Written by

Peter Sempelmann

Retail trade generates around 5% of total value added in the EU economy, making the Eurostat retail volume index a central gauge of household demand. As a Principal European Economic Indicator (PEEI), it plays an important role in monitoring and guiding economic and monetary policy. Measured as an index of deflated turnover, the volume of retail trade is one of the EU’s key short-term business indicators.

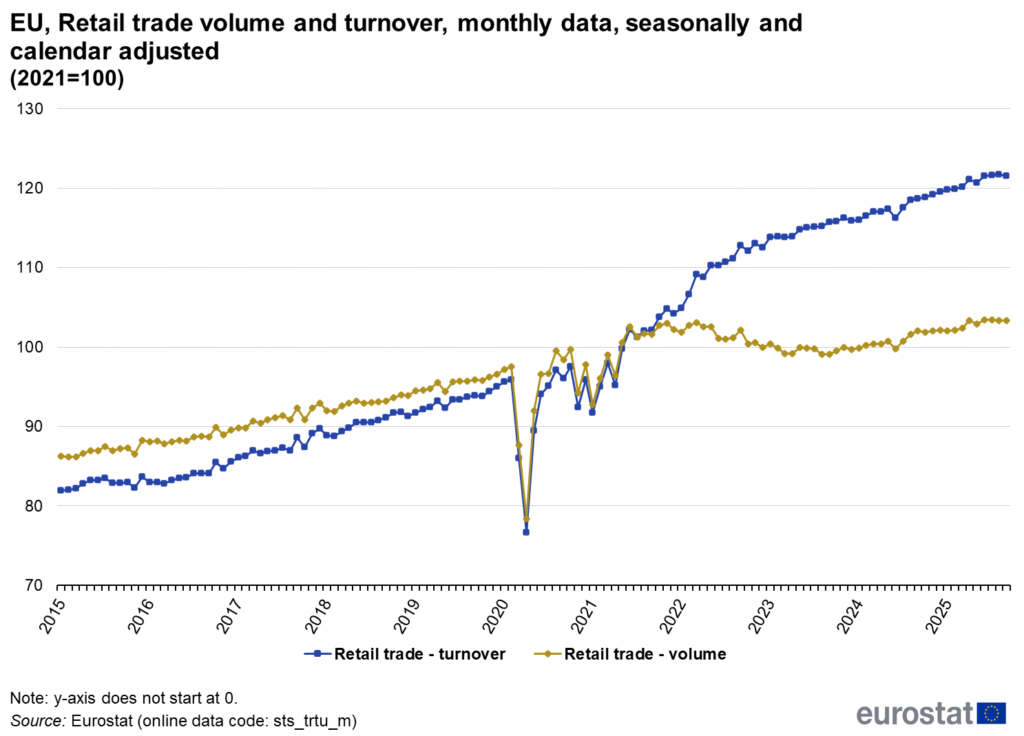

The latest Eurostat figures, extracted for the European Retail Trade Volume Index in November 2025 and published on December, 4th, point to a retail sector that has absorbed the pandemic shock and adjusted to a high-price environment. But while turnover growth has been robust, volume lags behind and tells a more cautious story.

Retail trade volume: from steady growth to shock and recovery

In the years following the financial and economic crisis of 2008/2009, retail trade volume in the EU increased slowly but steadily. This gradual upward trend persisted until early 2020.

Then, the COVID-19 pandemic marked a clear break. With national lockdowns and health measures introduced across Europe, retail trade volume collapsed in March and April 2020, reaching an unprecedented low point. The decline was abrupt, but the rebound was almost equally swift. By late summer 2020, volume had already returned to its pre-crisis level.

A second, less dramatic downturn followed in late 2020 and early 2021, reflecting renewed restrictions. From mid-2021 onwards, retail trade volume stabilized and gradually recovered, although without returning to a strong growth trajectory.

Volume versus turnover: the price effect since 2021

The most striking insight the Eurostat data highlights is the growing divergence between retail trade volume and retail trade turnover from autumn 2021 onwards. While volume indices have moved sideways or increased only moderately, turnover has risen markedly. This gap reflects the significantly rising price levels rather than stronger physical sales. A trend that is strongly believed to continue in 2026.

The divergence was particularly pronounced in early 2022, when turnover accelerated while volumes stagnated. Since then, the difference between nominal sales and real sales volume has persisted, though at a slightly slower pace. The data underline a key feature of recent years: higher retail revenues have been driven primarily by higher prices rather than quantities sold.

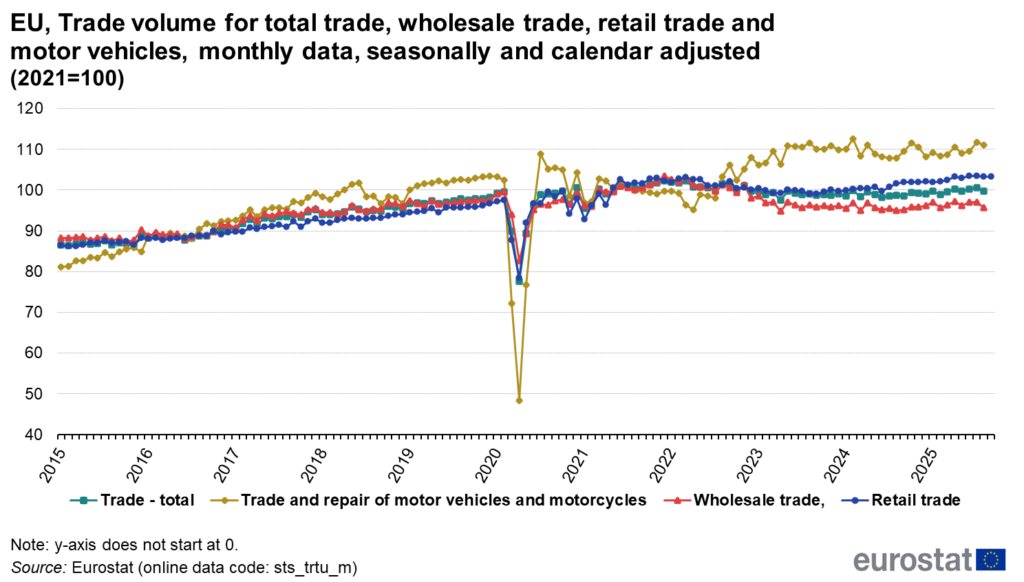

Retail trade compared with wholesale and motor vehicles

Looking beyond retail alone, Eurostat’s deflated turnover data for NACE section G show clear differences across trade segments. Wholesale trade and the trade and repair of motor vehicles reacted much more strongly to the pandemic shock in 2020 than retail trade. Volumes in these sectors fell sharply, but their recovery was also more dynamic.

Retail trade proved comparatively resilient, with smaller swings during both the downturn and the recovery. Since 2023, trade volumes across retail, wholesale and motor vehicles have been broadly stable, suggesting that the post-pandemic adjustment phase has largely run its course.

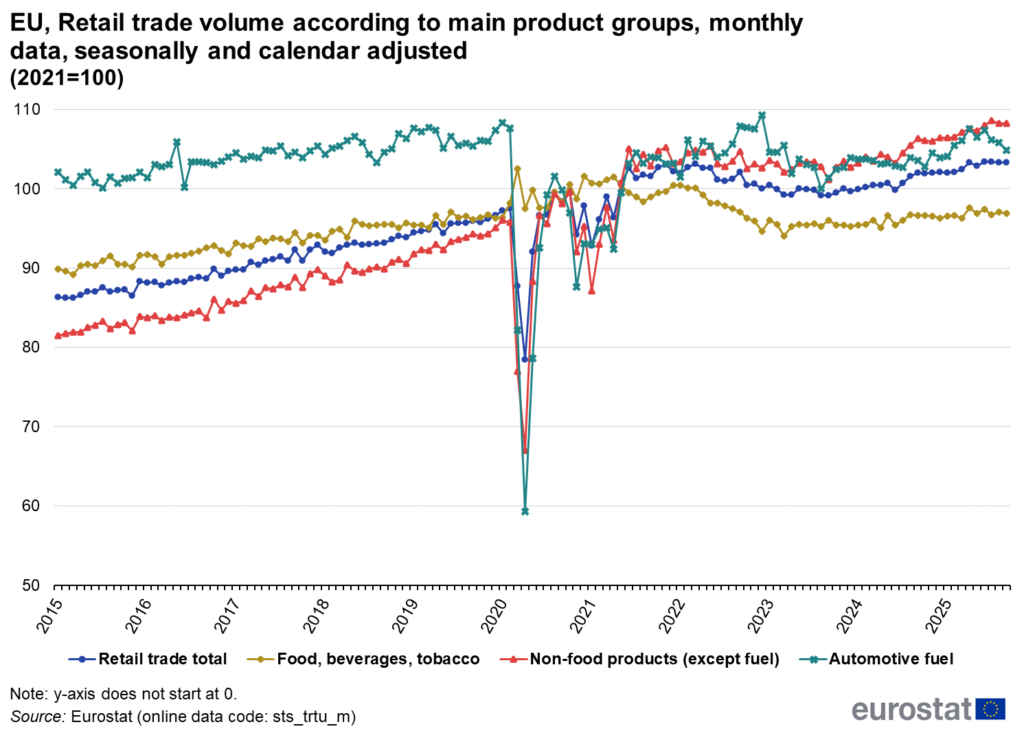

Product groups: food stability, non-food adjustment, fuel volatility

A closer look at retail trade volume by main product groups provides further insight:

- Food, beverages and tobacco showed the greatest resilience during the pandemic. Volume declines in 2020 were limited compared with other categories. However, in 2022 sales volumes fell and then remained broadly stable throughout 2023, 2024 and 2025.

- Non-food products (excluding fuel) experienced much stronger fluctuations. After the sharp pandemic drop and rebound, volumes stagnated in 2021 and 2022. A moderate upward trend has emerged in more recent years.

- Automotive fuel stands out for its volatility. During the COVID-19 crisis, sales volumes at filling stations dropped by more than 40%, reflecting mobility restrictions across Europe. Although fuel sales recovered in summer and autumn 2020, they did not return to pre-crisis levels. Subsequent years show no clear long-term trend, underlining the sensitivity of fuel volumes to mobility patterns and broader economic conditions.

Physical and digital retail volumes

Eurostat data on retail trade volume by type of sale highlight a clear structural shift within EU retail over the past decade. Figure 4 shows that non-specialised food stores (supermarkets) followed a relatively stable and moderately upward trend prior to the pandemic, reflecting the essential nature of food retail.

Department stores, by contrast, displayed weaker dynamics and greater sensitivity to economic shocks. During the COVID-19 crisis in spring 2020, department stores experienced a particularly sharp decline in volume, far stronger than that seen in supermarkets.

The most striking development is observed in mail order and internet trade. Starting from a comparatively low index level in 2015, internet sales volumes increased steadily and accelerated sharply during the pandemic. Although growth moderated after 2021, online retail volumes remained well above pre-crisis levels. The use of a separate (right-hand) axis underlines that internet trade followed a markedly different trajectory from store-based retail, confirming its structural expansion rather than a temporary pandemic effect.

Conclusions for 2025

The Eurostat retail trade volume data for 2025 point to a year of consolidation rather than expansion for the EU retail industry.

1. Volumes are broadly stable, not accelerating

By 2025, EU retail trade volume is slightly above the 2021 base level but shows no strong upward momentum. After the post-pandemic recovery and the adjustment phase of 2022–2023, volumes have settled into a narrow range. This indicates that household consumption in real terms has largely plateaued, despite continued population growth and economic normalisation.

2. Turnover growth remains price-driven

The persistent gap between retail trade turnover and retail trade volume remains visible in 2025. While nominal sales continue to rise, real sales volumes increase only marginally. For retailers, this confirms that revenue growth is still largely explained by prices rather than higher quantities sold, even though the price dynamics are less extreme than in 2022.

3. Food retail shows resilience but limited growth potential

Retail volumes for food, beverages and tobacco remain stable in 2025 after declining in 2022 and stagnating in 2023–2024. This stability underlines the defensive nature of food retail, but also highlights its limited contribution to volume growth. Demand is steady, yet structurally constrained.

4. Non-food retail shows cautious improvement

Non-food products (excluding fuel) display a moderate upward trend in 2025. This suggests a gradual normalisation of discretionary spending after several years of volatility. However, growth remains measured, indicating that consumers are still cautious and selective in real terms.

5. Fuel retail remains structurally volatile

Automotive fuel volumes continue to fluctuate and remain below pre-pandemic levels. The 2025 data confirm that fuel retail has not returned to its former baseline, reflecting lasting changes in mobility patterns, energy efficiency and transport behaviour.

6. Physical sales channels and online retail

By 2025, the data indicate a new balance between physical and online retail. Supermarkets remain stable in volume terms, while department stores have recovered only partially from their pandemic-related losses. Internet trade continues to outperform other channels, but growth has slowed compared with the surge observed in 2020–2021. Overall, the 2025 picture suggests that shifts between sales channels, rather than overall volume growth, dominate retail dynamics.

Outlook for 2026

Based strictly on the observed trends up to 2025, the outlook for 2026 suggests continued stability with limited upside for retail trade volume.

- No strong rebound in volumes is implied by the data. Retail trade volume has already recovered from the pandemic shock and adjusted to higher price levels. Absent a new demand impulse, growth in 2026 is likely to remain modest.

- Price effects will continue to matter, but less dramatically. The divergence between turnover and volume has become less dynamic since 2022. This points to a retail environment where price increases still support nominal sales, but without the sharp inflation-driven effects seen earlier.

- Structural differences within retail will persist. Food retail is likely to remain stable but flat in volume terms. Non-food retail may continue its gradual recovery, while fuel volumes are expected to remain volatile and structurally lower than before 2020.

- Retail strategy will increasingly focus on efficiency rather than expansion. With volume growth limited, competitiveness in 2026 will depend more on cost control, channel mix and productivity than on market growth in real terms.

- Looking ahead to 2026, the stabilisation of total retail trade volume implies that channel competition will intensify. With limited scope for aggregate volume growth, retailers are likely to focus on strengthening hybrid retail strategies, combining physical presence with integrated online sales. The long-term expansion of internet trade, as shown in the data, supports the view that omnichannel models will remain central to capturing demand in a largely saturated market.

In summary, the Eurostat data for 2025 describe a retail sector that has reached a post-crisis equilibrium. For 2026, the data supports an outlook of moderate, uneven development rather than renewed volume-driven growth, confirming that the European retail industry has entered a phase of consolidation shaped by lasting changes in consumption patterns.