ACROSS: Investors want more colorful portfolios. Is retail, which is one of the classic portfolio components, a relative loser compared to logistics and healthcare?

KURT JOVY: In recent years, there has, indeed, been a trend among investors toward logistics properties, which has also made it increasingly difficult to find suitable investments. There has also been greater investor interest and an increasing number of fund offers in the healthcare segment. However, the positive expectations have not been confirmed yet, despite the fact that the demographic data suggests that that is the case. A more differentiated view must be taken for the retail sector: Classic retail has recently shown an overall negative trend, while local supplies and the food retail industry have proven themselves to be robust and even gained in importance during the pandemic. At the end of the day, what counts most is what the individual investment promises. Above all, it is advisable to keep an eye on long-term development and to not solely focus on short-term trends.

ACROSS: How are return rates and transaction volumes developing these days, and how will they develop in 2023?

JÜRGEN KREUTZ: At present, the market is characterized by uncertainty: The combination the pandemic, a war, inflation, and interest rate turnaround is an unprecedented situation. Accordingly, many investors, especially those with a conservative orientation, prefer to wait and see how the situation develops. Naturally, transaction activity has slowed down as a result. Nevertheless, I am confident about the upcoming year: As soon the price level is stable again and the gap between buyer and seller expectations closes, the transaction market will recover. For 2023, I expect the return of significantly more momentum, including in the high street and other submarkets.

ACROSS: We see greater differentiation in the retail real estate market between types of company forms and product ranges. Is food retail still king? What are the most sought-after types of retail real estate, and what are the arguments in their favor?

KREUTZ: Food retail is an absolutely system relevant sector – the pandemic has clearly proven that to be true. As a result, there will be little change in the demand for food retail-anchored retail properties in the foreseeable future, which will, of course, keep returns relatively low. Other retail sectors, such as fashion, have been hit hard by coronavirus-related restrictions – in addition to the long-term trend towards higher e-commerce market shares in those segments. Accordingly, in the case of shopping centers, opportunistically oriented investors are currently more interested – in addition to long-term thinking portfolio holders who specifically invest in mixed-use and conversion projects as part of their active asset management strategies. High-street properties, on the other hand, continue to benefit from their central locations. Locations in the heart of our cities are potentially exciting for a wide variety of customers, and institutional investors also appreciate that.

CEO of IPH Transact GmbH

ACROSS: In which countries/regions is there a particular focus and why?

JOVY: In the North American market, we are currently seeing increased interest from investors as well as a growing range of products. The main reason behind that seems to be the more favorable development of the economic framework data as well as the considerable distance from conflict hot spots in Europe and Asia. In the real estate market, the general rise in market values is generating increased interest in North America. In Europe and Asia, on the other hand, economic and political risks are weighing on the markets, leading to a rather cautious attitude on the part of investors. Nevertheless, investment opportunities are also being seized there, with the diversification of the portfolio as the main objective.

ACROSS: The classic shopping center has increasingly evolved into a center that offers shopping opportunities. How should shopping centers be transformed in order to successfully attract investors today?

KREUTZ: Indeed, retail space has been reduced in many places in favor of other types of use. In some cases, pure retail space is being transformed into neighborhoods in which people enjoy living, working, and spending their leisure time. However, the right mix of uses is highly variable and depends on the particular location. Retail focal points can continue to function well, depending on the catchment area and USP. Elsewhere, investors should focus on positive coupling effects with complementary types of use, such as offices, hotels, and gastronomy. That maximizes footfall figures, diffuses risks, and creates more sustainable assets.

Head of Real Estate Product Management at Universal Investment

ACROSS: What role does the buzzword “mixed-use” play?

JOVY: The mixture of different uses under one roof has many advantages. Such properties are perfectly aligned with the requirements of modern urban development – living, working, and leisure in one place – and will continue to gain in importance. The trend is moving away from downtown areas and peripheral locations characterized by “mono-uses” that are geared solely for office or retail use and are deserted at night, and is moving toward neighborhoods with short distances between mixed-use facilities that are also populated in the evening. That also has a positive effect on the environment. For investors, the hybrid use of buildings means greater risk diversification in the tenant sector and, thus, greater independence from external market influences on individual types of use. A property designed for mixed use also generally allows greater flexibility when the space is changed for other types of use, as that is taken into account in the concept. The result is usually more stable earnings over the long term.

ACROSS: In that context, what expectations do investors have with respect to multi-channel approaches?

KREUTZ: Investors have been increasingly and intensively looking at the business models of existing and potential tenants, and not just since the outbreak of the coronavirus. Many owners have high hopes for the multi-channel approach – and rightly so, in my opinion. We must not forget that the branding idea is at the forefront of many settlements, especially at the top highstreet locations. Visitors should enjoy an exceptional experience on site. If they then have the opportunity to continue their shopping online, a classic win-win situation is created. Multi-channel perfectly combines the advantages of offline and online – they complement each other. That expands the potential tenant pool to include many creditworthy companies with strong brands, which is an enormous plus for investors.

ACROSS: Risk or opportunity: Catchphrases such as “rent turnaround” are currently causing great concern. Why is that, and what will happen in that regard?

JOVY: In traditional retail, the correction of rental prices and growing vacancy rates have recently been observed due to the pandemic and the increasing importance of online retail. The higher the previous level was, the stronger the adjustment usually is. Nevertheless, good returns have continued to be achieved in absolute terms, as rent prices often rose sharply in previous years. Additional pressure has now arrived in the form of rising energy costs, which will significantly increase the “second rent”. Therefore, enforcing index rents might prove increasingly difficult. Whether that is merely a correction or a fundamental turnaround in rent prices is not a relevant question. It is much more important to find solutions in light of the changing environment. They could be conversions or – as described above – “mixed-use” in general.

The 10th annual real estate survey conducted by Universal Investment

As the coronavirus pandemic ebbs away, the sustainable impact of structural megatrends is, once again, having a positive impact on the institutional real estate market. There is good news for the placemaking industry: Retail properties are once again becoming a focal point of investors. Key findings:

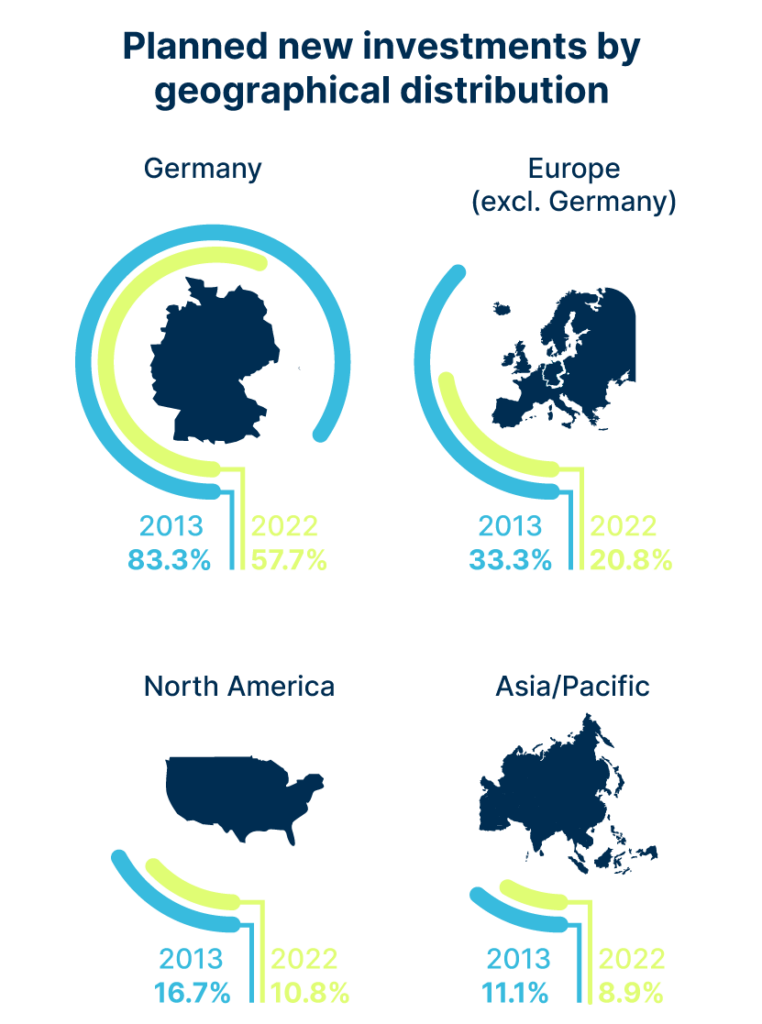

- The dominance of German and European real estate is decreasing; North America and Asia are gaining in significance.

- Two out of three investors prioritize cash flow return; expected return on investment increases to an average of 3.85% for core assets.

- Effective protection against inflation: Nine out of 10 investors intend to maintain or expand real estate allocation.

- Coronavirus-driven slump has placed high demands on logistics properties; retail properties are currently just as popular as in 2017.