Gift cards are by no means a niche market in retail. On the contrary, by 2024 estimations for the global market volume were up to USD 950 billion, and with continued strong growth, the market is expected to exceed USD 2 trillion by 2034.

With this perspective in mind, retail operators should carefully consider how to integrate gift cards into their business. One of the most important decisions is whether to implement an open-loop or a closed-loop system. While this choice may seem irrelevant to customers, it has a major impact on operators.

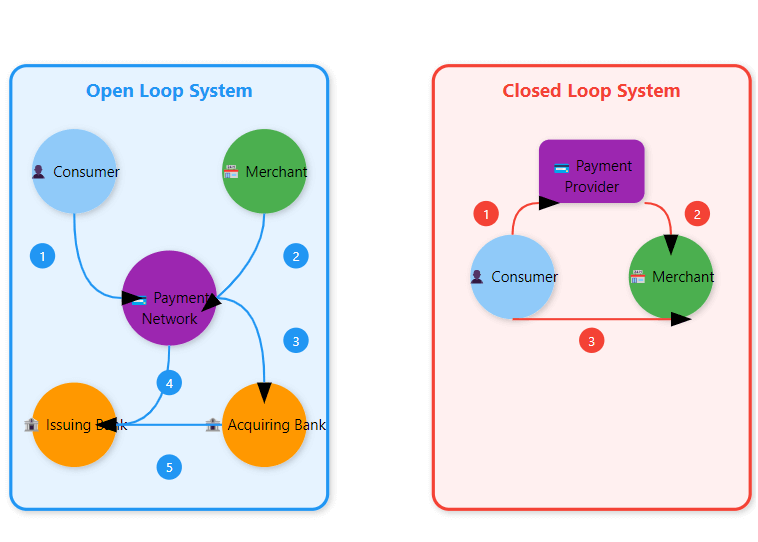

Open-Loop Versus Closed-Loop

Open-loop cards — usually carrying Visa or Mastercard logos — function like miniature debit cards. They can be used anywhere within the global card network, offering flexibility to the consumer.

Closed-loop cards, by contrast, operate entirely within a defined ecosystem — a shopping center, hotel group, or retail chain.

Advantages and disadvantages of open and closed loop card systems

At first glance, open-loop cards appear simpler: they plug into existing banking infrastructure and require little local management. Yet for retailers or shopping center operators, that simplicity and flexibility come at a price: transactions pass through banking networks, incurring fees and hiding valuable customer insights. Operators see only aggregated data, detached from individual behavior.

With closed-loop cards on the other hand the funds remain within the issuer’s account and circulate according to internal clearing rules. The operator decides how and when money moves to participating tenants, retaining both liquidity and insight.

The new hybrid model

In recent years, a “hybrid” model has also appeared — semi-closed (Visa/Mastercard) systems that combine regulated infrastructure with more control over customer data and experience.

But one has to keep in mind that the hybrid model basically still is an open scheme that only closes use on certain POS terminals, the rest remains the same.

The debate between open and closed loops will continue, but the future clearly points toward hybrid ecosystems — those combining flexibility with ownership.

Customer relationship in the hands of the operators

In a world where data is regarded as the new oil, the value of data coming from the use of gift cards should not be underestimated. Gift cards are not only a payment tool but also a measurable marketing and loyalty instrument.

Every redemption becomes part of a living dataset — revealing spending patterns, visit frequency, and tenant performance.

- When digitalized, these cards extend seamlessly into online platforms, loyalty apps, and e-commerce stores.

- Customers can buy, send, and redeem cards instantly, while operators gain real-time visibility over usage and trends.

- When linked with loyalty programs and basic AI analytics, gift cards move beyond transactions — offering predictive insight into what drives visits and repeat purchases.

This direct relationship strengthens both community and commerce. Funds remain within the network, tenants benefit from internal circulation, and operators gain actionable insight into customer behavior.

Data and customer ownership

SOS Solutions, a Slovenian company specializing in digital gift card infrastructure, developed the SmartGifty platform as a closed-loop system designed specifically for shopping centers and multi-location retail operators. SmartGifty allows centers to manage their own ecosystems — tracking sales, redemptions, and balances in real time.

„Deployed across Central and Eastern Europe, SmartGifty helps turn gift cards into data-rich instruments that strengthen both customer relationships and local retail networks,“ Jurij Triller, CEO of SOS Solutions says.

Jurij Triller, CEO SOS Solutions: “Shopping centers that build their own networks will truly know their customers.”

The SmartGifty platform has among others been successfully installed within Supernova Group, Arena Centar Zagreb, Nepi Rock Castle and BTC City Ljubljana. „These installations show how digital, data-driven card systems can improve engagement and boost repeat visits,“ stresses Triller.

Regulatory framework: the European context

In the European Union, the choice between open and closed loops also has legal implications. Open-loop cards are regulated under the Payment Services Directive (PSD2), subject to strict financial oversight. Closed-loop cards, when used within a limited network, can be exempt under the European Banking Authority’s “Limited Network Exclusion”, if yearly transactions do not exceed EUR 1 million.

This allows retail operators to design their own compliant systems without becoming financial institutions, keeping both funds and data within their networks.

Sustainability and control

Sustainability today also means keeping value local. Digital cards reduce waste, but their real impact lies in supporting tenants and communities within the same ecosystem — an act of conscious digitalization that benefits people and place alike.

Looking ahead, SOS-CEO Triller concludes: „Shopping centers that build their own networks will truly know their customers — not just serve them. To control the loop is to control the story — of every purchase, every visit, every connection.“