By Axel Vespermann, Head of Real Estate at Universal Investment

Geographical diversification – increased international real estate allocations

Recently, German institutional investors have increasingly diversified their portfolios geographically and by usage types. This trend is expected to continue in the coming years, as investors plan to more than double their allocations to North America and Asia on average.

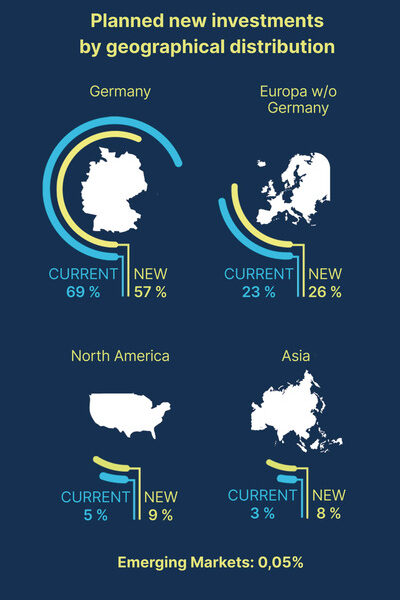

Currently, these investors hold 69% of their real estate investments in Germany, 23% in the rest of Europe, 5% in North America, and 3% in the Asia-Pacific region. However, for planned new investments, the allocation in Germany is expected to decrease significantly by 12 percentage points to 57%. In contrast, allocations in North America are expected to increase to 9% and Asia-Pacific to 8%. Investors also intend to invest more in European countries outside Germany, with growth there being less pronounced, reaching 26%.

Real estate is a portfolio stabilizer, not a yield booster

These structural trends reinforce what has already been observed. Nevertheless, it should be noted that even in the face of rising interest rates and various risk scenarios, real estate remains an essential pillar for most German institutional portfolios. On average, real estate is expected to account for approximately one-fifth (specifically, 21%) of the total portfolio.

However, investors are predominantly risk-averse: 60% prefer core strategies, while another 29% favor core-plus strategies. This suggests that real estate is generally expected to act as a portfolio stabilizer rather than as a driver of returns.

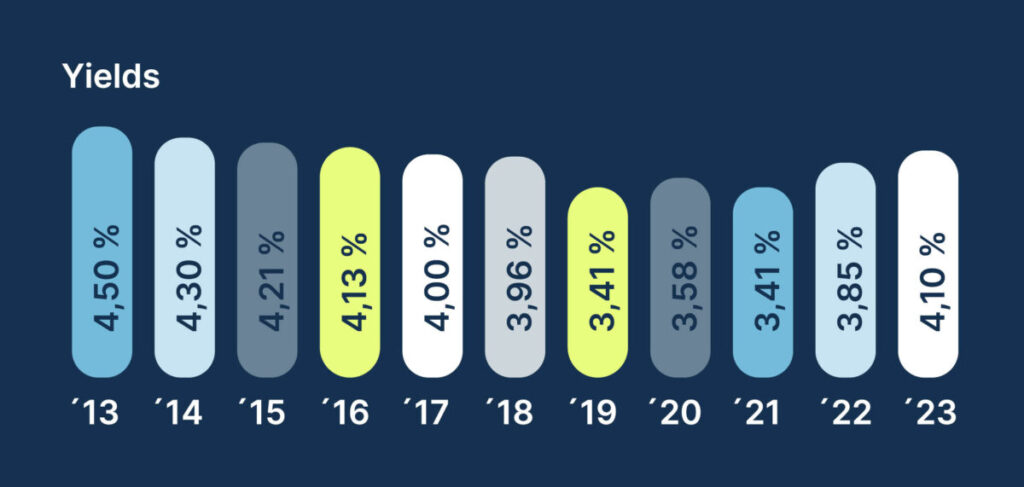

Nevertheless, with rising interest rates and yields in other asset classes, yield expectations in the real estate segment have also risen to an annual distribution yield of 4.1%. The most crucial yield metric for 61% of surveyed investors is the regular cash flow yield. This is understandable, as performance in the real estate markets is currently subdued.

Expected current cash flow return/dividend yield

Investment shift from retail and office toward residential

Regarding asset classes, the survey indicates that the office segment remains the most popular, accounting for 40% of total real estate allocations. However, this figure is slightly declining from 41.4% in the previous survey. This is followed by retail (18%), residential properties (16.3%), logistics (13%), miscellaneous (10%), and hotels (2%).

Future investment plans indicate a significant shift towards the residential segment (+7.7 percentage points) and other segments, such as medical practices and industrial properties (+7 percentage points). This change primarily comes at the expense of office properties (-12 percentage points) and retail properties (-4 percentage points).

In an environment of elevated inflation rates, real estate retains its reputation as an inflation hedge. Three-quarters of investors recognize the crucial role of real estate in protecting their portfolios against the erosive effects of inflation.

The survey shows that implementing Environmental, Social, and Governance (ESG) measures tends to impact real estate values positively but can negatively affect achievable cash flows. The most commonly implemented ESG measures are ESG-compliant acquisition criteria (50%) and the introduction of green leases (39%). Less than 10% of the participants claim to have fully implemented regulatory ESG requirements.

Conclusion: German institutional investors are transforming their real estate investment landscape with a significant shift towards diversification in global markets and asset classes. As they adapt to a changing market environment, these investors increasingly focus on cash flow and recognize real estate’s importance as a hedge against inflation. The integration of ESG is also high on their agenda, emphasizing the balance between sustainability efforts and profitability. The German real estate investment landscape is evolving, promising exciting opportunities and challenges in the future.

Axel Vespermann

Axel Vespermann is Head of Real Estate at Universal Investment.