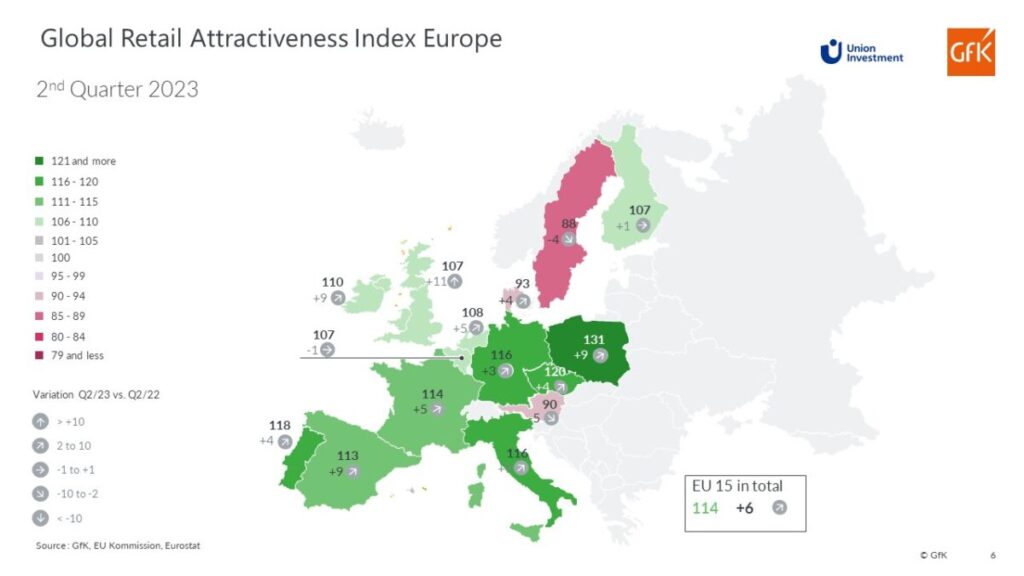

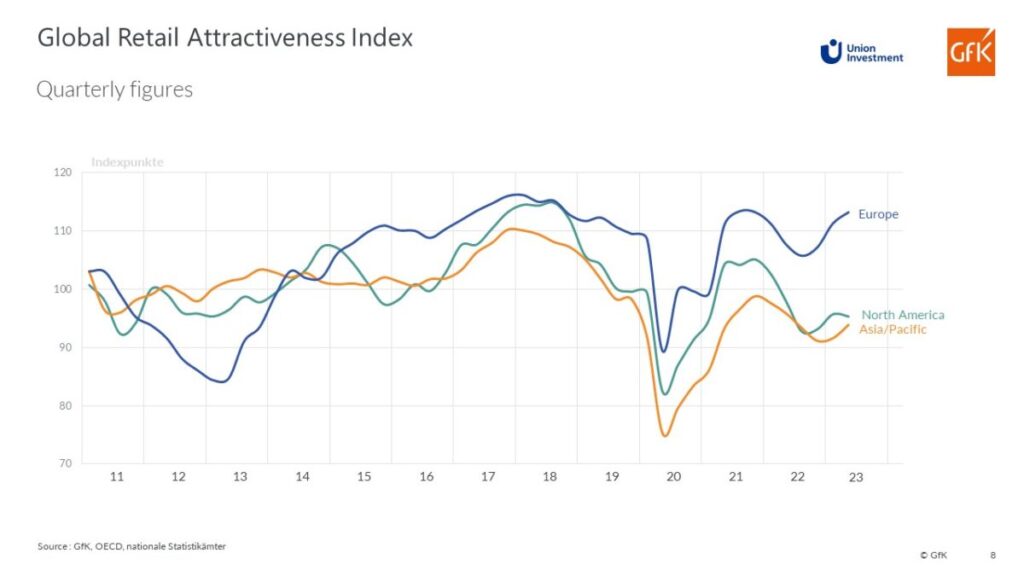

As early as the first quarter of 2023, Union Investment’s Global Retail Attractiveness Index (GRAI) showed tentative signs of recovery in individual European retail markets. This recovery gained strength and breadth in the second quarter. After the trend pointed upward in the first quarter for six of the 15 European countries included in the GRAI, eleven countries posted year-on-year gains in the second quarter. The increases were particularly significant in the UK, Poland, Spain and Italy, with nine and ten points respectively. Within a year, the Retail Index for Europe has risen by almost six points to a good level of 113 points.

“In addition to the positive trends in the labor market and retail sales that have been evident for some time, the rise in consumer sentiment in most European countries now also gives us reason to hope that the recovery will continue across the board and that markets will return to their pre-pandemic attractiveness levels,” says Roman Müller, Head of Retail Investments at Union Investment.

The reasons for the increase in the EU-15 index: Consumer sentiment (85 points) improved by eight points within a year. The labor market (137 points) and retail sales (135 points) are up by six and even nine points, respectively, compared with the previous year’s second quarter. By contrast, sentiment among retailers (100 points) remained virtually unchanged.

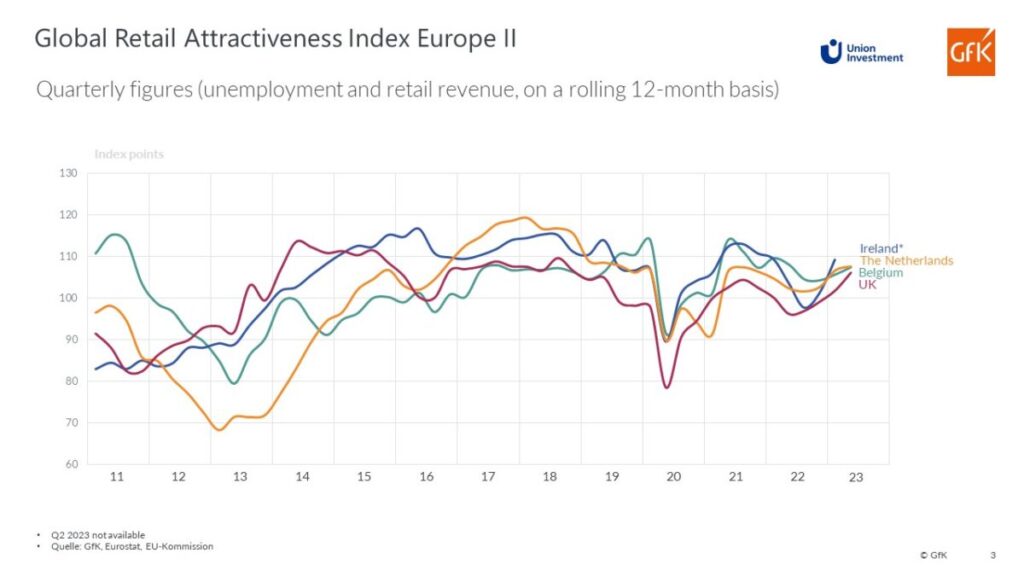

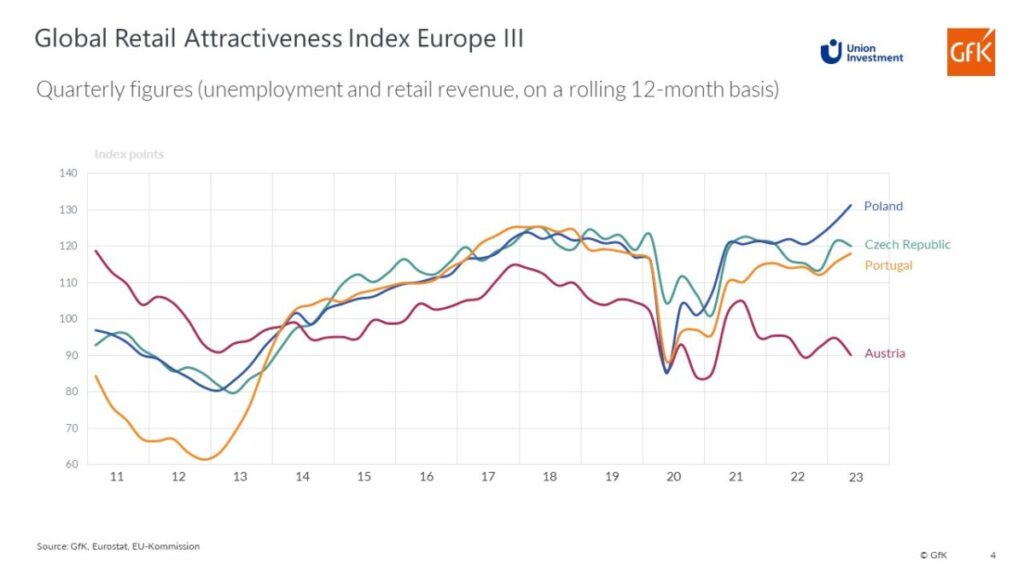

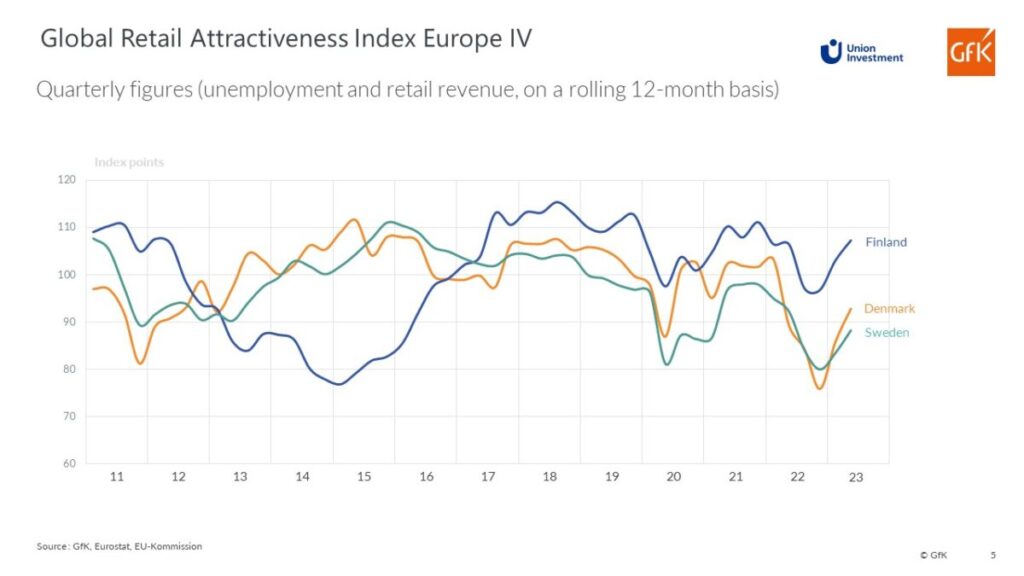

The country ranking in the EU-15 index continues to be led by Poland (131 points) and the Czech Republic (120 points), followed by Portugal (118 points). Germany and Italy also remain in the top five, each with 116 points. In Germany, the Retail Index increased by three points. Bringing up the rear in Europe at the end of the second quarter of 2023 are Sweden (88 points), Austria (90 points), and Denmark with 93 points. Sweden and Austria also suffered the most significant losses compared with the previous year, falling by four and five points respectively.

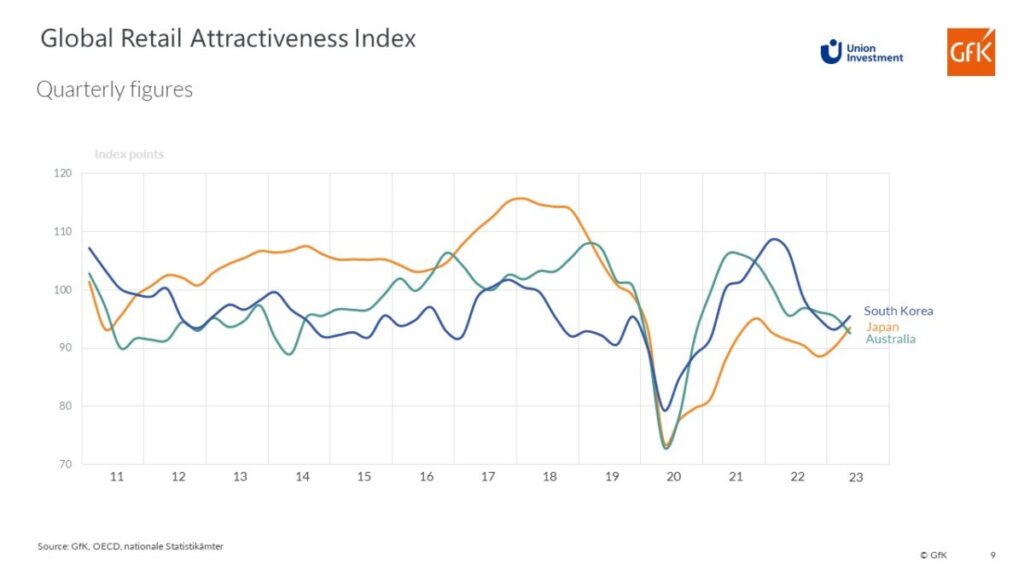

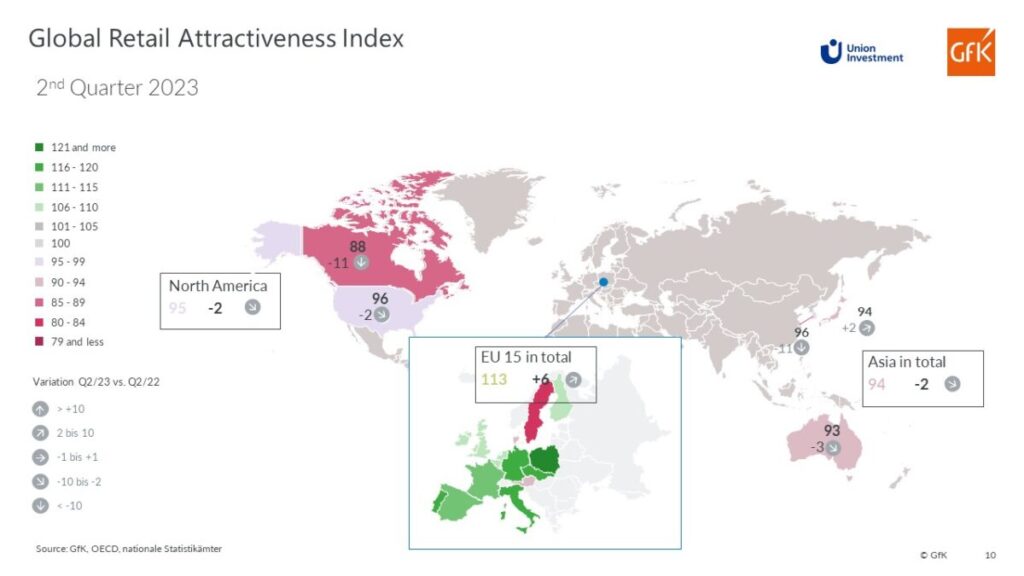

While the EU-15 index can improve its level, the recovery in North America and Asia is still a long time coming. The North American index in the GRAI lost slightly (-2 points) and was thus 18 points below the European level at the end of the second quarter. The Retail Index in Asia/Pacific also lost two points. The gap to the EU-15 index thus widened to 20 points. Except for Japan, which improved slightly by two points, all the countries in the two overseas regions declined year-on-year in the second quarter. The most considerable losses, eleven points each, were suffered by Canada (88 points) and South Korea (96 points). The Canadian retail market thus remains at the lowest position in the GRAI’s global country ranking.

Click to enlarge

Key Facts

The Retail Index for Europe (EU 15) continues its slight recovery in the second quarter of 2023. The indicator has 113 points, an increase of almost 6 points compared to the previous year.

On the one hand, consumer sentiment is rising, and the labor market and retail sales are also growing within a year. Consumer sentiment (85 points) is up 8 points, while jobs (137 points) and retail sales (135 points) are up 6 and 9 points respectively, from Q2 2022. In contrast, retail sentiment (100 points) is almost unchanged at -1 point.

As far as the level of the Retail Index is concerned, at country level, Poland (131 points) and the Czech Republic (120 points) are currently at the top, followed by Portugal (118 points), Italy, and Germany with 116 points each. At the bottom of the table in Europe are Sweden (88 points), Austria (90 points) and Denmark with 93 points.

The biggest gains are in the UK (+10 points) and Italy, Poland and Spain, each with +9 points. Austria, with a minus of 5 points, and Sweden (-4 points) have to accept losses.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Methodology

Union Investment’s Global Retail Attractiveness Index (GRAI) tracks the attractiveness of the retail markets of 20 countries in Europe, the Americas, and Asia-Pacific. A score of 100 index points represents an average rating. The EU-15 index includes the indices of the EU countries Sweden, Finland, Denmark, Germany, France, Italy, Spain, Austria, the Netherlands, Belgium, Ireland, Portugal, Poland, and the Czech Republic, plus the UK, weighted by their respective populations. The North America Index includes the indices of the USA and Canada; the Asia-Pacific Index includes Japan, South Korea, and Australia.

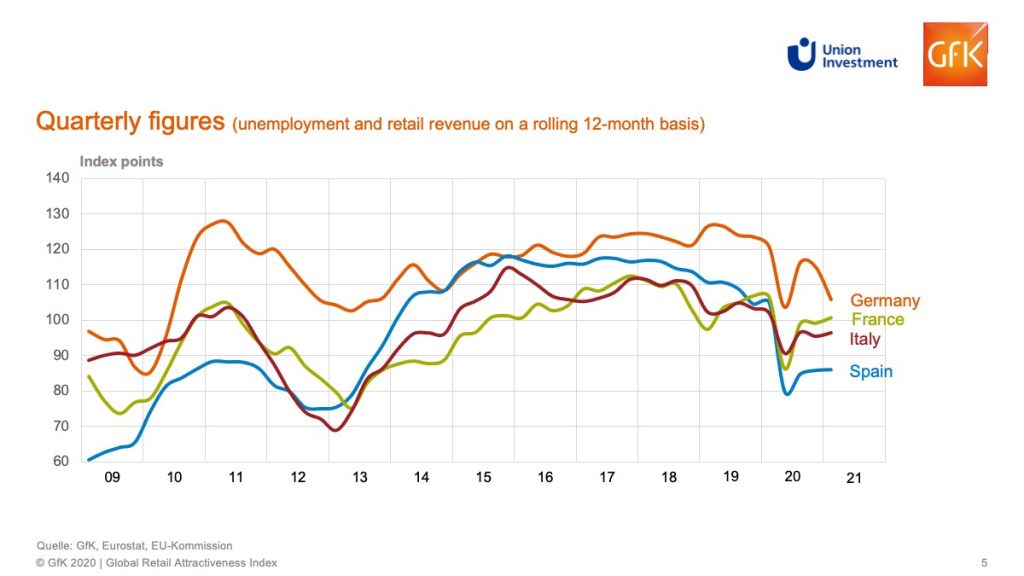

Determined semi-annually by the market research company GfK, the Global Retail Attractiveness Index comprises two sentiment and two data-based indicators. All four factors are equally weighted, i.e., 25 percent each, in the index. Both demand-side sentiment (Consumer Confidence) and supply-side sentiment (Business Retail Confidence) are included in the index. The change in unemployment and the development of retail sales (rolling 12 months) are included in the GRAI as quantitative input factors. After standardization and transformation, the input factors have a mean value of 100 and a theoretical range of 0 to 200 points. The index is based on data from current sources from GfK, the EU Commission, OECD, Trading Economics, Eurostat, and the national statistical offices. The changes shown refer to the corresponding period of the previous year (Q2, 2022).