by Jean Carlos Delgado

Over the past few weeks, I’ve spoken with experts across Europe—accessibility certifiers, safety and resilience specialists, property managers implementing ESG strategies, and technology leaders driving community engagement – to understand how retail and mixed-use properties are making the “S” in ESG a reality. What I found wasn’t just experimentation or marketing talk – it was a practical shift happening on the ground: certifications being earned, tools being deployed, tenants being engaged.

This piece brings together those insights. From data-backed accessibility strategies and safety certification frameworks to technology that drives tenant collaboration, it’s clear that social ESG is no longer soft or secondary. It’s a competitive capability, and the properties investing in it today are shaping the standard for tomorrow.

Jean Carlos Delgado

Jean Carlos Delgado is Brand and Marketing Director, HyperIn Inc.

The “S” in ESG: Why It’s Finally Getting Serious

While reflecting on the growing role of ESG in real estate, I found myself thinking about what each letter truly represents in practice. The environmental and governance aspects often get the spotlight, backed by data, targets, and well- established frameworks. But the Social side – the “S” – seems to be the least understood, and perhaps the least implemented.

That curiosity led me to ask Federico Waltari, Property Operations Director at CBRE Finland, why ESG – especially the social side – is becoming a key focus in Nordic retail real estate. His answer came with a candid assessment.

“When we look at the environmental side of ESG, most of the low-hanging fruit has already been picked. The results are visible in lower energy consumption and reduced emissions. However, the social aspect, which brings benefits to communities, tenants, and vendors, is only now being recognized as a more critical component of ESG as a whole by the real estate market.

It’s not just a box to tick. Federico shared that shopping centers and business parks are starting to embrace the social side of ESG in tangible ways—partnering with mental health and well-being organizations, hosting community events such as cleaning days or art workshops, and even organizing charity auctions. These initiatives go beyond compliance – they create real engagement between places and the people who use them.

“In addition to the more established environmental certifications, like BREEAM or LEED, we’re now also seeing more assets pursue wellbeing-focused certifications such as WELL. These help us ensure that the spaces – and the amenities within them – support healthy and sustainable experiences for everyone who uses them.”

Federico has worked on ESG initiatives across retail, office, and logistics properties. Together with his team at CBRE Property Management, he’s helping asset owners take a broader approach—one that combines environmental and social goals to create more sustainable and attractive properties.

Accessibility: From Obligation to Opportunity

As I continued exploring the social dimension of ESG, one question kept recurring: how do we ensure that spaces are truly inclusive – not just in principle, but in practice?

That led me to Access4you, a social impact company founded by Balázs Berecz, who has been a wheelchair user since 2005. Their work centers on auditing, certifying, and qualifying accessibility in the built environment, from shopping centers to office buildings and retail chains.

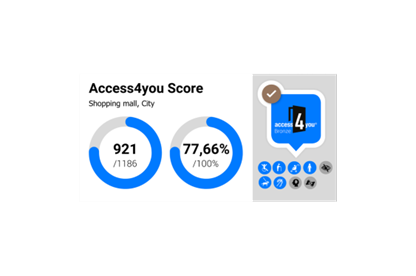

They utilize a structured, data-driven system to audit properties for 8+1 user groups living with disabilities. Buildings receive a rating from Certified to Gold, and the resulting data supports landlords, investors, tenants, and end-users alike.

When I asked how this contributes to ESG goals, Balázs made a key point: “Detailed and reliable information in itself is also a form of accessibility… The S pillar is hardly measurable, but accessibility is.”

I also asked if their work had made a measurable difference. Balázs shared a compelling case: “One of our clients, Multi, shared that receiving detailed accessibility data through our audit and certification significantly contributed to the Allee Shopping Centre in Budapest earning an Excellent’ BREEAM In-Use rating.”

And what about broader market trends? Balazs notes growing momentum: “We’re seeing more and more demand across the CEE region. Retailers like Auchan and Media Markt are not only certifying but regularly re-certifying their spaces. Accessibility is being treated as an ongoing responsibility.”

Talking to Balazs made one thing clear: accessibility isn’t just a checklist – it’s a measurable, meaningful way to bring the social pillar of ESG to life. It’s also a reminder that when inclusion is treated as an ongoing process, everyone benefits.

Making Safety a Strategic ESG Pillar

In most ESG conversations, safety shows up late, if at all. That surprised me. In a world grappling with blackouts, public security threats, and operational vulnerabilities, I couldn’t help but wonder: Why isn’t safety treated as a central pillar of ESG? That question led me to Safe Asset Group (SAG), a company redefining how safety and resilience are embedded into real estate strategies.

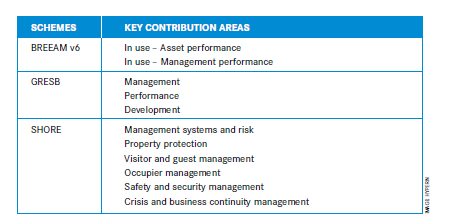

Through their global SHORE certification – tailored for hospitality, office, retail, and exhibition spaces – Safe Asset Group positions safety not as a technical detail, but as a pillar of governance and social responsibility. Especially in the Nordics, expectations from regulators, tenants, and visitors are rising fast.

“Safety has become a crucial part of the ESG agenda,” explains Erik Engstrand, CEO of SAG/ SHORE. “It directly impacts social trust and long-term resilience.”

What makes certifications like SHORE so relevant is their strategic weight. Certified assets Aren’t just safer – they’re more competitive. Erik highlights Frolunda Torg in Sweden, which now holds the world’s highest SHORE score. Their proactive safety culture – grounded in risk assessments, crisis simulations, and tenant engagement – has significantly improved reputation, reduced liability risks, and strengthened stakeholder confidence.

The future of safety in ESG lies in the full integration of operational risk management directly into sustainable business practices. Real estate owners are beginning to understand that safety isn’t just a physical or regulatory issue – it’s a governance imperative. As Erik puts it, “It’s not just about compliance anymore. It’s about actively managing risk to protect people, assets, and reputation.”

This signals a broader shift in ESG thinking –from passive box-checking to active risk stewardship. Certifications like SHORE aren’t optional extras; they’re investments in resilience, signaling long-term responsibility and operational readiness. Safety is no longer the silent partner in ESG – it’s becoming its cornerstone.

Tenant Engagement: Technology as an ESG Enabler

One theme kept surfacing in my conversations: ESG success doesn’t just depend on reporting frameworks – it depends on how well people are engaged. Tenants, property teams, and communities. Without them, ESG stays abstract.

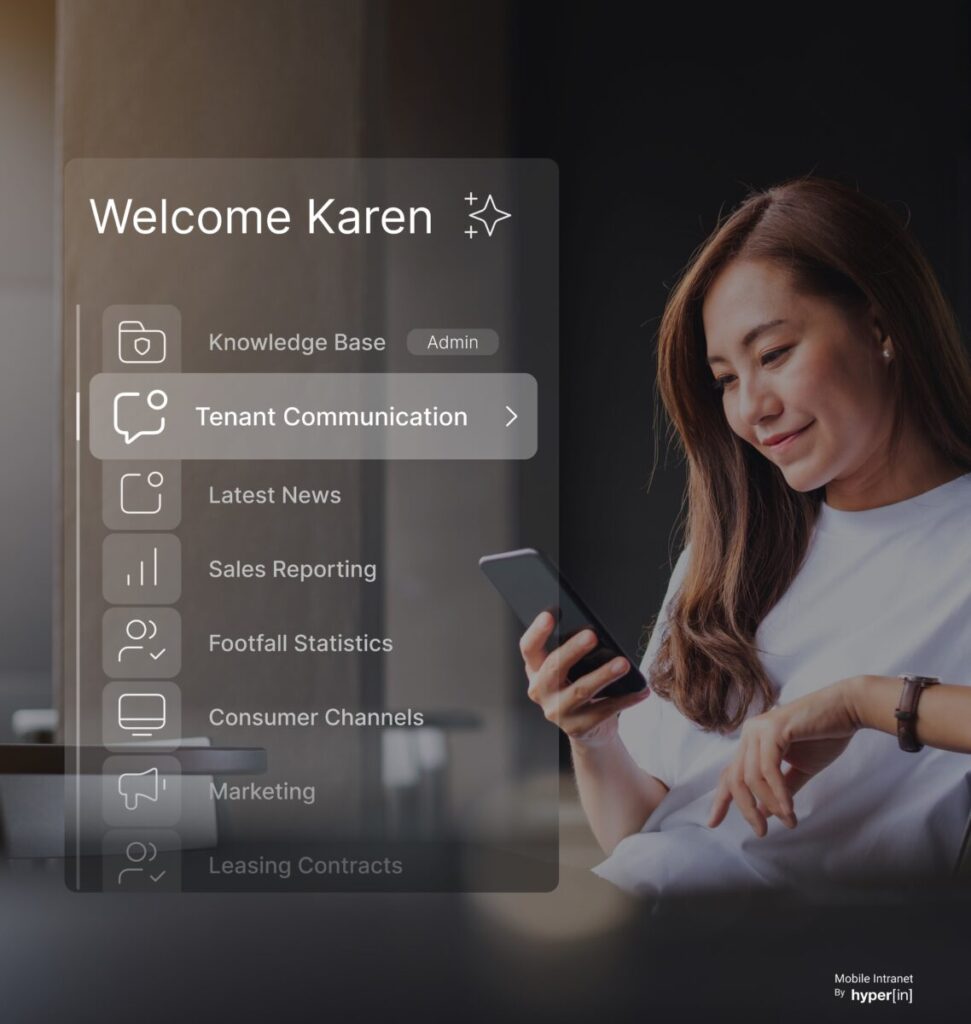

Curious about how technology could enable this kind of engagement, I spoke with Markus Porvari, CEO of HyperIn. His answer was straightforward: participation needs structure, and structure needs tools. “ESG goals won’t be met through reporting alone. It takes people who are engaged, informed, and connected. Our role is to make that happen, not just with data, but with tools that activate real participation.” Markus Porvari added.

HyperIn’s mobile intranet empowers real estate operations with seamless ESG integration. It centralizes ESG initiatives, enabling seamless communication across departments, properties, and tenants in a single, structured space. It fosters tenant engagement by supporting energy-saving and recycling programs that go beyond awareness to participation. And it enables data-driven decisions, helping property teams monitor key ESG metrics and stay ahead of evolving regulations.

From reducing operational waste to increasing tenant participation in energy efficiency efforts, the platform also supports major ESG schemes— BREEAM, GRESB, and SHORE – by embedding structure, data, and measurable actions into day-to-day management.

The results are tangible. Clients using HyperIn have achieved a 15% reduction in carbon emissions, a 74% tenant participation rate in sustainability programs, and a 25% drop in ESG-related admin time.

“Every property talks about ESG. But the ones that lead are the ones that make it operational. That’s where technology—and especially tenant engagement – makes the difference between promise and performance.” – Markus Porvari, CEO, HyperIn.

As ESG expectations continue to evolve, what will separate leading properties from the rest won’t just be how they measure success, but how they mobilize the people and systems behind it.

Final Thought

What started for me as a question about the elusive “S” in ESG ended with something much clearer: Social ESG isn’t a checkbox. It’s a capability. It’s found in how we treat accessibility, how we manage risk, and, most importantly, how we engage people.

The most effective strategies I encountered weren’t the loudest or most heavily marketed. They were the most operational – the ones built into systems, daily processes, and shared ownership across tenants, staff, and leadership.

And that’s where I think the future lies, not just in better frameworks, but in better followthrough. We already have the knowledge, the tools, and the need. What we require now is alignment and the willingness to act on it.