The study’s findings offer a nuanced view of current consumer dynamics – revealing where manufacturers and brands must adapt to stay aligned with evolving expectations.

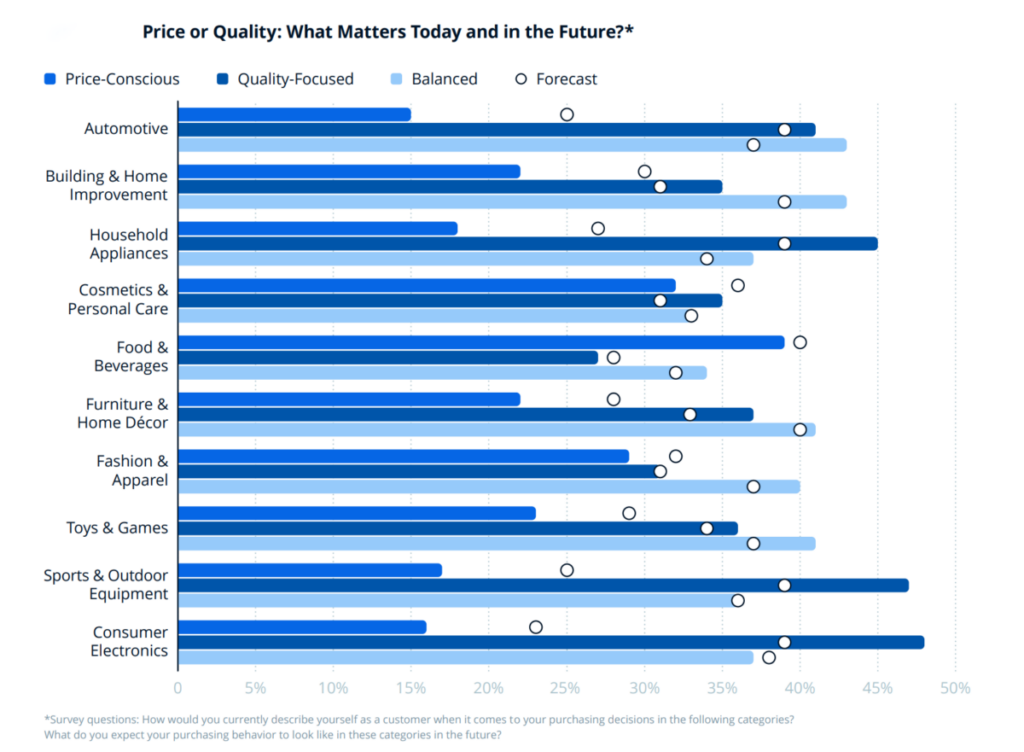

Rising living costs, economic uncertainties, and shifting consumer habits are measurably influencing purchasing decisions – but not in the same way across all categories. While price is becoming increasingly important in some segments, quality remains the key factor in others. A growing preference for discount options is particularly evident in fast-moving everyday goods. And even for long-term investments, price is playing an increasingly pivotal role.

Price sensitivity is steadily increasing for everyday products, and in some categories, price has already become the dominant decision factor. 39% of consumers prefer lower-cost alternatives over premium brands when buying food. A similar trend is emerging in the cosmetics sector, where 36% plan to switch to more affordable products.

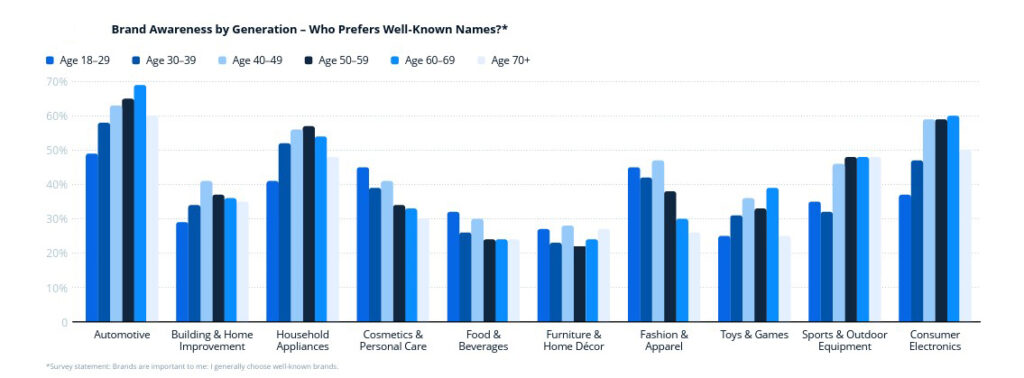

Accordingly, the role of brands is also in constant evolution. In the past, brand names were seen as a guarantee of quality and trust. Manufacturers and retailers invested heavily in brand-building, with premium providers in particular reinforcing their brand promise through consistently high product quality – translating consumer trust into higher prices.

While some established brands continue to thrive in durable goods, the mid-market segment is facing increasing pressure. Brands that fail to position themselves clearly as either affordable private labels or premium brands risk losing ground.

In trend-driven markets, popular brands hold a clear advantage – often secured through large marketing budgets. But brand loyalty among younger consumers is fragile: they switch flexibly between lesser known and

premium products, as long as the look and overall experience meet their expectations.

Key Findings

Price sensitivity is rising, particularly in the food, cosmetics, and fashion sectors. While durable goods remain driven by quality, consumers are becoming increasingly price conscious.

In everyday categories, brand relevance is declining. Consumers are shifting their focus toward price or premium quality, leading to a shrinking mid-market segment. Brands positioned around a balanced price-performance ratio (mainstream) face increasing challenges.

The line between planned and impulse purchases is becoming increasingly blurred – accelerated by digital shopping experiences and social media.

Consumer decisions vary by product category – sometimes price-driven, sometimes quality-focused, or striking a balance between both. Younger consumers prioritize trends and premium products, while older shoppers focus more on value for money. Lower- income households are particularly sensitive to rising prices.

Relevance For Businesses

Strategic Focus Is Essential for Brands: While price-conscious consumers have more affordable alternatives than ever, quality-driven buyers expect real added value – delivered through innovation, service, or exclusive offers.

Digital Purchase Triggers Demand Agility: Online channels are driving purchasing decisions across all price segments. Even high-ticket items like household appliances and cars are increasingly bought online – companies must adapt accordingly.

Winning Strategies Start with Data-Driven Insights: Brands that analyze purchasing behavior through data can identify trends early and make targeted decisions. This study provides a fact-based foundation for strategic planning for brands, manufacturers, and retailers.

To learn more about the study, please click here.