This interview was conducted by Reinhard Winiwarter

ACROSS: Mr. Kaufmann, Mr. Vorih – how did the story of CC Real begin?

FABIAN KAUFMANN: As is often the case in life, it was a coincidence. In the late 1990s, we were still purely an architectural office. Together with my father, Wolfgang Kaufmann, we became involved in a group in Hungary that was developing retail parks and created the brand Stop-Shop. We were one of four families who took part. For us, it was a first step into the retail sector, initially only as architects, but soon the fascination grew.

SVEN VORIH: I joined in 2006 as the first employee in Croatia. My “office” was a container on a construction site in Zagreb, four by two meters in size. From there, we literally began to plan and build centers according to Western standards. Less than a year later, I was already a partner. Those beginnings were incredibly intense – full of improvisation, but also full of energy.

ACROSS: What were the decisive early projects?

KAUFMANN: City Center One West in Zagreb, which opened in 2006, was our first significant project. In 2009, the second phase followed. Later came City Center One Split (2010) and City Center One East (2012), with a total investment of over € 400 million. We were the first developers to build a shopping center in Croatia modeled after Western standards. For us, it was crucial to buy only land with building permits. Our attitude can perhaps be summed up as: “No gambling on greenfield sites.”

VORIH: Back then, Zagreb was a highly competitive market. Alongside us, major players were active with projects like Westgate or Arena Mall. But we had one advantage: we opened earlier, kept our promises, and brought the first international brands into the country—including Peek & Cloppenburg, Hervis, Spar, and Müller. Tenants trusted us because we delivered on time. That basis of trust was, and still is, decisive.

ACROSS: The timing seems reasonable on the one hand, but then came the financial crisis. What role did that play during this time of building and expansion?

KAUFMANN: A significantly defining one. Before the crisis, almost any developer could buy a plot, build a center, and sell it profitably. With the crisis, everything changed. In Split, we opened with around 60% pre-letting, in Zagreb East with even significantly less. That was brutal. But we held on, worked intensively with tenants, and learned how crucial real asset management is.

VORIH: It was a tough school. But we stabilized the properties, reached over 90% occupancy long term, and have maintained that level to this day. That time shaped us: ever since, we think strictly long-term, we go into detail, and we see tenants as partners. And most importantly: it pays off. Many employees from that time are still with us today.

CC REAL AT A GLANCE: Founded in 2006 and headquartered in Vienna’s Millennium Tower, CC Real employs over 200 professionals across multiple countries, serving as both an investor and operator of commercial real estate, with assets worth €3 billion. CC Real offers a full-service package comprising comprehensive INVESTMENT (transaction, fund, and portfolio management) and REAL ESTATE MANAGEMENT (asset, center/property, facility, construction management, EU-Taxonomy, green building certification, and leasing) services. The company also has proven experience in (co-) investments with international institutional investors such as Morgan Stanley Real Estate Investors, Hyprop Investments, InterCapital Real Estate, Family Offices, Australian Superannuation Funds, and other Investment Banks. CC Real’s vision focuses entirely on creating long-term value.

ACROSS: How did expansion beyond Croatia come about?

KAUFMANN: A decisive step was the partnership with Morgan Stanley Real Estate in 2013. Together, we acquired and repositioned existing properties. Millennium City and Wien Mitte The Mall are the best-known examples. In parallel, we also invested in Hungary and Scandinavia. With Morgan Stanley, we were also able to resolve our challenges in Croatia in 2016. That was a major success.

VORIH: At the same time, we also began working with private investors. One example: together with Austrian entrepreneurial families, we acquired Center West in Graz, further developed it, and, after a successful refurbishment, sold it again. We – and this distinguishes us from some other market players—are flexible. We can work with global and local institutional investors (also work with regulatory requirements), but also with private investors, and we like to invest on our own.

ACROSS: Today, CC Real is active in several asset classes. What does your strategy look like?

KAUFMANN: Our three pillars are retail, industrial and logistics, and private debt. We’ve been active in retail the longest; that’s where our DNA lies. Logistics is a new field we began to structure about two years ago. We are redeveloping business parks in urban environments, for example, in Stuttgart. And in the area of private debt, we have built up a second foothold in Australia through Madigan Capital and plan to set up the strategy in Europe as well.

VORIH: Madigan started during the pandemic. Through our contacts with the Australian sovereign wealth fund Future Fund, we were able to bring in Barry Brakey, an experienced global investor who was about to retire. With him, we invested in the private debt platform in Australia, which has AUD 1,5 billion under management and has a significant growth strategy on the way. For us, that serves as a safety anchor and is part of our diversification strategy.

ACROSS: You repeatedly emphasize the distinctiveness of your retail approach. What differentiates CC Real from others?

KAUFMANN: Every center and mixed-use building is individual. We don’t develop a blueprint; instead, we think from the location and the people. Based on intensive research, we make a particular decision for each location, drawing on our experience. It’s more complex, but more successful in the long term. Moreover, we are not pure managers, but entrepreneurs, and have skin in the game.

VORIH: We don’t see ourselves as “Excel managers” only. Of course, we analyze figures, but we also look behind them. We talk to every tenant and respond to their needs. That builds trust. In Croatia, for that reason, we were able to retain brands even though they had contracts with much larger companies in parallel. They still signed with us because they knew: we deliver. Especially during the pandemic, it became clear: our partnership-based approach with tenants pays off.

STRATEGIC FOCUS: THREE PILLARS FOR GROWTH

Retail – relevant and resilient: Retail remains CC Real’s anchor strategy: after years of adjustment, structural changes have plateaued, footfall is strong, and occupiers have streamlined portfolios. With pricing still below long-term averages, convenience formats and experience-driven malls present attractive opportunities primarily across the DACH region, CEE/SEE, Italy, and the Nordics.

Industrial & logistics: Alongside retail, CC Real pursues industrial and logistics assets, targeting both city logistics and big box formats in undersupplied European markets with rent-growth potential.

Private debt: The third pillar is selective private debt investment, where higher-for-longer interest rates and attractive entry valuations create interesting return opportunities. In sum: While industrial and logistics, and private debt add diversification, retail and mixed-use remain the strategic heart: relevant, resilient, and ready to deliver value.

ACROSS: Can you give concrete examples?

VORIH: City Center One Split is a good example. Although revenues were stable and we were entirely let, we invested €22 million in refurbishment and repositioning, creating new space and a new entertainment area and gastronomy. We wouldn’t have had to do that, but we wanted to secure long-term trust from customers and tenants and create long-term value.

KAUFMANN: Millennium City in Vienna is another example. When we took it over, it was positioned more as a competitor to Donau Zentrum or SCS. We deliberately repositioned it as a neighborhood center for the 20th district and a destination for a larger catchment area. That meant less fashion, more daily needs, and better entertainment. Today, Millennium City is a vibrant hub for the community.

ACROSS: Entertainment and gastronomy seem to play a key role in general?

KAUFMANN: Absolutely. Entertainment drives footfall. Millennium City attracts up to 28,000 visitors even on Sundays, although the shops are closed. That shows its importance.

VORIH: We also introduced new food concepts, for example, a “Local Market” in Split and a “Food Market Hall” in Helsinki. Such concepts increase dwell time and make centers places to be where people enjoy spending time.

ACROSS: Many investors have reduced their retail engagements. Why are you staying with it?

KAUFMANN: Because retail still creates value. You can actively shape it, change tenant mixes, repurpose space, and develop community-oriented concepts. And the crisis has shown: retail is more resilient than many believe. Yields are priced in, and the fluctuations are not as extreme as in other asset classes.

ACROSS: How do you currently see consumer behavior changing, and how do you respond?

KAUFMANN: Of course, people buy more online, spaces are getting smaller, food and entertainment are becoming more important. But humans remain social beings. They want to go out, experience things, and touch products. That’s why retail will never disappear.

VORIH: Tenants also play a vital role in the new online world; they need hybrid concepts to reach customers both online and offline, and brick-and-mortar retail plays a role that should not be underestimated.

ACROSS: In many centers, discounters like Action, TEDi, or Woolworths are increasingly moving in—tenants that were previously seen more in retail parks. How do you deal with this trend?

VORIH: That is indeed a trend that can be observed in many European markets. Our stance is clear: every location must be evaluated on its own merits. In a retail park or hybrid center – such as Center West in Graz – these formats have a clear justification and complement the offer meaningfully. In a classic mall like Wien Mitte or Millennium City, however, one must be more cautious, because there the audience is different and a different shopping experience is expected.

KAUFMANN: We don’t exclude such tenants- quite the contrary. They can enliven a center and bring new footfall. But they must fit the overall concept. That’s why we choose very carefully where and how we integrate them. Often, access is not via the main mall, but rather separately, to avoid mixing different target groups. Ultimately, our principle applies: we don’t have a blueprint. We conduct our research, listen to the location and customers, and then decide which tenant is the best fit.

ACROSS: Which geographical markets are currently in focus for you?

KAUFMANN: Italy and Eastern Europe. There, rents are sustainable, the properties healthy, and the yields attractive. In Croatia, we are firmly established anyway. We are more cautious about Germany: sometimes you buy a property with a 9% yield, but realistically, it’s more like 7%, because rents are not sustainable. However, we also remain genuinely interested in Germany, looking for the right asset. In general, we prefer to invest in markets that have grown healthily and have a growth perspective.

ACROSS: Which of today’s many challenges concerns you the most?

KAUFMANN: Construction costs are one of the most significant issues. They’ve risen everywhere. Interest rates, however, we see as less dramatic. Four percent existed before, and we did good business then, too. What worries me more is purchasing power. Prices for daily needs have risen so sharply that less money is left for not everyday consumption. That will affect revenues and rental space.

VORIH: ESG is, of course, also important. We consistently certify our properties and have in-house certification specialists on our team. But we would like the guidelines to focus on the “right” topics with environmental impact, be less formal, and be distributed more fairly, not borne solely by landlords, but in partnership with tenants.

ACROSS: How do you finance your projects?

KAUFMANN: Very conservatively. We learned from the financial crisis not to build complex multiple structures with mezzanines and sub-mezzanines. We finance solidly, with clear structures. That sometimes means lower shortterm returns, but more long-term stability and resiliency. None of our projects had to be refinanced or sold under distress. That shows our approach works.

ACROSS: With some distance now, what lessons did you carry over from the financial crisis into the pandemic?

KAUFMANN: The most important thing is to keep calm and think long-term. During the financial crisis, we learned how to manage vacancies, interact with investors, and work with banks. During the pandemic, we immediately worked in partnership with tenants, rather than in court, to find solutions, extend contracts, and strengthen trust. That carried us through the crisis, back in business faster, and will be the path we follow in any potential future crises.

ACROSS: Finally, in a short statement, where do you see CC Real in five years?

VORIH: We want to expand further and grow our position as a reliable, long-term-oriented investment and asset manager in existing and new markets. Our three pillars – retail & mixeduse, urban logistics, and private debt – form a solid foundation.

KAUFMANN: What remains decisive: we create value – for investors, tenants, customers, and us. And we treat every project as if it were our own. From the construction site container in Zagreb to today, that has been our blueprint for success.

Fabian Kaufmann

Fabian Kaufmann is the Founder and Managing Partner CC Real

Sven Vorih

Sven Vorih is the Co-Founder and Managing Partner CC Real

Highlight Projects of CC Real

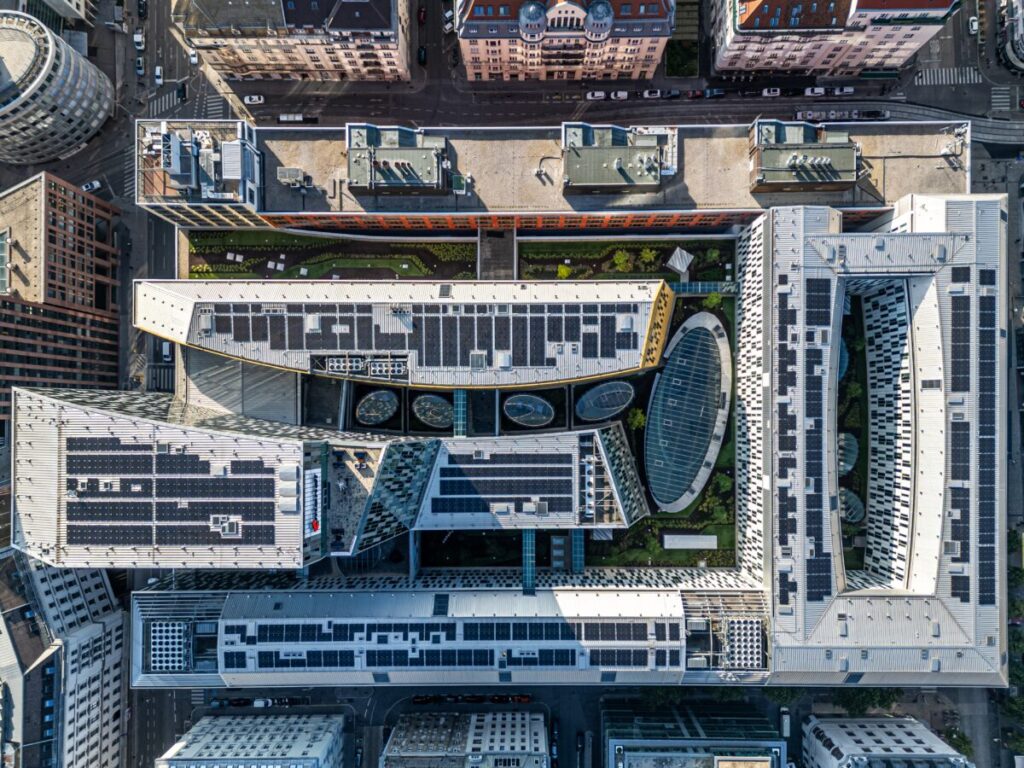

MILLENNIUM CITY / TOWER – VIENNA, AUSTRIA

• Client: MSREI & Art-Invest & CC Real; 97,600 sq m retail/office/hotel; 100 tenants

• Occupancy: 98%; footfall: ~13mm;

• CC Real impact: lobby, main plaza & food court refurbishment; entertainment; sharpened tenant mix (e.g. medical center); DGNB Platinum; EU-Taxonomy; repositioned as a neighborhood & entertainment hub.

WIEN MITTE – THE MALL – VIENNA, AUSTRIA

• Client: MSREI (Future Fund & IGIS); 95,000 sq m retail & office; 60 tenants

• Occupancy: 100%; footfall: ~16m;

• CC Real impact: comprehensive refurbishments, including courtyard/entrances; sustainability upgrades culminating in DGNB Platinum certification and EU Taxonomy.

CITY CENTER ONE WEST & EAST – ZAGREB, CROATIA

• Client: Hyprop; 96,000 sq m retail; 280 tenants

• Occupancy rate: 100%; footfall: ~12m;

• CC Real impact: greenfield development of Croatia’s first western-style mall; creation of the City Center One brand (CCO West 2006; CCO East 2012); full lease-up throughpost-GFC headwinds; BREEAM Excellent

CITY CENTER ONE SPLIT – SPLIT, CROATIA

• Client: InterCapital Real Estate & CC Real; 60,000 sq m retail; 190 tenants

• Occupancy rate: 100%; Footfall: ~6.5m;

• CC Real impact: greenfield development, which was followed by a redevelopment process (2023–2024) in which center has significantly enhanced its offerings, strategically clustered tenants, and revitalized both its interior and exterior spaces; DGNB Gold and EU Taxonomy.

ITIS – HELSINKI, FINLAND

• Client: MSREI & CC Real; 100,000 sq m retail & office; 170 tenants

• Occupancy: 98%; footfall: 15.0m;

• CC Real impact: acquisition of one of the Helsinki metro area’s largest centers; major refurbishment and reconfiguration program to reinforce dominance and improve performance; BREEAM Excellent.

CENTER WEST GRAZ – GRAZ, AUSTRIA

• Client: Family Office; 62,500 sq m retail; 62 tenants

• Occupancy: 97%; footfall: ~4,6 m;

• CC Real impact: extension, rebuilding, and refurbishment; repositioned as a family, sports, and entertainment hub; DGNB Platinum.

all credits: Mitja Kobal/CC Real