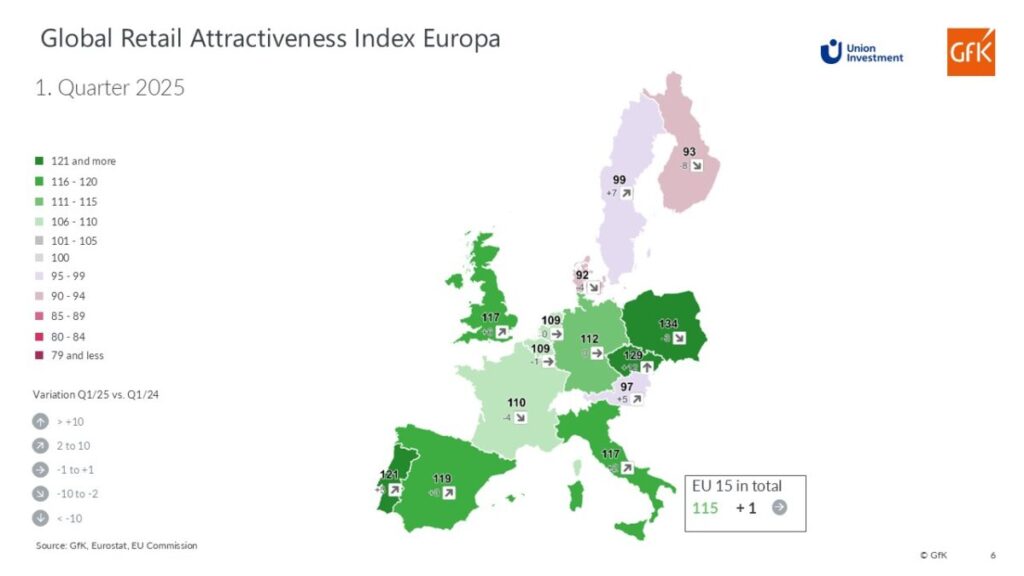

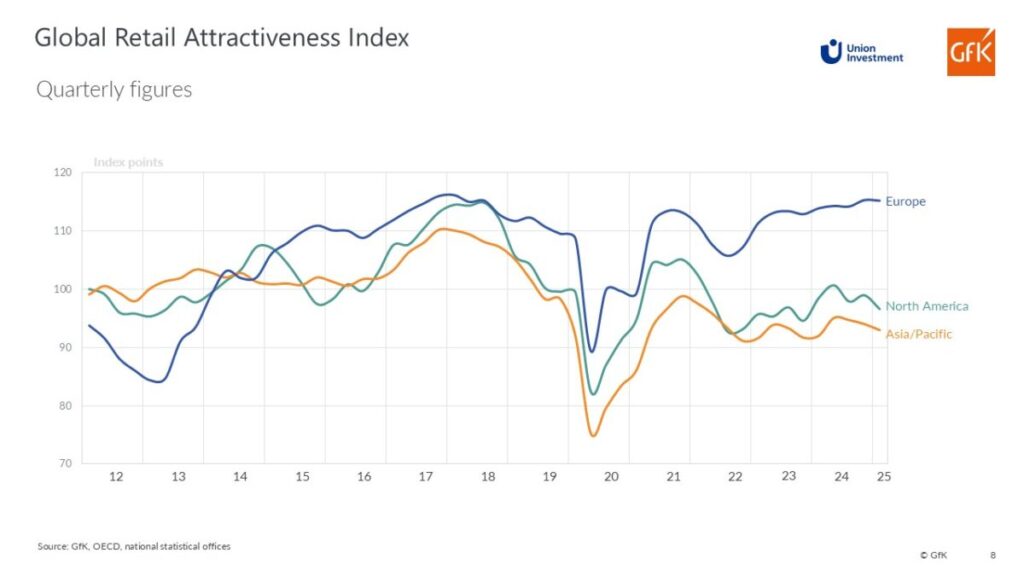

The European retail markets have moved beyond the trough of 2022. The brighter mood among retailers and consumers, as well as the healthy fundamental data, is reflected in the 115 points reached by the Global Retail Attractiveness Index (GRAI) for Europe in the first quarter of 2025. With a further one-point increase compared to the previous year (first quarter of 2024: 114 points), the recovery that began three years ago is expected to continue in 2025. By spring, the index calculated by Union Investment and Gfk had even reached a new high since the first survey seven years ago (2018).

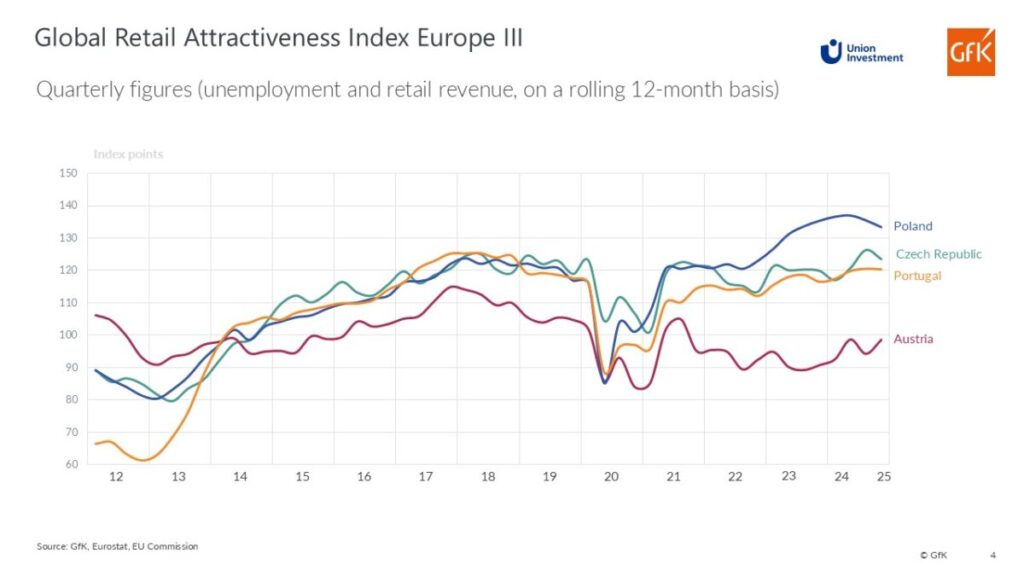

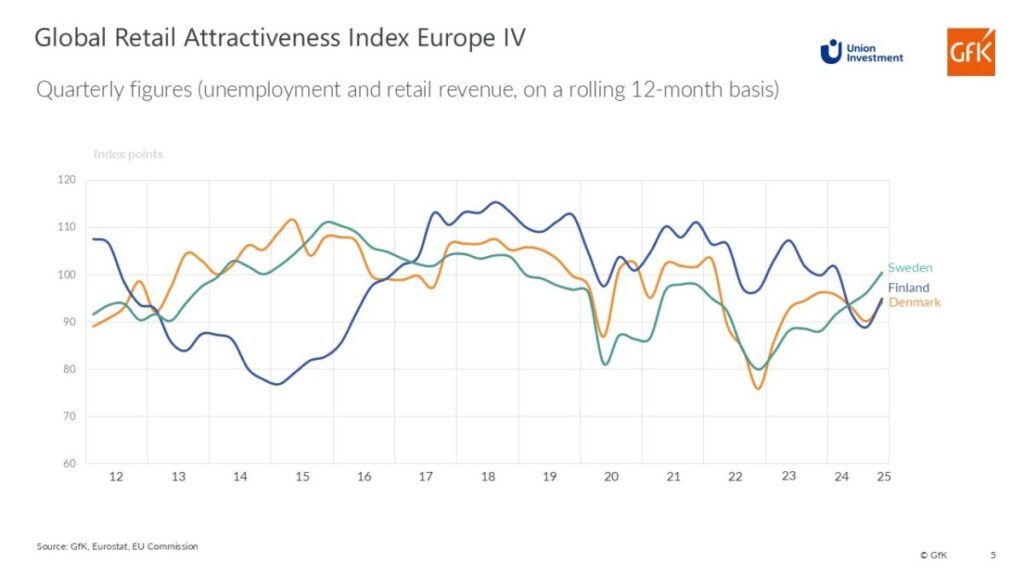

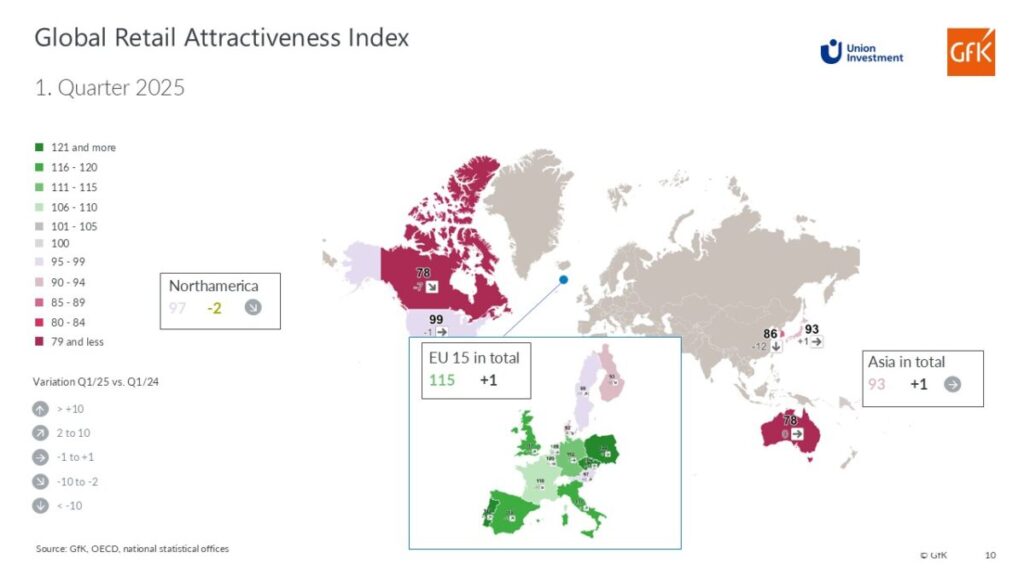

The slight to strong upturns in seven European retail markets contributed to a more “green” European map throughout the year. In two other markets, figures stabilized at the same levels as the previous year. Growth was robust in the Czech Republic, with a twelve-point increase, and in Sweden, with a seven-point increase. Poland remains the current leader in the EU-15 index with 136 points despite a slight drop. The Czech Republic (129 points) and Portugal (121 points) also remain among the top trio. The German retail market maintained its good level in the first quarter with a stable 112 points, while Austria showed a trend reversal with a substantial increase of five points, reaching 97 points. In addition to Poland and France (both with 110 points), only Denmark (92 points) and Finland (93 points) saw declines, primarily in the low single-digit range. The two Nordic countries thus bring up the rear in the current European ranking.

“The majority of European retail markets are stronger three years after the crisis, with healthy fundamentals, above all rising retail sales, and intact labor market figures. Accordingly, we are also seeing improved sentiment among institutional investors, who are increasingly exploring opportunities to enter the retail sector again,” says Henri Eisenkopf, Director Transactions Shopping Places at Union Investment. “After initially focusing on properties with value appreciation potential, investors in Europe are now increasingly looking for core properties across the entire retail spectrum, including shopping centers. For us as investment and asset managers, the current market phase with its positive trend in the operating performance of retail properties promises attractive yield contributions in the portfolio as well as good opportunities for profitable sales.”

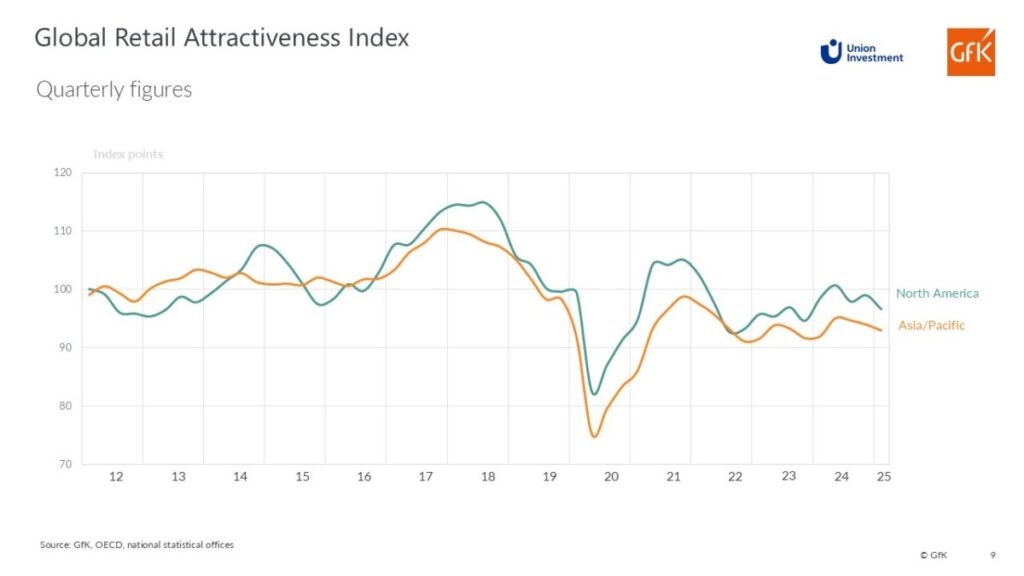

While the European retail markets have emerged from the crisis, development in North American markets is still lagging. Above all, however, the Asia/Pacific region is still lagging well behind Europe. The North America index in the GRAI deteriorated slightly by two points over the year, reaching an average value of 97 points at the end of the first quarter of 2025. The Retail Index in Asia/Pacific rose by one point, but still only reached a below-average level of 93 points.

“Overall, it should be noted for the coming months that trade tariffs and a weakening GDP trend could hurt trade, at least temporarily,” says Henri Eisenkopf.

Click to enlarge

Key Facts

GRAI 1/2025 (Global Retail Attractiveness Index) confirms a positive trend in the European retail sector in Q1 2025. The EU-15 Index reached a new high of 115 points, up 1 point from the previous year (Q1 2024: 114 points).

Seven European countries reported slight to strong growth in retail market performance. Czech Republic (+12 points) and Sweden (+7 points) showed particularly strong increases. Poland remains the leader with 136 points, followed by Czech Republic (129) and Portugal (121). Germany remained stable at 112 points, while Austria reversed its trend with a significant 5-point increase to 97. Denmark (92) and Finland (93) experienced slight declines and are at the bottom of the European ranking.

Improved sentiment among retailers and consumers, backed by healthy fundamentals such as rising retail sales and stable labor markets. Institutional investors are returning to the retail sector, now also targeting core assets like shopping centers. The current market phase offers attractive yield opportunities and potential for profitable asset sales.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Methodology

Union Investment’s Global Retail Attractiveness Index (GRAI) measures the attractiveness of retail markets across 20 countries in Europe, North America, and the Asia-Pacific region. An index value of 100 points represents average performance. The EU-15 index combines the indexes for the following EU countries, weighted according to their respective population size: Sweden, Finland, Denmark, Germany, France, Italy, Spain, Austria, the Netherlands, Belgium, Ireland, Portugal, Poland and the Czech Republic, plus the United Kingdom. The North America index comprises the US and Canada, while the Asia-Pacific index covers Japan, South Korea and Australia.

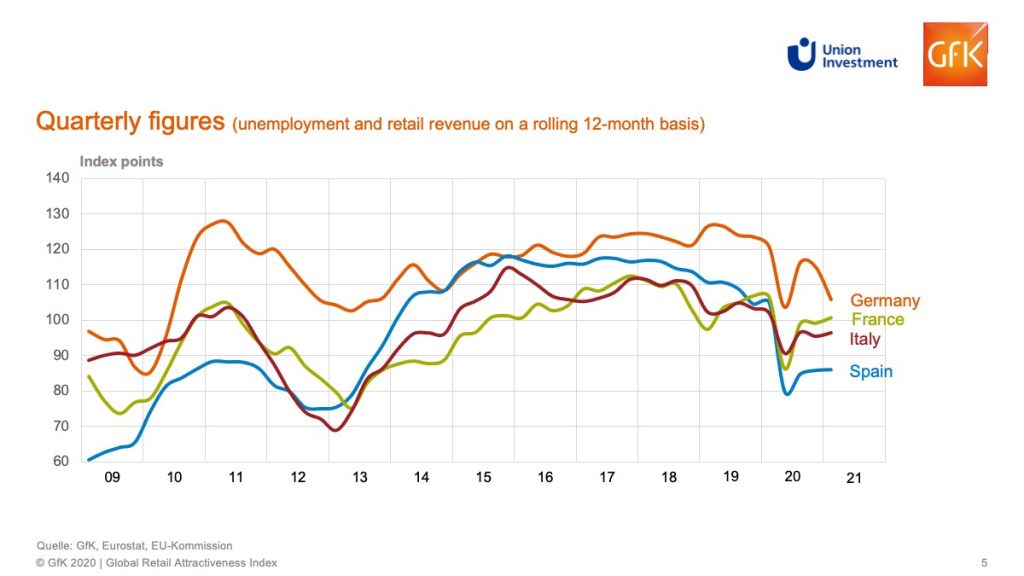

Compiled every six months by market research company GfK, the Global Retail Attractiveness Index consists of two sentiment indicators and two data-based indicators. All four factors are weighted equally in the index, at 25 percent each. The index reflects consumer confidence as well as business retail confidence. As quantitative input factors, the GRAI incorporates changes in the unemployment rate and retail sales performance (rolling 12 months). After standardization and transformation, each input factor has an average value of 100 points and a possible value range of 0 to 200 points. The index is based on the latest data from GfK, the European Commission, the OECD, Trading Economics, Eurostat, and the respective national statistical offices. The changes indicated refer to the corresponding prior-year period (Q1 2024).