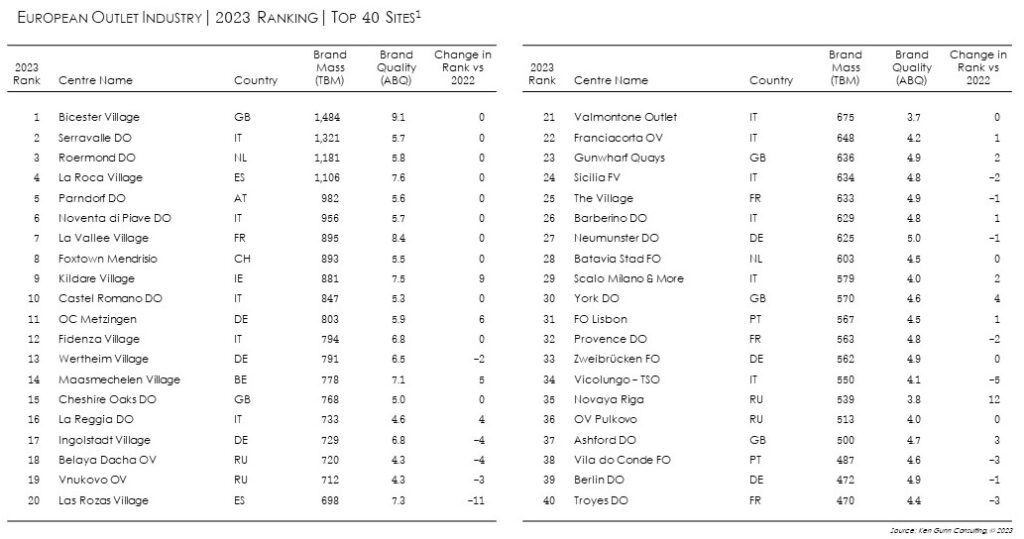

The European ranking methodology is designed to reflect turnover rather than sales density. As a result, the positioning of sites reflects a combination of scale and brand mix. The ranking is published annually and is based upon a review of all brands present at all trading outlet centres every summer.

Sites at the top of the European ranking have large footprints, dominant competitive positions, above average brand quality (European Average ABQ is 4.2) and tend to serve international and elite domestic guests. As a result, the positions of the top 40 sites are relatively stable and this leading group is increasingly difficult for challenger sites to break into. Four operators manage twenty-eight of the top forty sites and the ranking positions of the top eight outlet centres is unchanged from 2022.

While Europe’s outlet centres are spread across 30 nations, 30 of the top 40 sites are located in just 5 countries. Italy has 11 centres in the top 40, Germany has 6, the UK has 5, France has 4 and Russia has 4.

Focussing on the top 20 sites, Kildare Village is the most improved outlet centre in 2023/24. A 5,100 sqm extension (29 shops and 2 restaurants) in 2021 brought American Vintage, Claudie Pierlot, Elemis, Hugo, Lui Jo Umo and Oscar Graves to the site, which has climbed 9 places to 9th in the European ranking.

Outlet City Metzingen rose 6 places to 11th spot, with the arrival of Roberto Cavalli, Dr Martens, Thomas Sabo and Rapha.

Maasmechelen Village added Kenzo, Vans, Zadig & Voltaire, Rituals and Longchamp and has risen 5 places to 14th position.

La Regia DO added Napapijri, Plein Sport, Kappa, Hugo and Barbuti and has risen 4 places to 16th spot.

Russian centres such as Belaya Dacha OV and Vnukovo OV have declined as international brands quit the country. However, Novaya Riga has improved 10 places to 35th position as the centre continues to mature after opening in 2019.

Outside the top 40 sites, recent developments such as West Midlands DO (+11 places) and San Marino OE (+22 places) are making strong progress. Paris-Giverny DO entered the ranking in 48th place and will challenge the top 40 when the next edition of the rankings is published in September 2024.

Added value investment

The dynamic nature of turnover leases encourages outlet centres to strengthen and improve income. Growth is not limited to new assets and is not always driven by floorspace extensions. The incentive for investors to improve is substantial, as every step up the European hierarchy can triple the capital value of an asset. It is therefore not a surprise that owners and operators continue to invest heavily in their outlet centre holdings. This includes creating appropriate space for key brands, attracting new brands, increasing occupancy, improving environments, remerchandising and evolving retail mix to suit the new post-pandemic customer paradigm.

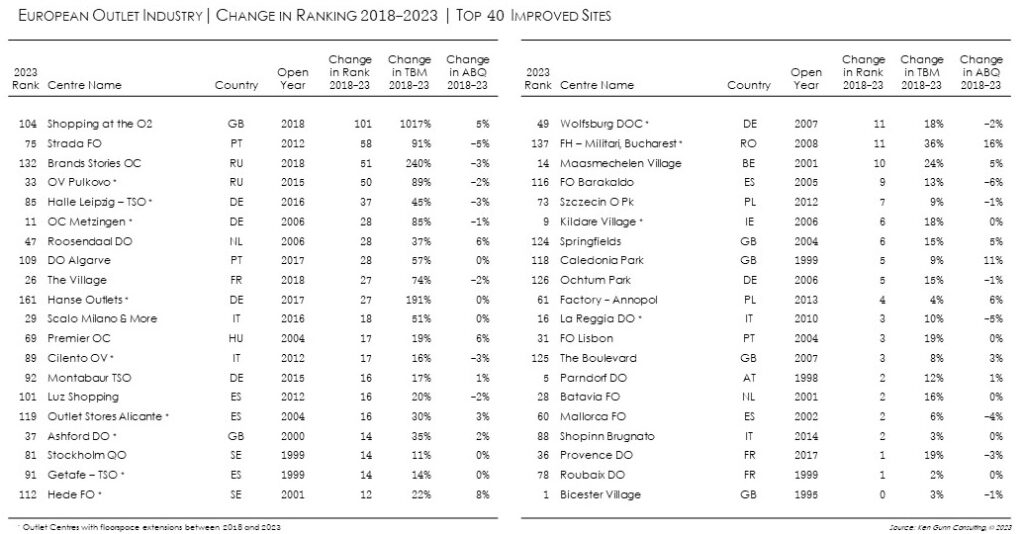

It is unusual for the results of asset management activity to be realised in a single year. So it is important to review change over a longer period, to fully understand the impact of asset management on sites. The table below shows the most improved sites over the period between 2018 and 2023.

Investment, strong operators and maturation (at recently opened sites) continue to improve the proposition at established sites. The table shows that outlets throughout the rankings have improved their positions, with 27 of the most improved sites falling outside Europe’s top 40. So growth isn’t exlusive to the leading operators, the largest investors or particular countries.

Maturing sites– improved occupancy

There is a noticable concentration of maturing outlet centres amongst Europe’s most improved sites. For example, since opening in 2018, Outlet Shopping at The O2 (formerly Icon DO) has improved occupancy by attracting brands such as French Connection, Luke, Reiss and Superdry. This has elevated The O2 101 places to 104th spot in the European ranking.

Brand Stories in Yekaterinburg (RU) also opened in 2018. Twenty openings in 2021/22, were followed up by twenty- four new stores in 2022/23, with new brands including Amazing Red, Ecco, Marc O’Polo, Mustang and Snow Queen. As a result, Brand Stories has climbed 51 places to 132nd position during the last five years.

The Village (FR) near Lyon, achieved strong trading performance from the outset. This has attracted quality entrants such as Armani, Iro Paris, Longchamp, Pierre Herme Paris and Under Armour and brand mass (TBM) has increased by 74%. As a result, The Village has climbed 27 places from its initial 53rd spot at opening, to 26th position today.

Extended sites – additional brands

Elsewhere, a number of older assets have benefited from extensions. For example, Ashford DO (UK) was expanded by 50 shops in 2019, adding 7,400sqm. Since then, new entrants have included, Hugo, Jack & Jones, Loake and Rituals, improving brand mass (TBM) by 30%, quality (ABQ) by 2% and Ashford DO’s European ranking 10 places (to 37th).

Hede FO (SE) has improved brand mass (TBM) by 22% and brand quality (ABQ) by 8% since 2018. VIA Outlets expanded the scheme by 3,200sqm in 2019 and has continued to attract superior brands including Lacoste, Michael Kors, Polo Ralph Lauren and Under Armour.

Fashion House Militari (RO) was expanded by 3,600 sq m in 2020. New brands include Boss, Calvin Klein, Cacharel, Marc O’Polo, River Woods and Tommy Hilfiger increasing brand mass (TBM) by 36% (compared to 2018) and average brand quality by 16%. The site has climbed from 148th position in 2018 to 137th place in 2023/24.

Enhanced sites – improved brand quality

The table also highlights that age does not prevent outlet assets from improving. For example, Springfields (UK) has improved brand mass (TBM) and quality (ABQ) by 15% and 5% respectively, since 2018. Recent entrants include Levi’s, Jigsaw, Dune London, Osprey London, Saltrock and Skopes, lifting the site 6 places in the ranking.

Caledonia Park, UK (formerly Gretna Gateway) has improved brand mass (TBM) by 9% and quality (ABQ) by 11% since 2018. Entrants include Dune London, Kate Spade New York, Levi’s, Murmur and Radley, elevating the site 5 places in the ranking.

The operator of Premier Outlets Center (HU) was changed to Retail Outlet Shopping (ROS) in 2017. ROS has worked diligently to strengthen the offer with leading brands, including Boss, Guess, Karl Lagerfeld, Superdry, Under Armour and Vans. This has increased brand mass (TBM) by 19% and brand quality (ABQ) by 6%, lifting the asset 17 places to 69th in Europe.

These examples are just a snapshot of activity across Europe. Notable progress has been achieved at many other schemes including Ochtum Park (TBM +15%), Lisboa FO (TBM +19%), Batavia FO (TBM +16%) and DO Parndorf (TBM +12%).

When measured over several years, it is clear that the most successful outlet centres never stop evolving. The volume of improvement across the 2023/24 European Ranking is a testiment to the entrapreneurial partnership between brands, operators and investors and their common interest in turnover growth. Despite the Pandemic and cost of living crisis, this focus, facilitated by turnover leases, is being rewarded by increased guest spending and asset values.

In addition to the maturing of new sites and extension of existing sites, the ranking of outlet centers can also improve through asset management initiatives which increase brand quality. To achieve the maximum benefit from this approach, it is important that managers have realistic asset strategies and that investors fully empower and support their operators. Where this is the case, the resulting uplift in ranking can be as much as achieved through adding an extension.

Asset management activity is taking place in all tiers of the outlet hierarchy and delivering significant movements throughout the European ranking. This suggests that outlet assets will continue to improve and produce strong investment growth, for many years to come.

Ken Gunn

Ken Gunn is the Managing Director of Ken Gunn Consulting.