth.

Looking back, between 2015 and 2019, all countries with available data recorded positive developments, reflecting favourable economic conditions. The sharp contraction in 2020 was visible across all Member States, though the scale varied significantly depending on national lockdown measures and consumption structures.

In 2021, a broad-based recovery took hold, continuing into 2022 but at a more moderate pace. In 2023, rising price levels contributed to declining retail volumes in many countries. By 2024 and 2025, retail trade volume increased again in several Member States, though growth remained uneven. Similar patterns are visible in selected third countries for which Eurostat publishes data, underlining the shared impact of the pandemic and subsequent inflationary pressures, while also reflecting national specificities.

In 2025, retail trade volume across the EU and comparator countries points to stabilisation rather than convergence. While most countries show volumes above their pandemic lows, the differences between national trajectories remain pronounced. This confirms that retail recovery has been shaped as much by structural factors as by cyclical ones.

Retail trade volume annual rates of change, 2015-2024; calender adjusted

EU regions and European third countries: development of retail trade and 2026 outlook

With overall EU retail volumes broadly stable, future developments will depend on country-specific consumption patterns and retail structures. For retailers operating across borders, the data reinforce the importance of flexible, hybrid strategies that can adapt to differing national market conditions rather than relying on EU-wide volume expansion.

Regions in detail

1) Western European EU Member States

Development

In Western European EU Member States, retail trade volume shows a mature and largely saturated pattern over the last decade. Between 2015 and 2019, volumes increased steadily but at a moderate pace, reflecting stable consumption, high market penetration and limited demographic growth. The COVID-19 shock in 2020 led to a sharp but comparatively controlled contraction, followed by a rapid recovery in 2021. Since 2022, however, retail trade volume growth has weakened noticeably. Rising price levels reduced real purchasing power, and by 2023–2025 retail volumes in many Western EU countries either stagnated or grew only marginally. The data point to structural stability rather than expansion, with consumption shifts occurring more between channels and product categories than through higher overall volumes.

2026 outlook

For 2026, Western European retail markets are likely to remain low-growth environments in volume terms. With demand largely saturated, future performance will depend less on macroeconomic expansion and more on operational efficiency, value positioning and omnichannel integration. Volume growth, where it occurs, is expected to be incremental rather than cyclical.

2) Southern European (Mediterranean) EU Member States

Development

The Eurostat data for Southern European EU Member States – excluding France – show a distinct retail trade volume pattern shaped by higher cyclicality and stronger sensitivity to economic shocks. In the period from 2015 to 2019, retail trade volume generally increased, but at a more moderate and uneven pace than in Central and Eastern Europe. Growth was supported by tourism-related consumption and gradual economic recovery following the sovereign debt crisis, yet remained structurally constrained by lower average purchasing power compared with Northern and Western Europe.

The COVID-19 pandemic had a particularly pronounced impact on retail trade volumes in this group of countries. The sharp contraction in 2020 reflects both strict lockdown measures and the sudden collapse of tourism flows. Although a recovery set in during 2021, retail volumes did not rebound as uniformly or as strongly as in some other EU regions. Inflationary pressures in 2022 and 2023 further weighed on real consumption, leading to stagnation or renewed declines in several Southern European markets. By 2024 and 2025, retail trade volume improved again, but in most cases remained only modestly above pre-pandemic levels, underlining a fragile and incomplete recovery.

Overall, the data point to structural vulnerability: retail trade in Southern Europe is more exposed to external shocks and price increases, and less supported by strong underlying volume growth.

2026 outlook

Based on the observed trends, the outlook for 2026 suggests moderate and uneven development in Southern European retail markets. While continued recovery in tourism and services may provide some support, Eurostat data do not indicate a strong acceleration in retail trade volume. Growth is likely to remain limited and dependent on domestic purchasing power rather than broad-based consumption expansion. For retailers, 2026 is expected to remain a year of cautious optimisation rather than volume-driven growth, with a continued focus on cost efficiency, pricing discipline and channel flexibility.

3) Western European EU Member States – including France, excluding Southern European (Mediterranean) countries

Development

For this group of states (Western European EU Member States including France but excluding Southern European Mediterranean countries), Eurostat data depict a highly mature retail landscape with limited long-term volume growth.

Retail trade volume stagnated or declined slightly in several countries during 2023, before stabilising again in 2024 and 2025. The markets have entered a phase of structural maturity, where changes in consumption patterns, channel shifts and pricing dynamics play a greater role than increases in total sales volume.

2026 outlook

Based on the developments observed up to 2025, the outlook for 2026 points to continued low or near-zero volume growth in the region. With demand largely saturated and demographic growth limited, Eurostat data suggest that retail performance will remain driven by efficiency gains and competitive positioning rather than expanding volumes. Incremental growth may occur in specific segments or channels, but at the aggregate level, retail trade volume is expected to remain broadly stable.

4) Central and Eastern European EU Member States

Development

CEE EU Member States show a more dynamic long-term development of retail trade volume compared with Western Europe. From 2015 to 2019, many CEE countries recorded stronger growth rates, reflecting economic convergence, rising incomes and expanding consumer markets. The pandemic-induced decline in 2020 was significant, but the rebound in 2021 was generally robust. While inflation-related pressures in 2022 and 2023 also dampened volumes in the region, the contraction tended to be less persistent than in more mature markets. By 2024 and 2025, retail trade volumes in several CEE countries resumed growth, supported by continued structural catch-up effects.

2026 outlook

In 2026, CEE retail markets are expected to outperform Western Europe in volume growth, albeit from differing national starting points. While price sensitivity remains high, the data suggest further convergence-driven expansion, particularly in non-food retail and modern retail formats. Growth is likely to be uneven but structurally supported.

5) Central and Eastern European non-EU Member States

Bosnia and Herzegovina, Montenegro, North Macedonia, Albania, Serbia and Türkiye

Development

In the Western Balkans and Türkiye, retail trade volume developments have been more volatile but structurally upward over the longer term. Prior to the pandemic, most of these countries experienced solid retail volume growth, driven by income growth, urbanisation and formalisation of retail structures. The COVID-19 shock caused sharp declines in 2020, followed by strong recoveries in 2021. Subsequent developments, especially in 2022–2024, reflect heightened sensitivity to inflation, exchange rate movements and domestic economic conditions. Compared with the EU, fluctuations are stronger, but long-term retail expansion remains visible.

2026 outlook

For 2026, retail trade volume in these non-EU markets is expected to remain growth-oriented but unstable. Structural expansion of modern retail supports medium-term growth, but short-term outcomes will continue to depend heavily on macroeconomic stability and price dynamics. Retailers will need to balance expansion opportunities with higher volatility risks.

6) Western European non-EU Member States

Norway and Switzerland

Development

Norway and Switzerland display highly stable but structurally constrained retail trade volume trends. As mature, high-income economies, both countries showed modest growth before 2020, followed by a pandemic-related decline and a swift recovery. Since 2022, retail volumes have remained broadly flat, reflecting limited population growth and high market saturation. Inflation effects are visible in turnover figures, but volume developments remain subdued. Overall, retail trade in these markets behaves similarly to Western EU countries, though with even lower volatility.

2026 outlook

In 2026, retail trade volume in Norway and Switzerland is likely to remain largely flat, with minimal cyclical movement. Growth strategies will continue to focus on premiumisation, service quality and omnichannel optimisation rather than volume expansion.

Overall regional conclusion

The Eurostat data confirm a clear regional pattern:

- Western Europe and EFTA markets are in a phase of volume consolidation.

- CEE EU countries continue to benefit from convergence-driven growth.

- Western Balkans and Türkiye combine long-term expansion potential with higher volatility.

For 2026, retail trade volume growth across Europe is expected to remain uneven and structurally driven, reinforcing the need for region-specific strategies rather than uniform European assumptions.