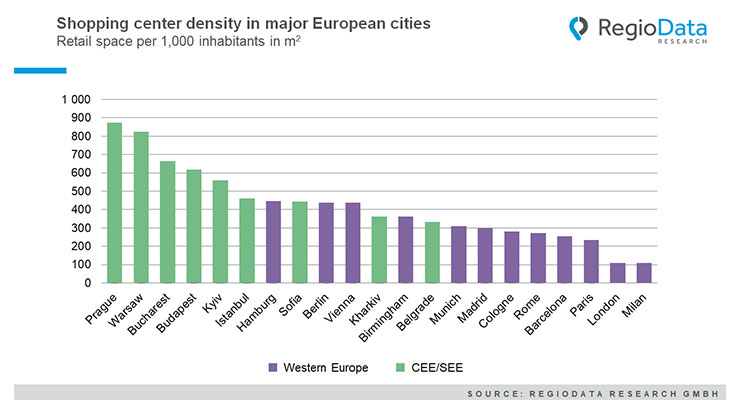

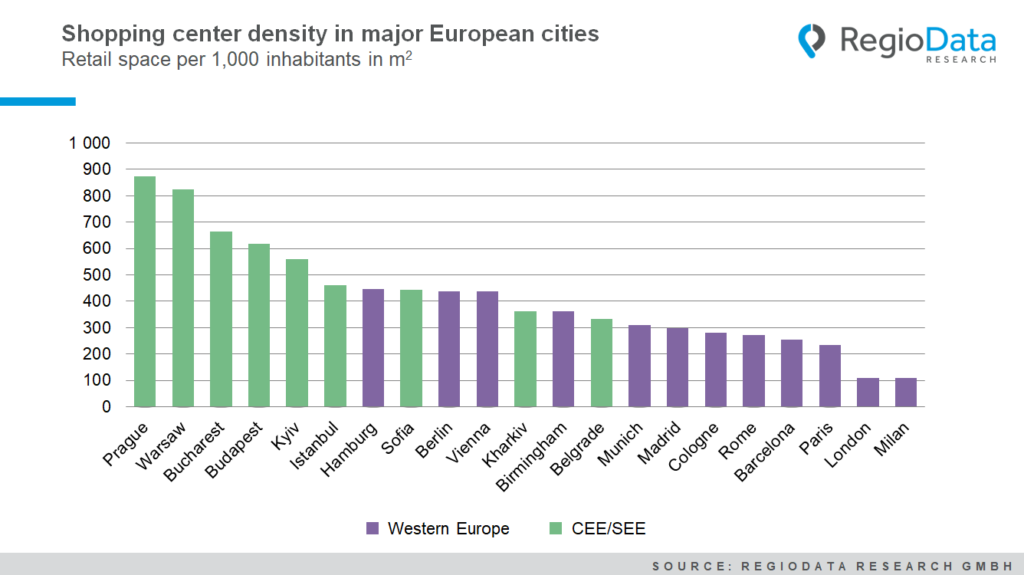

With a density of approximately 876 sq m of shopping center space per thousand inhabitants, Prague is clearly at the top. In total, 1.1 million sq m of retail space in the form of shopping malls, retail parks, hypermarkets, and factory outlets are available here. This translates to almost 1 sq m per inhabitant. Warsaw follows closely behind with 826 sq m.

Shopping centers are defined here as retail agglomerations with more than 5,000 sq m of leasable area (GLA) that have unified management and/or ownership and multiple business units (usually more than 5): Shopping Malls, Retail Parks, Factory Outlet Centers, Hypermarkets.

Bucharest can also keep up with 666 sq m of retail space. Finally, Budapest takes fourth place with a shopping center density of 619 sq m per thousand inhabitants, and Kiev ranks fifth with 562 sq m. However, the timetable for the construction of new retail space was very different. The shopping center journey began in Prague as early as 1997 with a peak of 124,000 sq m of implemented retail space. The pace then slowed until 2005, when another 123,000 sq m of shopping center space was added. After the Corona slump with only 10,000 m2 of additional space, the curve is rising slightly again. Budapest also reached peak values towards the end of the last millennium. In Warsaw, the hype began a bit later, namely in 2002. In that year, most of the shopping centers were opened, totalling 221,000 sq m. All three countries, Czechia, Poland, and Hungary, were particularly hard hit by the real estate crisis in 2008, which is why most projects were postponed or discarded. Latecomers were Bucharest with peak values in 2010 and Kyiv with the most new retail spaces in the last 5 years.

The foundation for the current situation in CEE/SEE cities was laid far in the past. The almost non-existent trade structure caused by the communist systems and the increasing purchasing power naturally created a lot of catching-up demand, which some daring companies already served shortly after the political changes in the 1990s. After the turn of the millennium, however, shopping malls were practically the order of the day. Especially Western investors have sensed this opportunity and rushed into the new possibility, which led to the rapid realization of the project.

As classic metropolises in Western Europe, such as Barcelona, Paris, and London, have always relied on their established trade structure, they were rather disregarded regarding shopping center expansions. In most Western European cities, the shopping center share reaches a maximum of 25%, while in CEE/SEE cities the value can easily be more than 50% of the total trading volume. With a retail space density of only 0.11 sq m per inhabitant, London or Milan, for example, achieve only one-eighth of the values of Prague or Warsaw.

However, the shopping center industry is showing signs of movement again after the Corona “standstill”. Currently, the largest shopping center in Europe, the Westfield Milano, with a total retail space of 155,000 sq m, is under construction in Milan. In Kosovo a major project is in the planning stage with the Prishtina Mall and 114,000 sq m of retail space. In Poland and Germany, more than 400,000 sq m of additional shopping center space is planned for each of the coming years. However, it remains to be seen whether all of the almost 200 shopping center projects across Europe will actually be realized.