By Paulina Brzeszkiewicz-Kuczyńska, Research and Data Manager at Avison Young

Retail market – Expanding Retail Park Portfolios

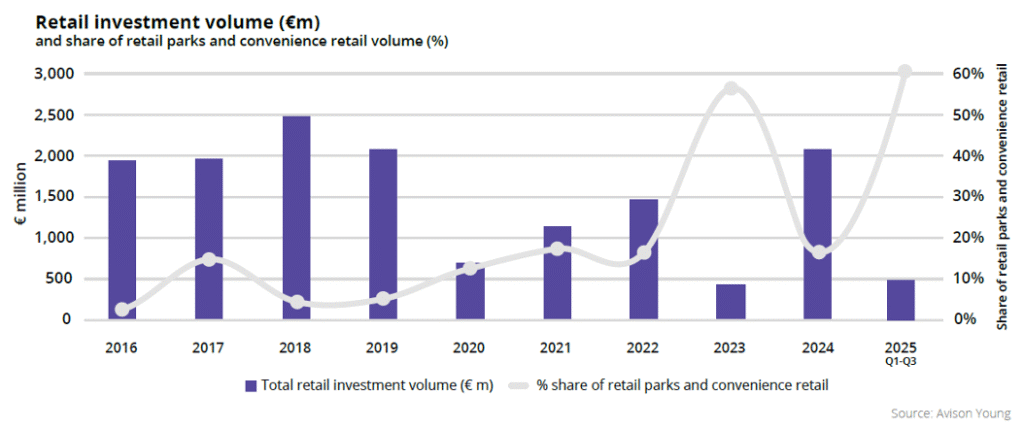

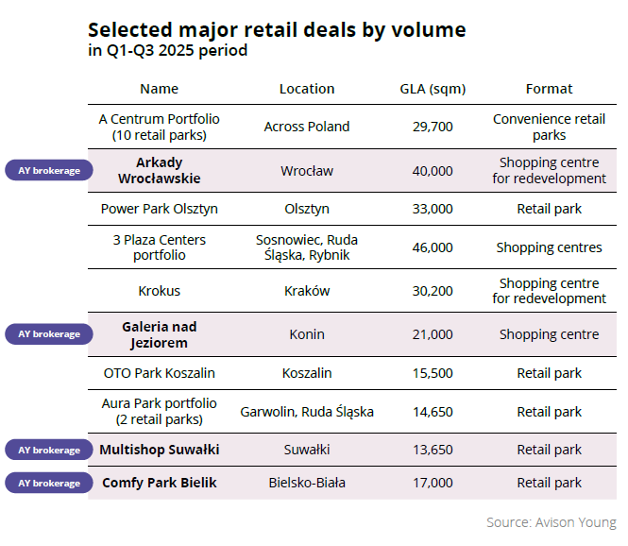

The retail sector registered a total investment volume of €453 million during the first three quarters of 2025. Retail parks, convenience schemes as well as stand-alone grocery stores continue to be highly sought-after assets, accounting for 2/3 of all transactions and 56% of the total transacted volume. Redevelopment transactions represented 20% of the volume, primarily involving shopping centres and stand-alone retail warehouses earmarked for residential conversion.

Regional shopping centres emerged as the third most attractive retail asset class, with 6 centres divested across 4 transactions. The diversity of investment opportunities in the Polish retail market supports stable liquidity; however, the absence of prime shopping centre deals has kept overall volume at a moderate level. Avison Young professionals brokered 4 of the 10 largest retail transactions completed so far this year, including all retail formats.

Sector highlights:

- €453m – retail investment volume in Q1-Q3 2025

- 6 redevelopment transactions in Q1-Q3 2025

- 27/39 transactions regarding retail parks and convenience grocery stores in Q1-Q3 2025

Director, Investment at Avison Young

“In recent years, Poland has become an attractive entry point for new investors looking to expand into Central and Eastern Europe. The standout retail transaction of Q1-Q3 2025 period was the acquisition of a 10-asset A Centrum convenience portfolio by Czech-based investor My Park. One of the strongest draws has been the retail park segment, which continues to perform well thanks to convenience-oriented shopping trend and a resilient tenant mix dominated by discount and necessity-driven retailers.

First-time investors entering the Polish market often see retail parks as a relatively safe gateway asset class: they offer lower entry costs compared to prime shopping centres, provide consistent rental income, and are typically located in growing regional cities where consumer demand remains solid. This combination of accessibility, stability, and growth potential has made retail parks a key target for debut players seeking to establish their presence in Poland’s commercial real estate landscape.” – comments Artur Czuba, Director, Investment at Avison Young.

What’s Next?

Poland remains attractive to investors due to strong economic growth and solid market foundations. Being among G20, Poland attracted significant interest during EXPO, increasingly from US investors.

We anticipate the trend of interest rates reductions to continue, accompanied by a relaxation of lending policies by banks and increased interest in real estate funds. Now is the final time to take advantage of attractive property prices – with interest rate cuts on the horizon, yields are expected to decline, making today’s conditions particularly favourable for buyers.

Continued activity from mid-cap investors is anticipated across all commercial real estate asset classes. Following economic stabilisation, core capital – currently only moderately active – is expected to return to the market, driving large-scale, prime transactions once again. Smaller real estate formats with long WAULTs are likely to remain attractive investment products.

The increased activity of domestic capital is expected to continue.

Paulina Brzeszkiewicz-Kuczyńska

Research and Data Manager at Avison Young

Credit for all images: Avison Young