ACROSS: Takko recently announced an ambitious expansion strategy. What specific goals are you pursuing?

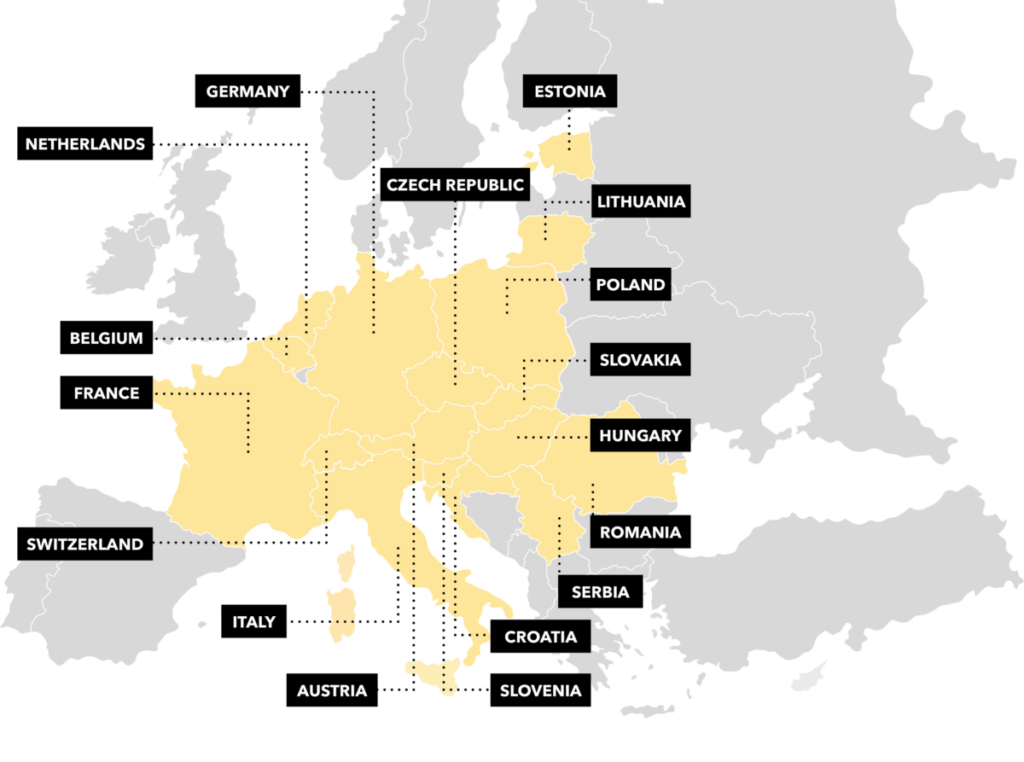

Oleg Krüger: Takko has experienced substantial like-for-like growth in recent years, bucking the general market trend. We are now building on this positive momentum and strengthening our expansion activities in a targeted manner. With the help of modern data analysis, we have investigated which regions still have so-called “white spot” potential – i.e., geographical gaps in which we are not yet, or only weakly, represented, but which offer an attractive market environment. It has become clear that our core markets, Germany, Austria, and the Netherlands, still have considerable untapped potential. These white spots were once barely visible, but today we can identify them with great precision thanks to modern analysis tools. We have therefore already begun to focus more strongly on these three markets. Approximately 90% of our planned expansion will take place there.

ACROSS: What is the actual figure for the stores, and what is the target figure?

Krüger: We are currently on the verge of surpassing the 2,000-store mark – a significant milestone on our expansion path. Based on the opportunities we have identified, we have set ourselves an ambitious target: to open 300 new stores by 2028.

ACROSS: What are your criteria when choosing a location?

Krüger: We want to be present where people regularly shop – in other words, near supermarkets, drugstores, and other local suppliers. We focus on locations with a high supply character, whether in a retail park, city center, or shopping center. Locations with fewer than 10,000 inhabitants are currently not our focal point.

ACROSS: Which retail formats do you prefer?

Krüger: Approximately 1,500 of our nearly 2,000 currently operating stores are situated in retail parks. The rest are located in city centers and shopping malls. But whether it’s a retail park, a pedestrian zone, or a mall, the only thing that matters to us is the retail environment. If retailers such as REWE City, dm, or Deichmann are next door, then Takko fits in between. We are currently focusing on the trend towards inner-city reurbanization and the associated resurgence of food retailers in medium-sized towns. This certainly presents a growing and attractive environment for us. In general, our preferred sales area is between 400 and 450 sq m; in individual cases, we also consider areas as small as 350 sq m, provided the layout is suitable.

ACROSS: Is there a difference in performance between the branches in shopping centers and retail parks?

Krüger: Retail parks are still more profitable, simply due to their lower ancillary costs. But the performance in shopping centers is also strong. That’s why we view them as complementary, not as either-or. Our strategy is to occupy both suitable locations within the catchment area.

Takko Fashion does not choose between a shopping center, high street or a retail park, but rather strives for a uniform, high-quality standard.

ACROSS: Does your digital strategy, especially omnichannel, play a role in your choice of location?

Krüger: Not at all: bricks-and mortar retail is our core business. Our online shop is a vital marketing tool, but it also serves as a source of inspiration and is fully integrated with our stationary range. A store finder and the option to check product availability in the physical stores help to inspire customers to shop in their nearest Takko store. Also, around 40% of online orders are delivered to stores today, where they are tried on, bought, or returned. This is precisely our goal: to attract customers to our stores through the online platform, thereby generating additional sales. Our customer is also still a traditional, brick-and-mortar shopper.

ACROSS: How do you differentiate yourself from the competition?

Krüger: We provide quality fashion for the whole family, at discount prices that everybody can afford. This concept works – our growth is impressive proof of this. We have a very clear positioning, also meaning we offer our customers reliability in our product range, pricing, and local availability. We combine local supply with fashion that works. And in spaces that are also attractive to real estate owners, because we are stable tenants with longterm contracts.

ACROSS: The European retail landscape is characterized by a polarization between premium and discount. How do you perceive this development?

Krüger: We are observing this trend. We can see that the price-sensitive segment is gaining relevance – not only in our sales figures, but also in our increasing awareness and attractiveness within the retail real estate sector. Takko offers reliable, high-quality fashion at discounted prices, which is increasingly attracting the attention of project developers, shopping center operators, and portfolio managers who would not have previously worked with us. We are also increasingly being asked for A-locations. Our performance and reliability make us a sought-after tenant.

ACROSS: Part of the polarization trend is that the middle ground needs to be redefined. Recently, traditional providers in the so-called middle have disappeared from the market. Are you now occupying this new middle ground with your concept?

Krüger: I struggle with the term “middle” or “new middle”. “Center” is a bit of everything and somehow nothing. All the new stores we have opened in the last two years have performed above our expectations. Our concept, the products, and our choice of location hit a nerve – whether this serves the center is ultimately a matter of definition. For us, it’s all about precise positioning and absolute reliability for customers and partners.

ACROSS: Shopping center operators are now opening up to discounters – something that was previously unthinkable. How did this development come about?

Krüger: It was a two-way process. On the one hand, the pandemic has made it very clear that even shopping centers cannot grow indefinitely – trees do not grow to the sky. It became evident that the portfolio of potential tenants is limited. During this time, many shopping center operators realized the importance of having reliable partners – in other words, retailers who remain stable even in times of crisis, pay their rents reliably, and consistently bring customer foot traffic to the centers. This has further strengthened our profile as a solid, crisis-proof tenant. On the other hand, we are currently experiencing the growing appeal of the discount segment, which resonates with the times and is highly relevant for many customers. This makes our concept even more appealing from the perspective of shopping center operators. We can offer precisely what is currently in demand: an attractive price-performance ratio combined with a professional appearance.

ACROSS: What role does rent development play in this?

Krüger: Space prices in shopping centers are now approaching a reasonable level, aligning with the market again. The difference to retail parks, which was sometimes huge in the past, has narrowed considerably. This makes our presence in shopping centers even more economically attractive for us.

ACROSS: What was your part in this mutual rapprochement with the shopping center and high street world?

Krüger: We have fundamentally revised our store design, in particular in recent years. Our new store concept also fits perfectly into the more sophisticated environment of a shopping center. We believe price awareness and high-quality store concepts are not mutually exclusive – on the contrary, we see this as a strength of our business model. We have also analyzed our existing shopping center locations comprehensively and determined that we have the right space. Wherever we are represented with the appropriate space concept, we are also very successful.

ACROSS: You say that one of the main factors in the change or adaptation was the store design. What makes the store design special, and to what extent does it contribute to the attractiveness of the Takko brand as a rental partner?

Krüger: We modernize around 100 stores every year as part of our modernization program. Our goal is to provide our customers not only with attractive prices but also a pleasant, contemporary shopping experience. We have been implementing our new store concept for approximately three years, which we continuously refine and improve. It’s all about modern store architecture, clear customer guidance, and a higher quality of stay. Many landlords are surprised when they enter a current Takko store – it no longer corresponds to the old image of a discount store. In shopfitting, we do not choose between a shopping center or a retail park, but strive for a uniform, high-quality standard.

ACROSS: A slightly more provocative question is when a shopping center operator states that a retailer like Takko is performing excellently in all locations with the same concept: What is the difference between a shopping center and a retail park?

Krüger: The central distinguishing feature is the location. Retail parks are typically situated on the outskirts of cities or greenfield sites, and are primarily geared towards regular, purpose-oriented supply. Shopping centers, on the other hand, are typically located in integrated areas or city centers, focusing more on leisure, shopping, and experiences. Both formats cater to different customer needs and shopping situations, enabling us to cover both effectively. As I said, for us, it’s not a question of “either-or,” but a clear “both-and.” This is also one of the reasons we have set a target of 300 new stores in three years: we are convinced that our concept is effective in all formats.

ACROSS: But the product range remains the same – both in the retail park and in the shopping center?

Krüger: Yes, the product range is the same, but the environment is crucial. In many shopping centers, you will find a clear structure by level. One floor, for example, is dedicated to everyday needs: this is where grocery retailers, drugstores, or other price-oriented providers are usually located. And this is exactly where we fit in perfectly with our discount concept. The upper floors are often home to classic fashion and lifestyle retailers, as well as food outlets, offering the quintessential shopping experience. Our concept perfectly complements the local supply and price focus of the lower levels. There is nothing contradictory about the fact that we are represented in both the retail park and the shopping center; on the contrary, we are a valuable addition to both formats.

ACROSS: How do you see the future of the discount segment? Do you believe that consumer interest will remain in the long term?

Krüger: Data and market analyses clearly indicate that demand for price-sensitive products will remain high. Consumers have learned to compare prices, become more price-conscious, and continue to prioritize quality. This is precisely what we offer: an attractive price-to-performance ratio that fosters trust and confidence. There are no signs that this trend will reverse in the foreseeable future. Additionally, especially in economically challenging times, the discount segment is becoming increasingly relevant for many people.

ACROSS: What are your expectations for the consumer market in the coming years?

Krüger: The demand for quality at a reasonable price will remain, as all our analyses show. We believe that discounters will continue to grow as long as they meet the demands for quality and customer experience. We see considerable potential here. The retail landscape is changing, and customers are now hybrid, combining luxury and discount in all areas, whether in fashion or food retail. The entire retail real estate sector would therefore benefit from continuing to embrace new concepts.

Oleg Krüger

Oleg Krüger is the Senior Director Expansion & Construction at Takko Fashion