By Olaf Hohmann

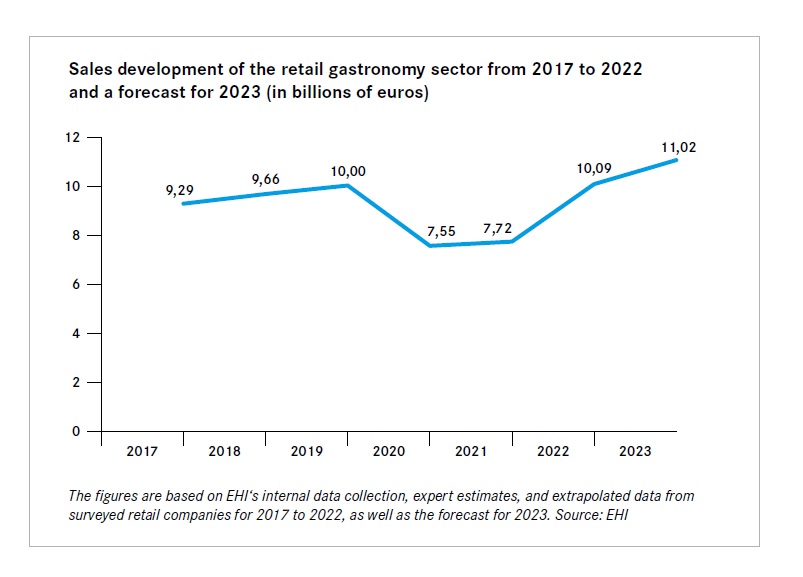

Retailers in Germany have reached pre-Corona levels with their restaurant sales in 2022. This is one of the findings of the EHI white paper “Retail Gastronomy in Germany,” which was produced in cooperation with GfK. For 2023, the surveyed retail caterers continue to expect a significant increase in sales.

The participating retailers expect a positive development with an average increase of 9.2 percent, so in 2023, total sales in the retail gastronomy sector are expected to be around 11 billion euros. However, growth is driven to a significant extent by price developments. For example, increased spending on food and energy has also been reflected in the prices of retail gastronomy offerings and contributed to the increase in sales. In 2020, trade restaurant sales were down about 24.5 percent from pre-Corona 2019 due to the Covid 19 pandemic. In the following year, 2021, sales rebounded slightly, down 22.8 percent from 2019. In 2022, trade food service sales benefited from the end of the pandemic, reaching about 10 billion euros, the same level as in the pre-Corona year of 2019.

Ensuring profitability

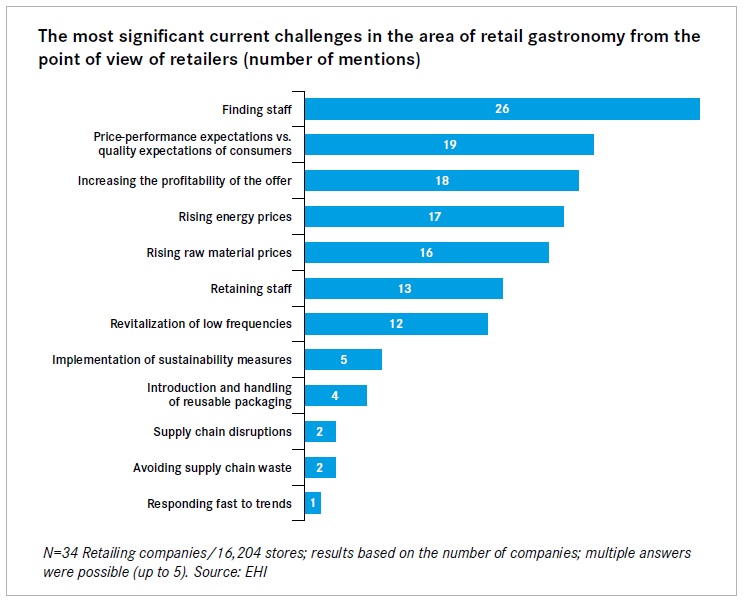

Despite all the optimism, the challenges for commercial gastronomy and their offerings have remained. Staff shortages and the increasing price orientation of consumers are key factors. In conjunction with rising raw material and energy prices, the aim is to secure the profitability of the offering.

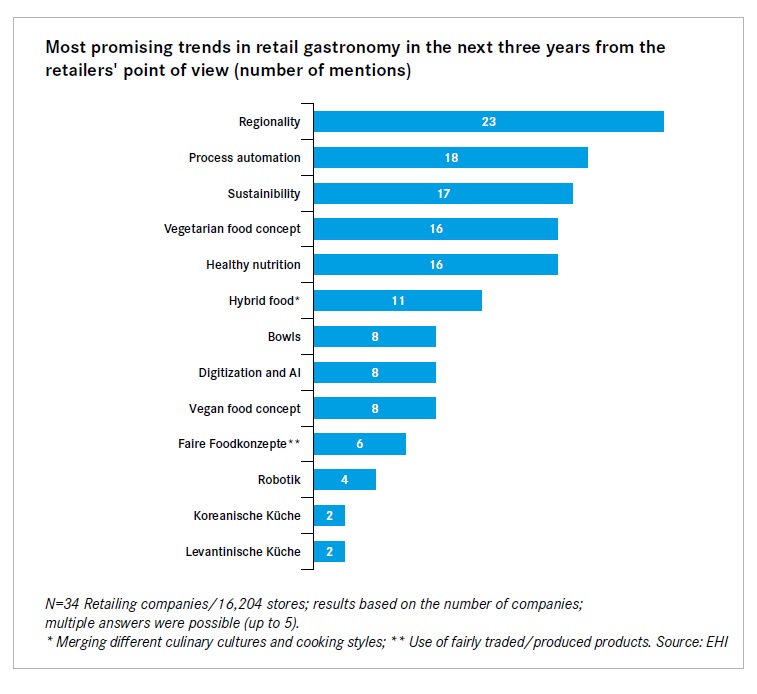

In this context, process automation is cited as one of the most promising trends for the next three years. Digitization and the use of robotics and AI can help reduce the workload of employees and help meet customers’ needs and expectations. Retailers also see future potential in the food sector in plant-based and overall healthy nutrition, regional cuisine, including the processing of local and/or fair-trade products, or in the dishes of Korean and Levantine cuisine.

Purchasing power increases with age

Well over half of spending in the retail gastronomy sector is made by customers over the age of 45 – and this trend is increasing. On the other hand, spending by younger age groups is declining, contrary to general market trends in retail gastronomy. For longterm and sustainable growth, an attractive, possibly new range of products should be created for younger target groups without neglecting the older target groups and the “classics of retail gastronomy,” i.e., the best-selling dishes such as sandwiches, meatloaf, home-style cooking, or pizza and pasta.

On average, customers in the retail gastronomy sector spend 5.43 euros per purchase (a 2022 to March 2023). This means that the average receipt of 4.90 euros has risen by 10.8 percent compared with the same period of the previous year. The group with the most significant purchasing power is the 55+ age group, which spends an average of 5.70 euros on its meals or snacks. Breakfast, lunch, and snacks between meals dominate the distribution of consumer spending by time of day. Customers spend the most on meals in the morning and at lunchtime. Spending on snacks in the morning and afternoon is also high, with a share of almost 30 percent.

Reusable and disposable packaging

Since January 1, 2023, the reusable offer obligation for takeaway food and beverages has been in force. It obliges restaurants, cafés, and grocery stores, among others, to offer packaged food and drinks in reusable packaging. However, despite the reusable offer, the use of disposable packaging dominates. In commercial gastronomy, reusable packaging is used in seven out of 100 cases when serving food and beverages. Why this is the case can only be surmised so far. Several suppliers on the market offer different reusable packaging and dispensing concepts. However, the containers can only be returned to specific locations or exclusively to the providers’ cooperation partners. There are numerous situations in which it is much easier for consumers to use disposable packaging, or handling reusable packaging proves too cumbersome. A uniform nationwide system with many drop-off points without a registration process, customer account, app downloads, or the provision of personal data would presumably make many things easier, faster, and more convenient from the customer’s point of view.

Olaf Hohmann

Olaf Hohmann is a member of the management board and Head of Retail Gastronomy Research at the EHI Retail Institute, Cologne, Germany. EHI white Paper Retail Gastronomy in Germany 2023: The white paper compiles all essential data on market activity from the perspective of retailers and consumers. For this purpose, EHI surveyed 34 retailers. GfK, as a cooperation partner, contributed current consumer data from the Out-of-Home (OOH) panel.