Written by

Peter Sempelmann

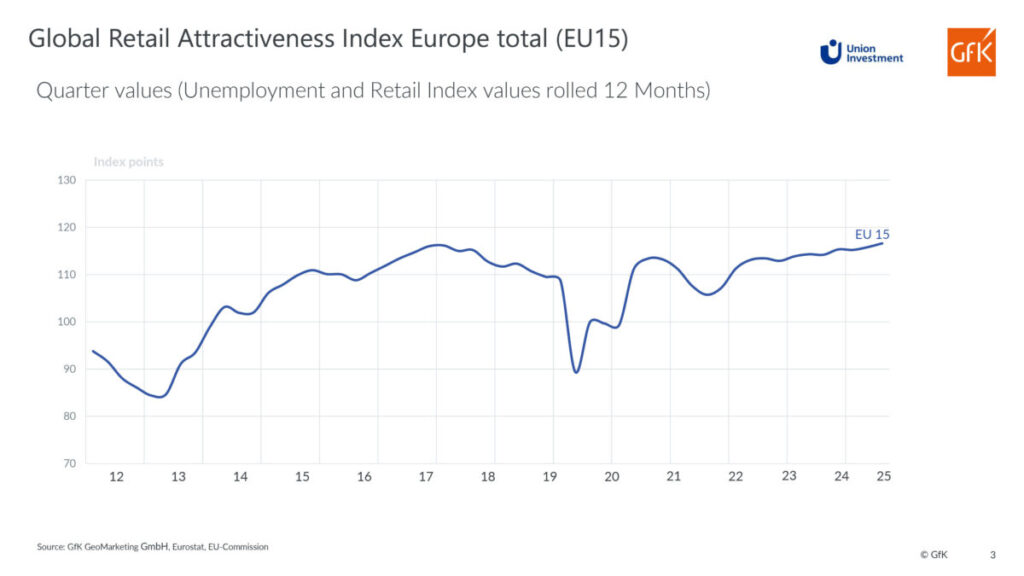

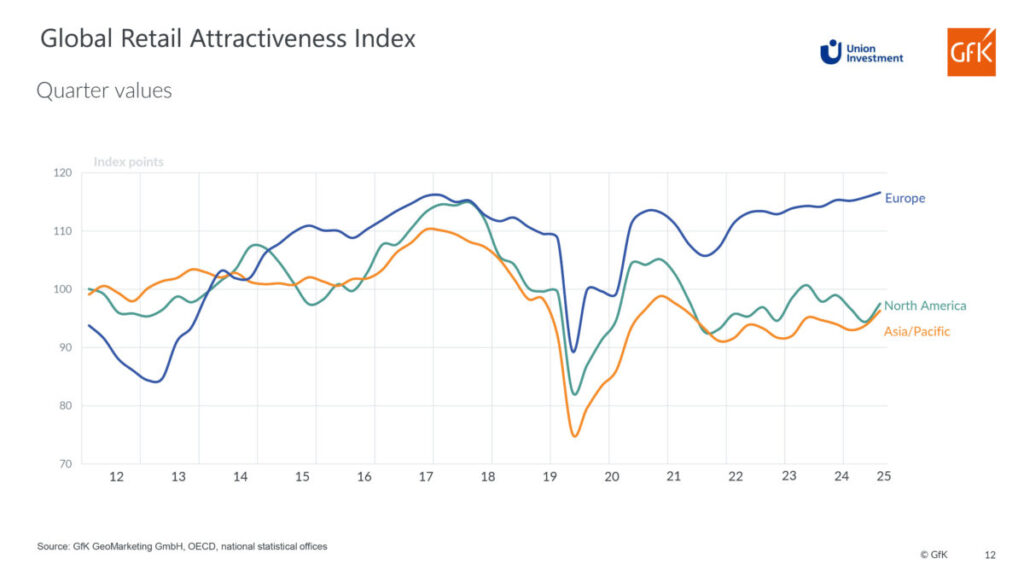

The Global Retail Attractiveness Index (GRAI) for Q3 2025 shows Europe continuing its upward momentum, outperforming North America and Asia-Pacific by a wide margin. Despite a tense labor market and mixed national developments, consumer sentiment and retail confidence are on the rise across the EU-15 – solidifying the region’s position as the world’s most attractive retail environment.

Europe’s Retail Landscape on a High Note

With the publication of the latest Global Retail Attractiveness Index, Union Investment and NIQ-GfK provide a detailed snapshot of the global retail climate – and the message for Europe is clear: the region continues to gain strength.

The EU-15 Retail Index has climbed to 116.6 points, extending the positive trend seen throughout 2025 and putting the region far ahead of its global peers.

The GRAI, which aggregates consumer confidence, retail confidence, unemployment, and retail sales, shows that Europe remains the world’s most resilient retail region, outperforming North America (97.54 points) and Asia-Pacific (96.3 points). As structural challenges shape global markets, Europe’s ability to maintain stability and consumer engagement stands out.

“The improved sentiment in the retail investment sector is reflected in the EU-15 index, which reached a new high this quarter, exceeding the level seen in the first quarter of 2018 for the first time. However, country-specific developments remain heterogeneous, with diverging labour market data in particular having a dampening effect. For active asset and investment managers with in-depth sector and country expertise, this presents attractive opportunities for selective purchases and sales of retail properties”, says Roman Müller, Head of Investment Management Retail at Union Investment.

A Market Positioned for Growth

Europe’s strong performance is slightly surprising as it arrives at a moment of global uncertainty. Inflation volatility, labor shortages, and fluctuating international demand continue to affect retail markets worldwide.

Yet, the GRAI indicates that:

- European consumers remain engaged

- Retailers across key markets are increasingly confident

- Retail trade is accelerating

This suggests that Europe’s retail sector is not merely stable – it is positioned for active growth into 2026.

“For active asset and investment managers with in-depth sector and country expertise, this presents attractive opportunities for selective purchases and sales of retail properties“

Roman Müller, Head of Investment Management Retail at Union Investment.

A Year of Steady Improvement

The positive trajectory established in Q1 and Q2 has carried forward into the third quarter. All major qualitative and quantitative indicators point in the same direction:

- Consumer sentiment increased by +1 point year over year.

- Retail confidence posted an even stronger rise of +4 points.

- Retail trade activity strengthened by +6 points.

- Unemployment decreased slightly, contributing modestly to the overall index.

Taken together, these developments reflect a retail sector that is gaining momentum – even as the job market shows signs of strain in some countries.

“The EU-15’s performance is particularly remarkable given the structural economic pressures and uneven national recoveries,” notes GRAI’s methodological team. “Retailers remain cautiously optimistic, consumers remain steady, and the sales data continues to confirm this trend.”

Data in Detail: Mixed National Trends in the EU-15

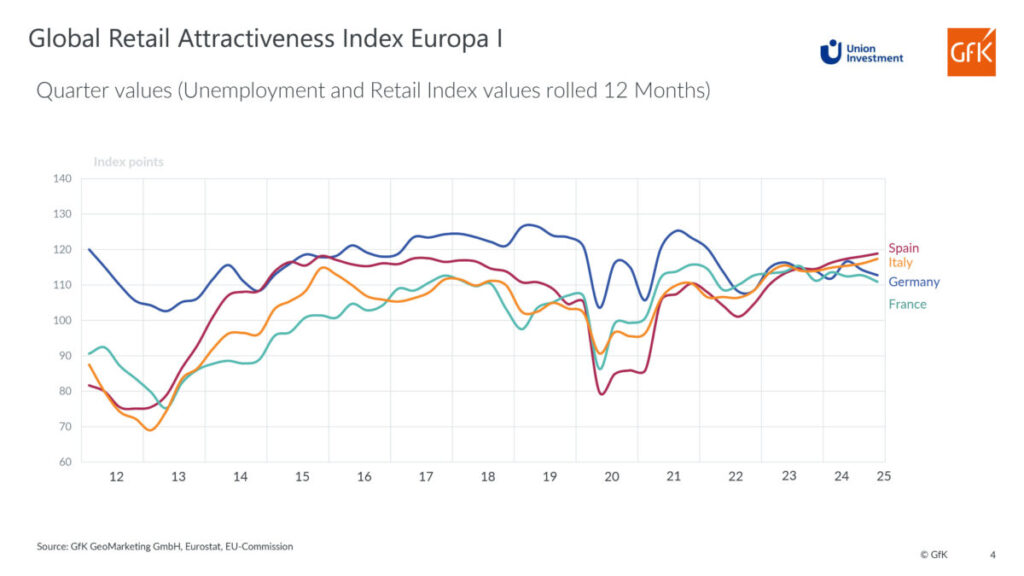

While the EU-wide figure paints a clear picture of growth, the underlying national developments reveal a more nuanced and dynamic landscape across Europe.

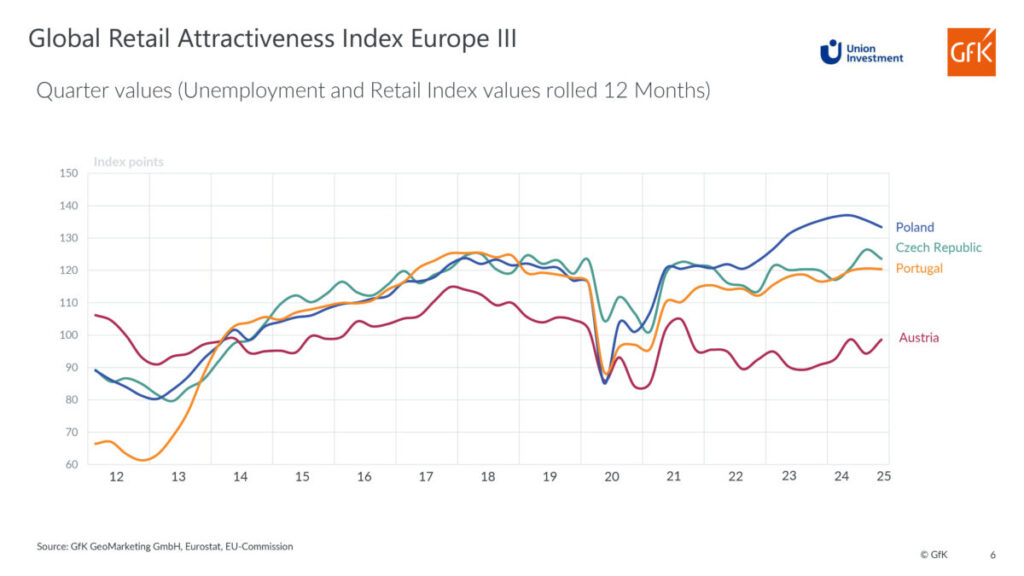

Southern and Eastern Europe Drive Consumer Optimism

Some of the most striking gains in consumer sentiment this quarter come from:

- Spain: +18.2

- Poland: +6.6

- Czech Republic: +6.8

Spain stands out with the largest increase across the entire region, reflecting a recovery in household confidence and spending expectations after a period of stagnation.

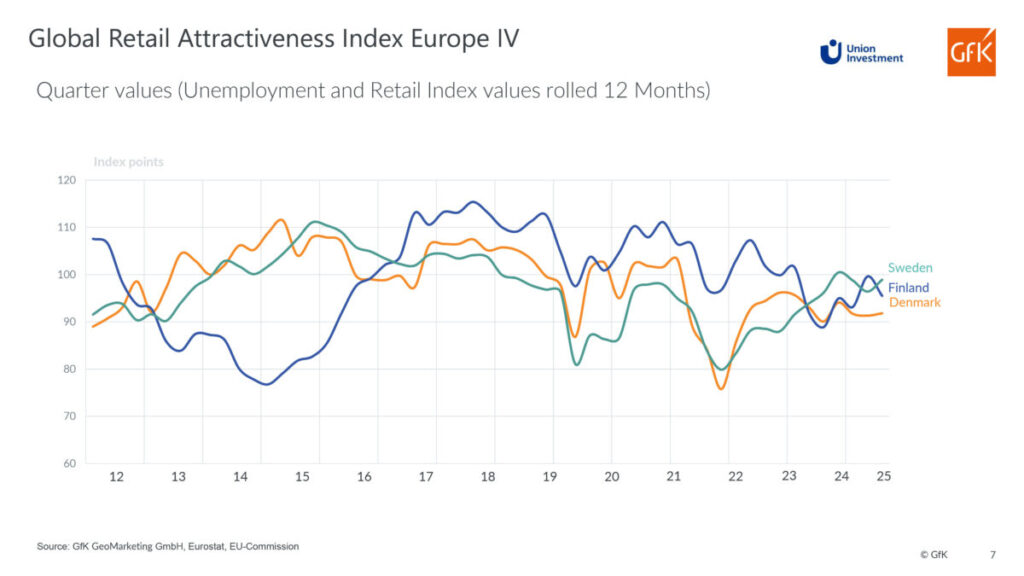

Retail Confidence Lagging in Austria and Scandinavia

Retailer Confidence shows a strong growth in several markets, even those with cooling consumer sentiment:

- Finland: +38.1

- Austria: +34.8

- Denmark: +25.0

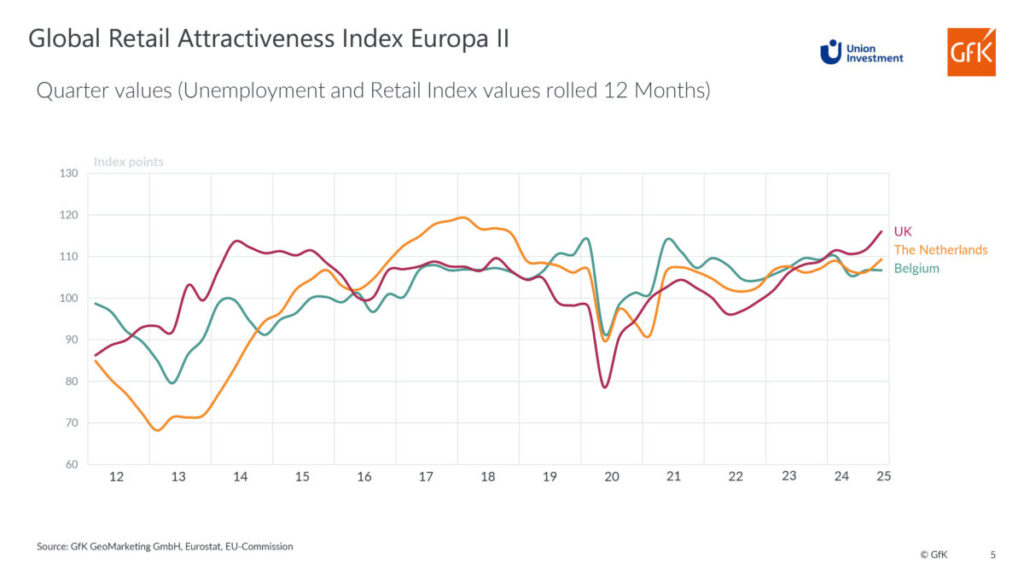

- Belgium: +24.5

- The Netherlands: +15.2

The Nordic region in particular recorded unusually strong increase in Retail Confidence, suggesting that operators anticipate healthy performance through 2025 despite local labor market challenges. However, these growth rates should not be overestimated since the starting point was comparatively poor.

Denmark, Finland, Austria and Sweden are the four countries with the lowest Retail Attractiveness Index score among the 15 markets examined. Austria’s economy is still under high inflationary pressure, and the three northern states are severely suffering from the Ukraine crisis.

With total scores of only 91.9 (Denmark), 95.5 (Finland) 98.6 (Austria) and 98.9 (Sweden) are well below the overall EU-15 score of 116.6 points.

France, Germany and Czech Republic Face Headwinds

Not all markets shared positive momentum. Compared to the value from Q3/2024 France experienced the sharpest decline in consumer confidence (–10.8) and recorded an overall drop of –4.1 points in its Retail Index. The data reflects the country’s ongoing macroeconomic uncertainties, which continue to weigh on consumer sentiment and retail outlooks.

The decline also continued in Germany and in the Czech Republic, with a loss in Retail Confidence by -1.2 points in Germany and -1.4 points in the Czech Republic in comparison to last year’s value.

On the other hand, the United Kingdom shows an +8.7 rise in the Retail Index compared to the previous year, which marks the biggest improvement among all European countries covered in the survey.

Retail Trade: Broadly Positive Across the Continent

However, the Retail trade indicators remain stable to positive across all EU-15 markets. Gains range from +0.4 in Italy to +7.9 in the Czech Republic

This consistency underscores the foundation of Europe’s resilience: even in markets where confidence wavers, actual retail performance remains strong.

Europe vs. the World: A Widening Gap

Strinkingly, the GRAI continues to highlight a widening performance gap between Europe and other major global regions. Europe Remains a Global Outlier With 116.6 points, Europe’s Retail Index is nearly 20 points higher than the next-strong region.

North America: Stable but Sluggish

North America posted only minor changes in Q3 2025:

- Retail Index: 97.54

- Consumer sentiment: +3 points

- Business confidence: slight increase (+2 points)

- Retail trade: +3 points

- Labor market: stable

The region remains steady, but without the upward momentum that characterizes Europe.

Asia-Pacific: Mild Improvements, Limited Acceleration

Asia-Pacific’s Retail Index stands at 96.3, with:

- Consumer sentiment: +8 points

- Retail trade: +2 points

- Labor market: +2 points

While positive, these improvements are not strong enough to close the gap with Europe. This long-term advantage of the European continent is consistent with historical GRAI data.

Conclusion

Europe’s retail environment is experiencing a noteworthy upswing, but with significant national variation. Still, the EU-15 overall continues to outperform other global regions by a wide margin. The Q3 results underline Europe’s resilience and confirm the continent as the most attractive retail region worldwide – a trend that is set to continue into the year ahead.

The Mechanics Behind GRAI: A Balanced View of Retail Health

The GRAI draws on four equally weighted factors.

Qualitative Inputs

- Consumer Confidence; Sources: GfK GeoMarketing GmbH, EU-Commission, OECD

- Retail/Business Confidence; Sources: GfK GeoMarketing GmbH, OECD, Trading Economics

Quantitative Inputs

- Unemployment (12-month rolling changes); Sources: GfK GeoMarketing GmbH, Eurostat, OECD

- Retail Sales (12-month rolling changes); Sources: GfK GeoMarketing GmbH, Eurostat, national statistical offices

All inputs undergo statistical standardization to ensure comparability and balanced influence on the composite index. Historically, realistic index values lie between 70 and 130, making this quarter’s result of 116.6 a strong indicator of above-average retail attractiveness.

The EU-15 result is population-weighted, ensuring that major markets like Germany, France, Italy, and Spain proportionally shape the index.