Written by: Paulina Brzeszkiewicz-Kuczyńska, Research and Data Manager at Avison Young

How it started

The origins of Poland’s retail park sector date back to the late 1990s, coinciding with the country’s political transformation. The first pioneers were developing their projects on the outskirts of major metropolitan areas, establishing early retail destinations which were further supplemented by other retail formats.

The sector has experienced three decades of varied development dynamic. In 2019, the market already offered 1.5 million sqm of retail parks larger than 5,000 sqm of GLA. The COVID-19 pandemic in 2020 highlighted the resilience of these formats, as their open architectural layouts meant they were largely unaffected by closures or restrictions. During this period, the trend towards local and convenience shopping accelerated, reinforcing investor confidence in retail parks as a safe and adaptable format. As a result, the real boom in development began, driven by changing consumer habits.

Only between 2020 and 2024, an additional 1.5 million sqm of GLA was added, with a further 120,000 sqm completed in the first half of 2025 and another 340,000 sqm expected in the second half of the year. Looking ahead, investor announcements indicate around 500,000 sqm of new retail park space is planned for completion in 2026.

Sector in numbers

Today, there are more than 290 large retail parks in operation, each with over 5,000 sqm of GLA. Together, they account for around 3.2 million sqm of space, representing a 21% share of modern retail stock – double the share recorded in 2010.

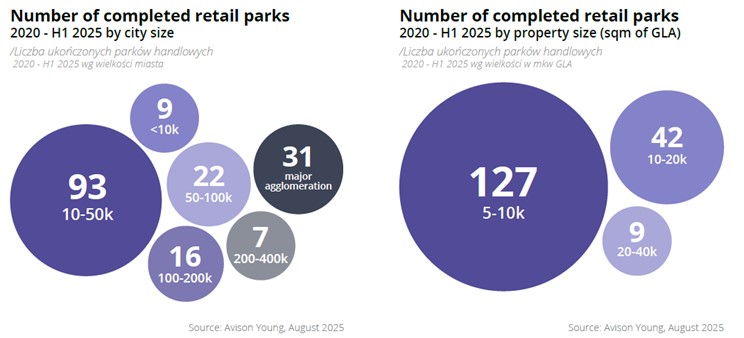

Over 70% of retail parks completed since 2020 fall within the 5,000 -10,000 sqm GLA range. A notable feature of this growth is its focus on smaller urban areas: 60% of new schemes have been built in towns with fewer than 50,000 residents.

Alongside the larger projects, Poland’s retail market is also supported by more than 400 smaller convenience retail parks. These schemes, typically between 2,000 and 5,000 sqm of GLA, provide an additional 1.3 million sqm of retail space nationwide.

Current trends

The development momentum in Poland’s retail park market shows no signs of slowing down. In fact, there is a clear shift toward larger projects. Currently, 52 retail parks with more than 5,000 sqm of GLA are either under construction or being expanded, with 10 of these planned to exceed 15,000 sqm.

Among them, the largest scheme underway is Osada in Żyrardów, which will deliver 33,000 sqm of retail space once completed. This scale reflects the sector’s evolution, as bigger retail parks are increasingly positioned as alternatives to traditional regional shopping centres.

“These larger formats have proven attractive to a broader tenant mix, drawing not only everyday convenience operators but also brands from the economy fashion segment, as well as gastronomy and service providers. As a result, retail parks are steadily transforming from purely local shopping destinations into more versatile hubs that meet a wider range of consumer needs”

– comments Artur Czuba, Director, Investment at Avison Young

Major operators

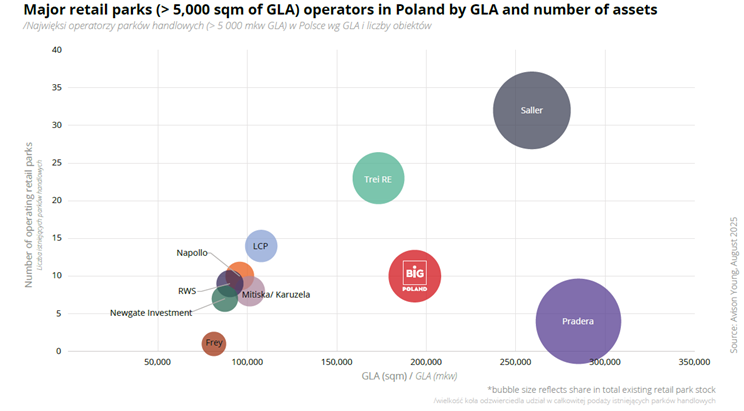

Approximately 45% of the existing supply in modern retail parks in Poland (with over 5,000 sqm of GLA) is held by the 10 largest market players. Pradera holds the leading position with a 9% market share, based on its portfolio of four large assets. Saller follows with an 8% share, BIG Poland with 6% and Trei Real Estate with 5%. The remaining ownership is highly fragmented, with the majority of stakeholders holding individual shares of 3% or less.

“BIG’s debut in Poland in 2022 marked the beginning of a focused, long-term growth strategy aimed at secondary cities with strong potential. We have acquired and developed assets in well-located areas with a carefully curated tenant mix and clear prospects for value enhancement. Since 2022, BIG Poland has built a portfolio of 10 fully commercialized retail parks totalling nearly 200,000 sqm of GLA, securing approximately 6% of Poland’s dynamic retail-park market.” – comments Eran Levy, CEO at BIG Poland

Projects under construction

As of August 2025, the 7 most active retail park and convenience retail developers accounted for nearly 50% of the newly built supply. Saller led the market with a 13% share of the total stock under construction, followed by LCP Properties with a 10% share. The ownership structure of retail parks and convenience retail parks under development remains highly fragmented, with around 40 active developers currently advancing projects at the construction stage

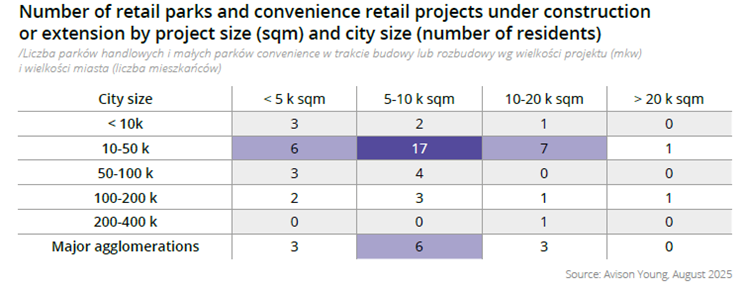

The total volume of retail park space currently under construction is estimated at approximately 510,000 sqm. A significant portion – 57% – of the new supply is being developed in towns below 50,000 residents, while 19% is located in Poland’s eight largest metropolitan areas. Notably, only 15 of the more than 64 projects underway exceed 10,000 sqm in size.

Dynamic retail park growth is reflected in the new supply completed within last five years. In the retail park format it amounted to 1.7 million sqm, while in shopping centres it slightly exceeded 500,000 sqm of GLA.

What is the typical retail park under construction like?

- Developed in city of 10-50 k residents (52%)

- GLA between 5-10 k sqm (62%)

- Located on the way home (40%)

Credit for used images: Avison Young

Paulina Brzeszkiewicz-Kuczyńska

Research and Data Manager at Avison Young