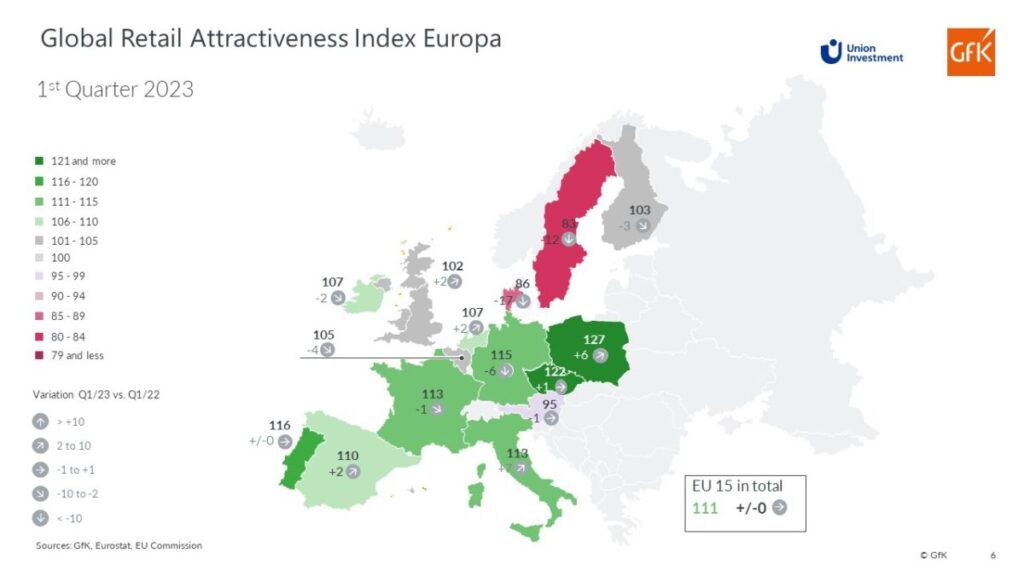

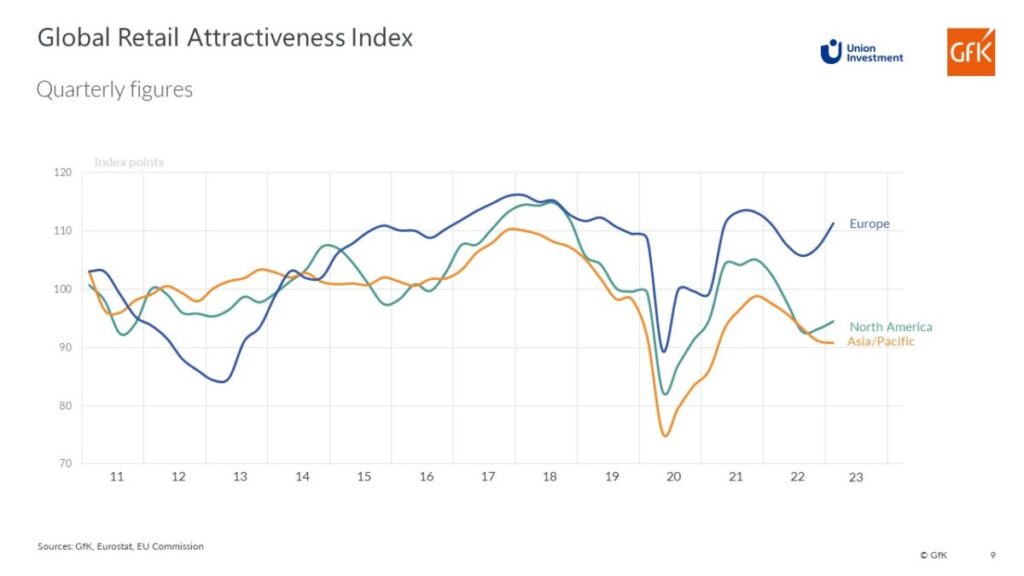

European retail markets have largely absorbed the direct and indirect strain from price increases due to commodity shortages and higher energy costs, amplified by the ongoing war in Ukraine. The trend points upward for six of the 15 EU countries in the Global Retail Attractiveness Index (GRAI) compared to the first quarter of 2022. The losses in the other countries are moderate, with a few exceptions in the Nordics.

“The positive developments across the board in the European labor markets and the fact that retail sales have been rising again in all 15 countries for a long time point to a recovery and a return of the markets to pre-pandemic levels in the long term”, said Olaf Janßen, head of Real Estate Research at Union Investment.

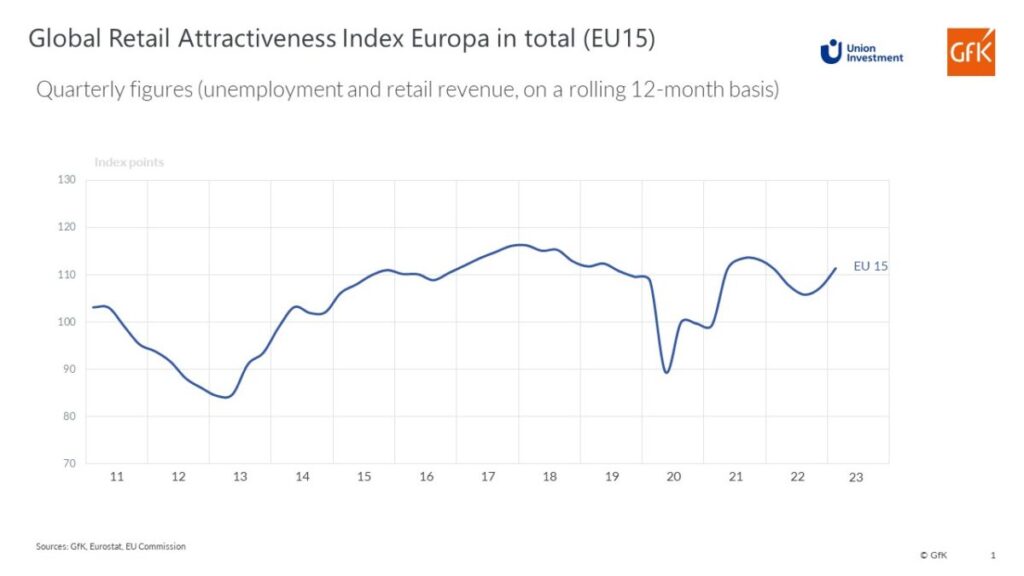

The Retail Index for Europe (EU 15), compiled by Union Investment and GfK, was unchanged in the first quarter of 2023 compared with the same period last year, at 111 points. At the same time, the discrepancy between strongly negative sentiment among consumers and retailers on the one hand and positive labor market data and inflation-driven retail sales on the other, which was already noted last autumn, is growing. Consumer sentiment (78 points) drops significantly by 14 points, and retail sentiment (95 points) by 12 points. On the other hand, both the labor market (136 points, up 9) and retail sales (133 points, up 10) improved.

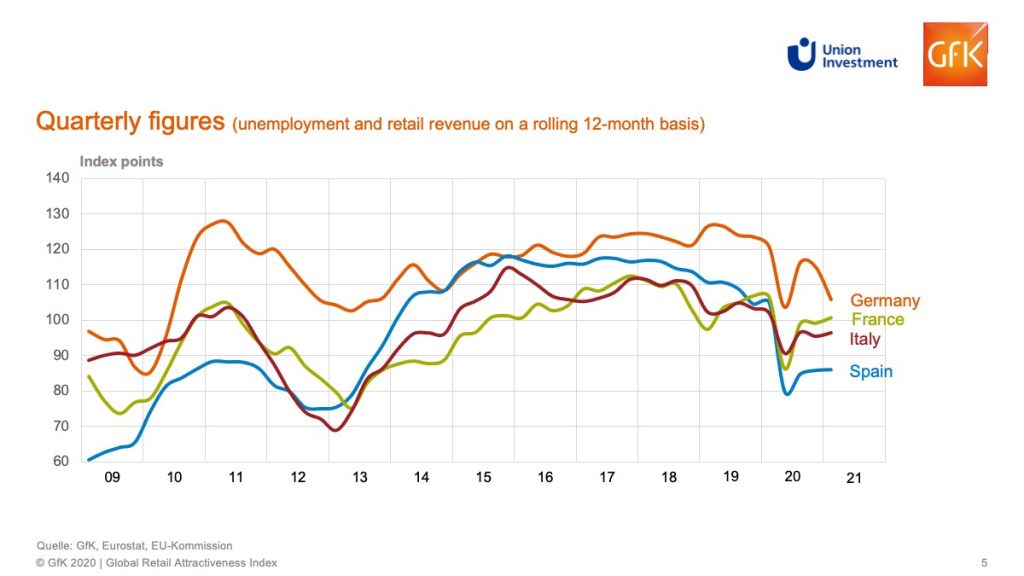

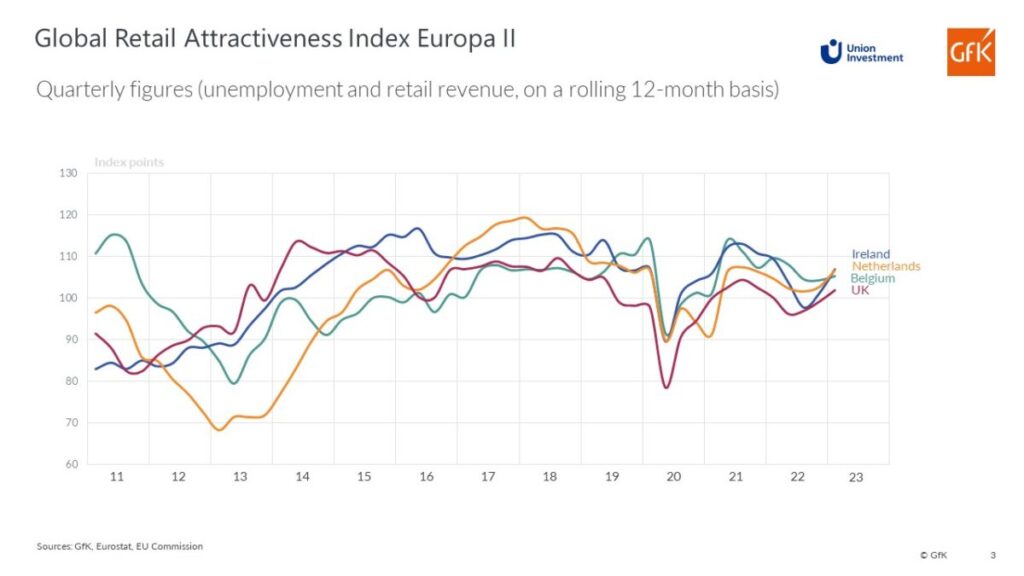

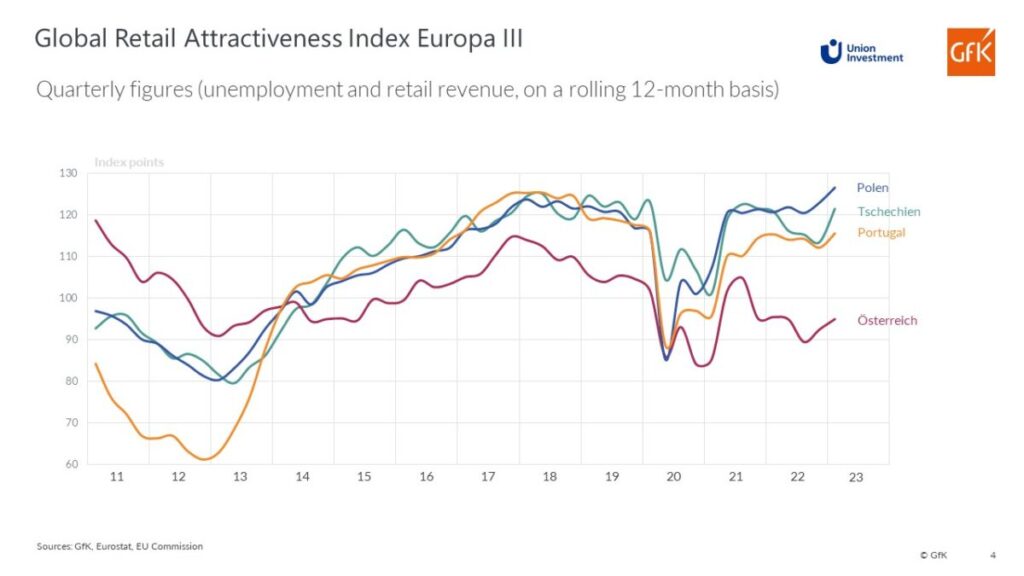

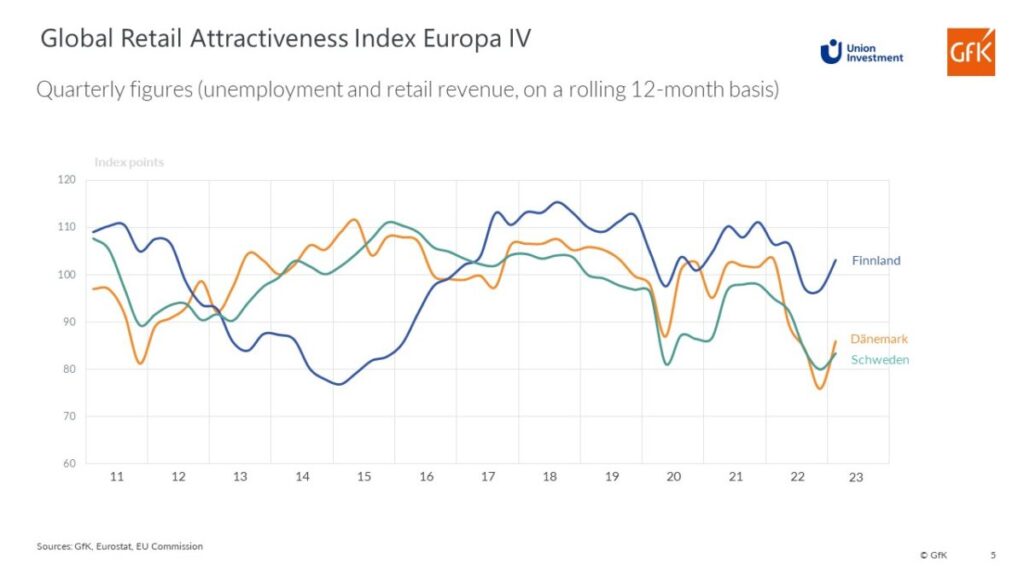

The most significant increases in the EU-15 Index compared to the first quarter of 2022 are shown by Italy, with a plus of 7 points, and Poland, with a plus of 6 points. In the country ranking, Poland (127 points) and the Czech Republic (122 points) are at the top, followed by Portugal (116 points) and Germany (115 points). France and Italy follow with 113 points each. Sweden and Denmark are bringing up the rear in Europe at the end of the first quarter of 2023 with 83 and 86 points, respectively. The two Nordic countries also suffered the most significant losses compared to the previous year, with 12 and 17 points dropping, respectively.

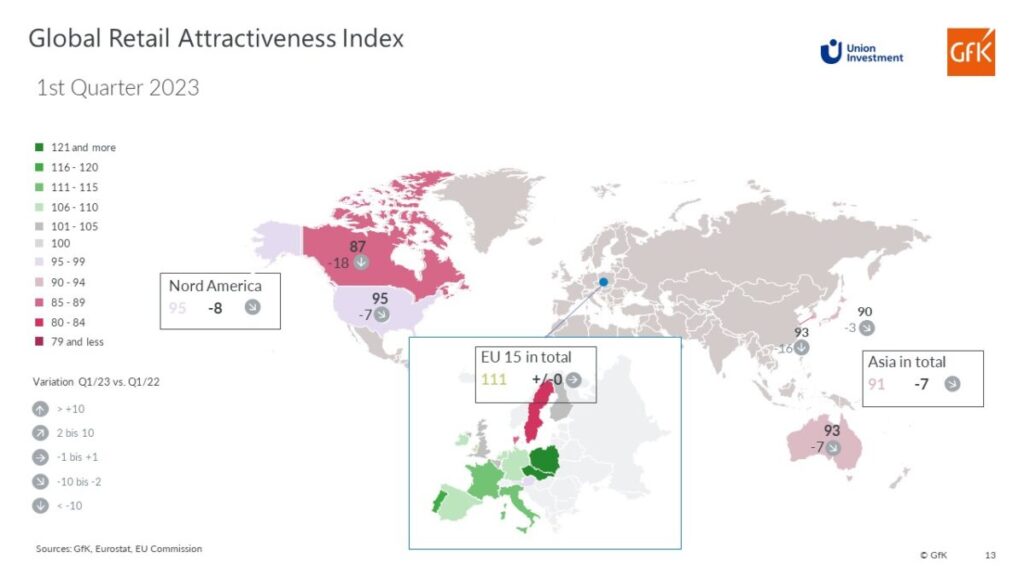

While the EU-15 index maintains its level, there are still no signs of recovery in North America and Asia. The North America Index in GRAI loses the most compared to Europe (minus 8 points) and only comes to 95 points. The Retail Index in Asia/Pacific remains at the lower end (91 points) with slightly minor losses (minus 7 points). The most considerable losses in the two overseas indices at the end of the first quarter of 2023 happened in South Korea (93 points, minus 16) and again in Canada (87 points, minus 18).

Click to enlarge

Key Facts

The Retail Index for Europe (EU 15) was unchanged in the first quarter of 2023 at 111 points compared to the corresponding period of the previous year.

On the one hand, both consumer and retail sentiment are declining. Consumer sentiment (78 points) is down 14 points, retail sentiment (95 points) is down 12 points. On the other hand, both the labor market (136 points, +9) and retail sales (133 points, +10) can improve.

As far as the level of the Retail Index is concerned, Poland (127 points) and Czech Republic (122 points) currently lead the field at country level, followed by Portugal (116 points) and Germany (115 points). They are followed by France and Italy with 113 points each.

Sweden and Denmark bring up the rear in Europe with 83 and 86 points respectively. They are followed by Austria (95 points) and Great Britain (102 points). The largest increases are in Italy (+7 points) and Poland (+6 points). Denmark suffered the biggest losses with a minus of 17 points and Sweden (-12 points).

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

Methodology

Union Investment’s Global Retail Attractiveness Index (GRAI) tracks the attractiveness of the retail markets of 20 countries in Europe, the Americas, and Asia-Pacific. A score of 100 index points represents an average rating. The EU-15 index includes the indices of the EU countries Sweden, Finland, Denmark, Germany, France, Italy, Spain, Austria, the Netherlands, Belgium, Ireland, Portugal, Poland, and the Czech Republic, plus the UK, weighted by their respective populations. The North America Index includes the indices of the USA and Canada; the Asia-Pacific Index includes Japan, South Korea, and Australia.

Determined semi-annually by the market research company GfK, the Global Retail Attractiveness Index comprises two sentiment and two data-based indicators. All four factors are equally weighted, i.e., 25 percent each, in the index. Both demand-side sentiment (Consumer Confidence) and supply-side sentiment (Business Retail Confidence) are included in the index. The change in unemployment and the development of retail sales (rolling 12 months) are included in the GRAI as quantitative input factors. After standardization and transformation, the input factors have a mean value of 100 and a theoretical range of 0 to 200 points. The index is based on data from current sources from GfK, the EU Commission, OECD, Trading Economics, Eurostat, and the national statistical offices. The changes shown refer to the corresponding period of the previous year (Q1, 2022).