ACROSS: To what extent do retail and the hotel industry feed off each other? Why does linking these areas make sense from an investment perspective?

Andreas Löcher: Both asset classes comprise operational real estate, which automatically means there are many similarities. The property itself is used to earn money through the sale of goods or the provision of overnight accommodation. In short: the property is a fundamental driver of success, which is reflected in the profit and loss statement. As such, there is a lot of overlap in terms of how things work and also with regard to the cycle.

Roman Müller: Both asset classes are extremely user-centric. While tenant and landlord satisfaction are essential for the long-term profitability and attractiveness of retail and hotel properties, it is also vital to meet customer needs. That’s the biggest similarity between the two asset classes and the starting point for achieving synergies, and also what sets them apart from other property types, such as offices and logistics.

ACROSS: Can you name some specific similarities for us?

Löcher: Some of the similarities were clearly evident during the COVID-19 pandemic. The retail and hotel industries are early-cyclical. Accordingly, they are directly affected when it comes to issues such as travel restrictions and social distancing, as well as by economic challenges and crises in general. During the pandemic, retail and hotel properties were essentially mothballed, but both asset classes were able to restart operations as soon as restrictions were lifted and they recovered relatively quickly compared to other asset classes.

Müller: There are macroeconomic trends and social developments that affect both asset classes in equal measure, thereby enabling us to create synergies, in particular in research and around forecasting consumer trends. One aspect here is the increasing polarization of brands, formats and categories, including the trend towards more luxury on the one hand and a greater focus on discount/budget propositions on the other. Although successful formats do exist in the mid-range segment in both asset classes, they appear to be on the decline in general.

Union Investment is one of Europe’s leading hotel real estate investment management companies. The Hamburg-based company boasts 93 hotel properties in its actively managed portfolio. The company is also pursuing a clear growth strategy outside of Europe. Last year, for example, it opened the first Motel One under the The Cloud One brand in the USA at Ground Zero in New York. According to Andreas Löcher, while budget hotels and luxury concepts are performing particularly well, conference hotels still have some catching up to do. Vacation hotels, on the other hand, are well above pre-COVID levels. Caro & Selig on Lake Tegernsee and the Steigenberger hotel in Heringsdorf (both in Germany) are Union Investment’s two most recent investments in this segment. The main challenge facing the industry is the dramatic rise in labour costs.

ACROSS: What conclusions can be drawn from identifying this commonality?

Löcher: We want to learn from each other in a holistic manner and leverage synergies in a variety of ways. At Union Investment, we believe that this is particularly relevant in the hotel and retail sectors. Issues range from industry-specific contract clauses and mechanisms to joint research and resource sharing, which has a significant impact on our team’s learning curve and the performance of our portfolio. It thus made sense to have a closer organisational alignment of our retail and hotel activities, which is what we’re doing.

Müller: Our investment strategy in the retail sector is based on a “best-in-class” approach. When it comes to shopping centers, we therefore only target the very best properties and prime locations in major European cities. These assets benefit significantly from tourism as well as from strong regional catchment areas. By bringing together our retail and hotel expertise in the new Investment Management Operational department, we can identify good locations across all property types at an even earlier stage, enabling us to develop them accordingly and operate them effectively over the long term.

ACROSS: You said that polarization is happening in both asset classes. To date, the link between the hotel and retail industries has been particularly evident in the luxury segment.

Löcher: The development of innovative hotel concepts has been a feature of the luxury segment in recent years. These service-oriented concepts, which are built around an individualised approach to guests, attract customers who are less price-sensitive when it comes to hotel rates. This trend has actually gained momentum in the current market environment. Having said that, the budget segment is also on the rise. Specifically, relatively low labour costs combined with high space efficiency have made the concept economically successful and crisis-resistant.

ACROSS: Could you give us an example?

Löcher: Motel One is probably the best-known example. Union Investment was their first institutional investor and is currently invested in 10 of the brand’s properties across Europe. We also supported Motel One in its expansion into North America with the opening of the Cloud One Hotel in New York City. In the budget segment, successful players have developed very attractive products with competitive rate structures, resulting in very high occupancy. Strong occupancy levels also allow rates to be disproportionately increased in the medium term.

ACROSS: That mirrors developments in the retail sector.

Müller: Absolutely! Developments in retail are pretty similar and the underlying megatrends and structural changes in consumer behaviour are also comparable. On the one hand, luxury is doing well, on the other hand, discount formats are very successful at the moment. In addition, today’s consumers shop in a much more flexible way than in the past. For example, fast fashion is being paired with luxury accessories as a status symbol. To a certain extent, that combination has replaced the mid-price segment.

ACROSS: What other polarization trends have you observed?

Müller: In addition to luxury vs. discount, we’ve also seen the increasing polarization of convenience and experience in the retail sector. By “convenience”, we mean the everyday purchase of fast-moving consumer goods, such as groceries and pet food. In this segment, consumers are quite sensitive with regard to price and time. By contrast, consumers are often willing to invest money and time in a comprehensive “experience” that goes well beyond covering basic needs. Shopping becomes a leisure activity and more of an event. Since a city’s shopping heritage and retail offering boost its appeal, this is precisely where the requirements for retail and hotel locations align. For weekend destinations in particular, retail is often considered one of the most important criteria for travel decisions, along with cultural attractions.

Löcher: Accordingly, properties with entertainment elements and a high-quality user experience are in much demand among investors. Due to the wider mixed-use trend, the combination of hotel and retail offers genuine 24-hour utilisation of a property. The optimal use of a site that results from this duality extends to ancillary issues such as parking spaces, which can be better utilised as a result of multiple types of use.

ACROSS: How can retail and hotels be combined at a single location? What does the local environment need to look like?

Müller: The key question to be asked is whether both types of use actually need to be combined within one property. Whether the combination of hotel and retail works better vertically or horizontally has to be considered for each location and each asset. There are some examples where the combination makes perfect sense in terms of micro-location and demand, but the building structure simply doesn’t allow for the addition of retail or a hotel within the property. The determining factor is whether both uses can function in a synergetic way within a micro-location. Riem Arcaden in Munich is a best-practice example: we placed two hotels, Novotel and Motel One, in front of the entrances to the shopping center, rather than on the upper floors of the mall. That allowed us to successfully combine those uses without any negative dependencies.

Löcher: That’s absolutely right – the combination doesn’t necessarily have to be implemented within a single property. Bikini Berlin, where customers are offered shopping experiences and also have access to an exciting hotel concept, shows that such a set-up can work really well. However, separate buildings can also work, as demonstrated by high-street destinations peppered with lifestyle hotels, such as the various examples on Mariahilfer Strasse in Vienna.

ACROSS: You mentioned Riem Arcaden, an urban ensemble that hosts an above-average number of events. How important is it that the retail and hotel side work together organisationally, for example with regard to events, in order to develop their potential?

Löcher: Yes, in addition to a strong core catchment area and the footfall driven by the adjacent trade fair and congress center, Riem Arcaden also benefits from events. There is an organisational structure in place for selecting and implementing events, and our center management team also involves both hotel operators in the selection process. Of course, in this specific case, and also in general, there is scope to become even more active and we intend to do so.

ACROSS: Let’s go back to your investment criteria and work through them again.

Müller: Our retail investment strategy is aimed at polarization winners with clear customer benefits. On the one hand, we are looking for grocery-anchored retail parks with a strong focus on meeting local needs, and on the other hand we’re interested in “best-in-class” shopping destinations with cross-regional appeal.

ACROSS: Which centers are we talking about here?

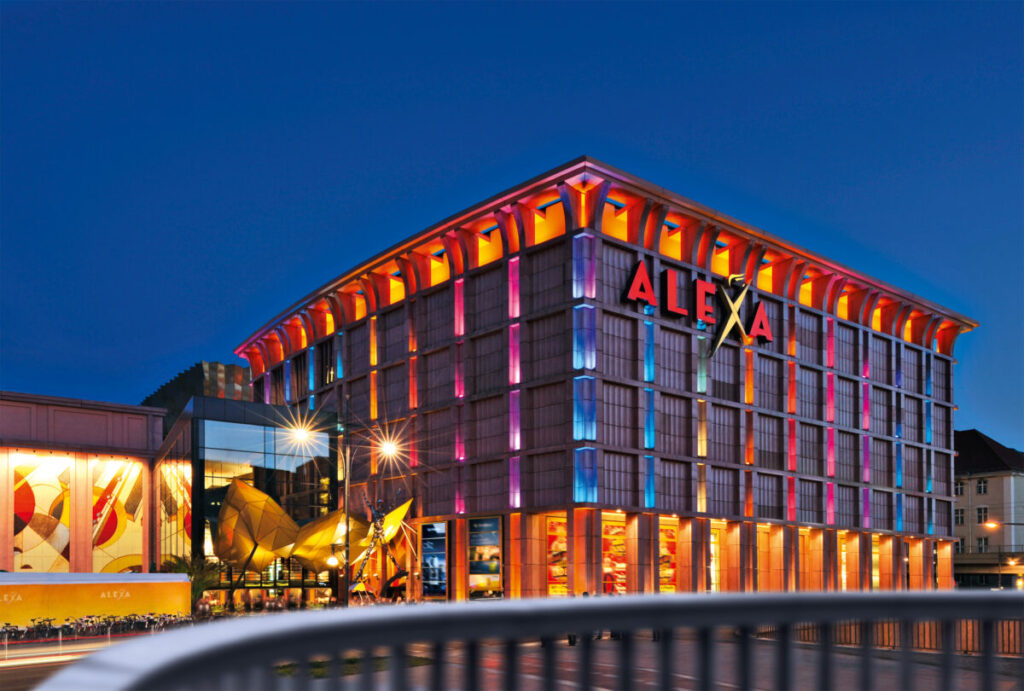

Müller: In Germany, we’re talking about properties such as Riem Arcaden, which we’ve already mentioned, and Lago in Constance, which overlooks Lake Constance, or Alexa in Berlin, which is located on Alexanderplatz in the heart of the German capital. In Italy, one of the most popular tourist destinations in Europe, our portfolio includes Le Befane in Rimini and Le Terrazze in La Spezia. In CEE, Manufaktura in Łodz is a prime example. Manufaktura is not just a shopping, center it’s the site of a former textile factory that has been transformed into a completely new urban center, focusing on retail, food outlets, and entertainment. Two hotels, albeit not owned by us, are also located adjacent to the market square.

Alexa in Berlin

Alexa in Berlin: Union Investment’s investment strategy is aimed at polarization winners with clear customer benefits. One of the company’s “best-in-class” shopping destinations is Alexa in Berlin, on Alexanderplatz. The rentable area is 57.971 sq m. Alexa brings together shops, restaurants and leisure facilities in the heart of Berlin. It shapes the architecture on Alexanderplatz like no other building. In addition to providing a diverse shopping experience and a range of eateries, the building is used for public events such as concerts. The shopping centre enjoys a high level of recognition among Berliners and visiting tourists due to its prominent position and wide selection of shops and facilities. Other notable Berlin sights including the television tower and the Nikolaiviertel quarter are just a short walk from Alexa.

ACROSS: What connects these locations?

Müller: What the locations have in common are high occupancy rates and very good operating figures, with tourism playing a key role in strong KPI performance. Retailers are keen to establish their flagship concepts at these locations and are clearly aiming to expand rather than to downsize. We are more than happy to continue investing in similar assets and locations. However, these are also the locations where we are carefully evaluating whether new use types can be introduced. That might involve the addition of a hotel, for example. The aim here is not to repurpose non-functioning upper floors, but to maximise synergy at the micro-location. The key question is: What can be done to stimulate retail at a specific location? In terms of our investment strategy, that is of the utmost importance.

Manufaktura in Łodz Manufaktura in Łodz: Union Investment’s Manufaktura in Łodz is not just a shopping center, it’s the site of a former textile factory that has been transformed into a completely new urban center, focusing on retail, food outlets and entertainment. Two hotels are also located adjacent to the market square. The rentable area is 104.939 sq m. The uniform red brick façade of the Manufaktura shopping center reminds visitors of the building’s history as a textile factory while also radiating a timeless quality. The property has a BREEAM Excellent rating and is a vibrant shopping destination in Poland’s third largest city. In addition to shopping opportunities, the building also offers space for concerts, open air performances and other public events. A DIY store and cinema also located on the site belong to Leroy Merlin and Cinema City and are therefore not part of the fund assets.

ACROSS: What is the strategy for the other retail classes?

Müller: In addition to shopping centers and grocery-anchored retail parks, we are looking into high-street assets in prime locations in major European cities. We see a strongly positive trend in that area. If we take a closer look at specific locations, cities such as Lisbon, Madrid, Barcelona, Brussels, Paris and London are at the top of the list.

Löcher: They’re also the same locations that are exciting for the hotel industry. Our focus in this regard is primarily on metropolitan regions. In particular, locations with strong tourist appeal have bounced back surprisingly quickly in the wake of the pandemic. Two years ago, for example, we acquired the Radisson hotel near the Sagrada Familia in Barcelona for our UniImmo: Europa fund. It’s a very successful hotel concept that is a superb fit with its immediate surroundings. We have generated a gratifyingly high variable rental income from the hotel asset since acquisition.

ACROSS: What kinds of concepts are generally of interest to you in the hotel industry?

Löcher: Strong, fresh concepts that surprise and delight the guest. In the hotel sector, one thing is clear: the room itself has faded into the background. Common areas have grown in both relative size and importance. This summer, we are opening a 25hours hotel on PAPER ISLAND in Copenhagen, with the “experience” theme featuring heavily in this concept. Large, design-oriented areas will invite guests to linger and, above all, to socialise. The spaces will be optimised for that purpose. Other well-known examples of this trend can be found in the Motel One chain, as well as Ruby Hotels and Premier Inn.

Paper Island, Copenhagen 25hours

Paper Island, Copenhagen 25hours: In 2022, Union Investment acquired the 25hours hotel on PAPER ISLAND in Copenhagen. It is part of the flagship PAPER ISLAND project, an artificial island in a prime city-center location in Copenhagen’s harbour. A mixed-use quarter is currently being built on PAPER ISLAND, which alongside the hotel will include 253 apartments, high-quality retail, restaurants, event spaces and the new Water Culture House.

ACROSS: What do you think of the synergy between the hotel industry and the outlet industry? In your opinion, are outlet centers, even ones that are a long way from city centers but located in attractive tourist regions, particularly interesting when it comes to combining retail and hotels?

Müller: Yes, but with the caveat that this only applies to a small number of outlet centers that have significant cross-regional appeal, in other words for centers such as Metzingen in Germany or Parndorf in Austria, which are expected to outperform not only now but also in the future. In this respect, I can only envisage a limited number of top locations in Europe where the combination of outlet center and hospitality makes perfect sense. However, there is also a much larger number of outlet centers which are performing well operationally but whose visitors tend to come from within the respective region. In my opinion, there is only limited scope for hotels at those locations.

ACROSS: What are your thoughts on the synergies in retail parks?

Müller: I don’t see many direct synergies in that kind of scenario. Of course, there are some examples where a hotel is built directly next to or above a retail park, but those cases are rather exceptional and, in my opinion, not an institutional product that justifies a broad investment strategy. The indirect effects are more interesting: tourism within a region creates economic power, economic power creates jobs, greater consumer confidence, higher purchasing power and, accordingly, better conditions for neighbourhood retail and retail parks.

ACROSS: Could you give us some examples?

Müller: The Algarve in Portugal is one such example. Population density there is quite low, but driven by tourism, purchasing power has increased significantly. That has had a positive impact on neighbourhood retail targeted at both local people and tourists. Obviously, we are monitoring such developments. Similarly, in Austria we have invested in the neighbourhood retail sector in tourist regions.

Löcher: Tenants who apply their hotel concepts in retail park locations don’t generally drive traffic to the retail parks themselves. Their guests are often transients who don’t stay long and don’t spend much. Examples that we see in the market where hotels are built above retail parks tend to involve properties with unwanted space. Developers are merely trying to improve property utilisation. That’s not a concept where we anticipate significant and sustainable investment opportunities.

ACROSS: Finally, there are retailers, particularly in the luxury segment, who are aggressively venturing into the hotel sector. What do you think of such plans?

Müller: Dior and LVMH in Paris, and Fendi in Rome, are undoubtedly showcasing exciting concepts and approaches. With them, it’s all about brand building and the user experience. We would love to be part of such concepts in the future, but we don’t see a broad institutional entry point at present.

Andreas Löcher

Andreas Löcher is Head of Investment Management Operational

Roman Müller

Roman Müller is Head of Investment Management Retail