With more than 9,000 consumers surveyed across China, Germany, the United Kingdom, and the United States, two big ideas stood out in this year’s research: Younger consumers are conceptualizing wellness in new ways, and wellness is showing up in new places. The latest findings reveal ways in which younger consumers are redefining the landscape.

Younger consumers spend disproportionately on wellness

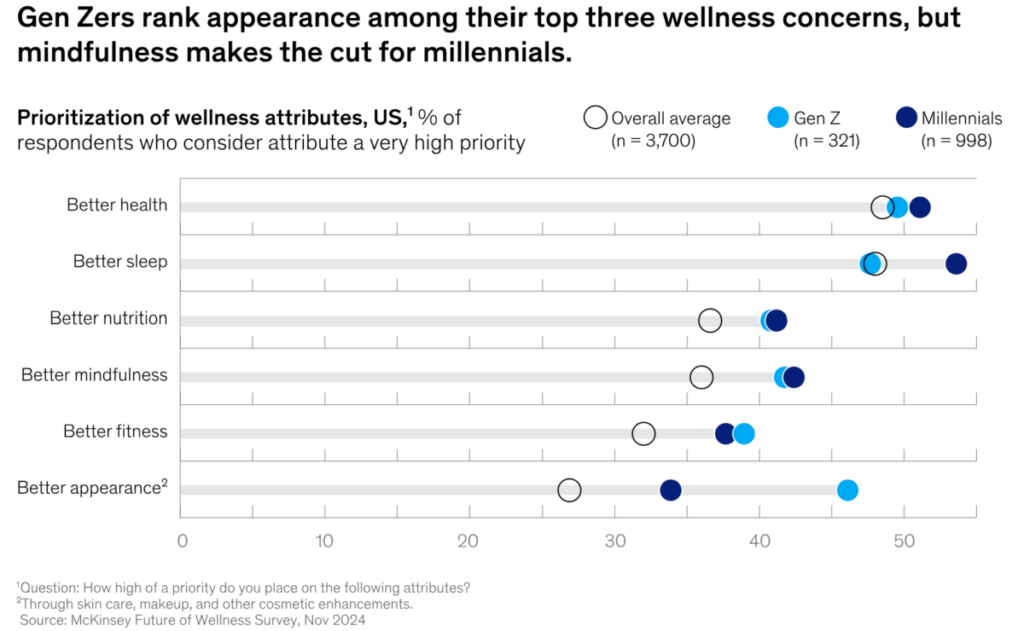

There are also differences in how younger and older consumers spend across wellness categories. While purchase rates for essential consumer health categories (such as oral care, cough and cold medication, and personal hygiene) are similar across demographics, younger consumers tend to purchase across a wider range of discretionary products, including health-tracking devices, beauty and mindfulness apps, and more. They are more open to experimentation and interested in testing digital solutions. Older generations, for their part, overindex on a smaller subset of health products such as vitamins, analgesics, and eye care but underindex on most discretionary categories. This could be because older consumers may be less familiar with newer wellness offerings.

The burgeoning prioritization of wellness is translating into money spent. In the US, while Gen Zers and millennials make up just over a third (36 percent) of the adult population, they drive more than 41 percent of annual wellness spend. Compare that with consumers aged 58 and older: These consumers make up 35 percent of the population but only 28 percent of wellness spending. To be sure, older consumers still represent a meaningful opportunity for wellness players, especially in advanced markets with aging populations. However, despite the wellness sector’s growth over the past several years, consumers report that some of their wellness needs—including cognitive health, mindfulness and mental health—remain unmet.

In general, Gen Zers and millennials purchase more types of wellness products and services per year than older adults. Some are connected to specific life stages, so spending on these products will decrease as Gen Zers and millennials age. But consumers in all age groups are also spending heavily on other products and services—such as health-tracking devices, wellness retreats, and energy drinks—that are not tied to particular life stages, indicating a broader cultural shift in how people think about wellness.

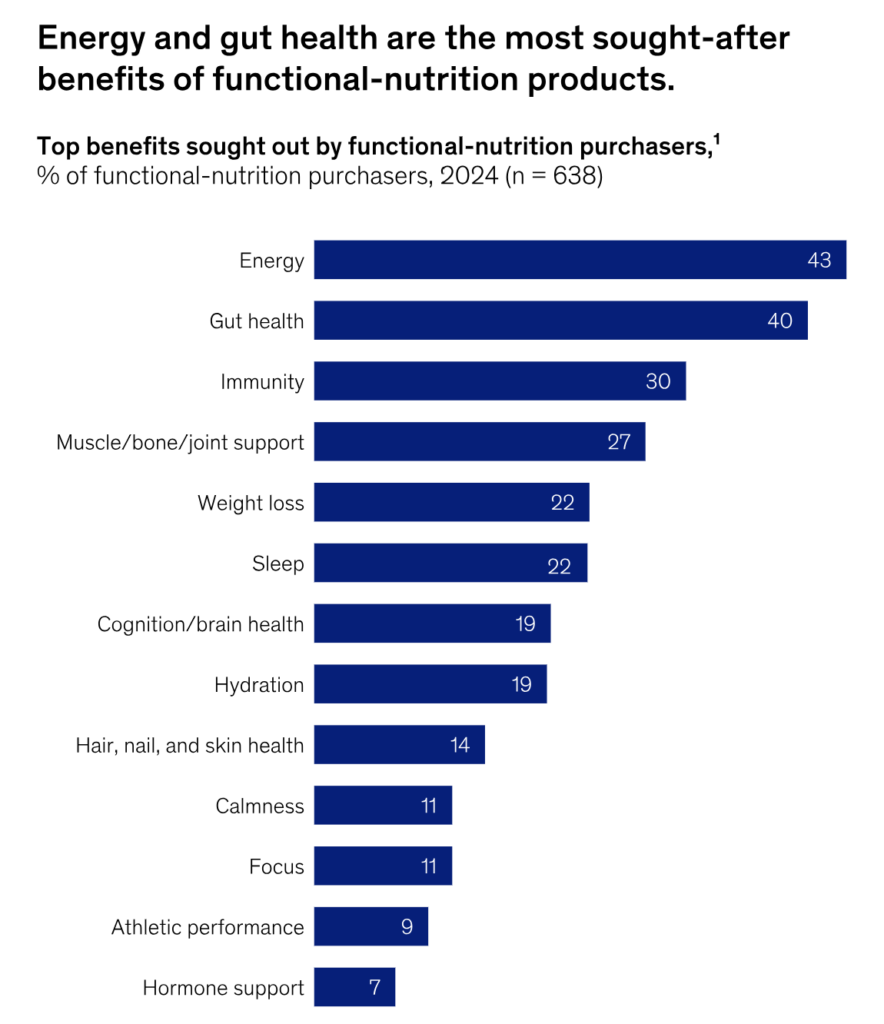

Consumers are becoming more aware of how food and beverage choices affect health

The functional-nutrition space—made up of food and beverages that claim to deliver health benefits—is also expanding. In the United States, United Kingdom, and Germany, approximately half of consumers and two-thirds of Gen Z and millennials say they purchased functional-nutrition products last year. In China, the share of consumers who purchased those products is even higher. More companies are introducing new products, such as fortified foods and supplements, to meet demand.

The research indicates that consumers take a broad view of functional nutrition, which encompasses fresh fruits and vegetables, fermented foods, and protein powders, as well as emerging subcategories like super greens, mushrooms, adaptogens, and pre- and probiotic drinks.

The survey finds that younger generations today are also more likely to travel for wellness retreats (trips intended to improve mental, physical, or spiritual well-being), for example, though more travel players are now tailoring their services to older consumers, too, such as by offering off-season wellness retreat packages targeted to retirees. This suggests that many of the wellness preferences of younger consumers today could become mainstream across all age groups.

The lines between beauty and wellness continue to blur. A growing number of beauty products feature active ingredients that have health benefits (such as arnica to reduce inflammation or CBD to promote calmness), while more consumers say they are interested in using ingestible beauty supplements that promote wellness from within

Also, demand for in-person services—spanning boutique fitness, wellness retreats, and more—has continued to rise as consumers prioritize experiences. Across all the markets surveyed, consumers reported purchasing more in-person services in this year’s survey compared with the prior year, and this trend is expected to continue. As consumers seek out opportunities to reset, digitally detox, and enhance their mental, physical, and spiritual well-being, there are opportunities for travel players (including hotels, cruise liners, and travel planners) to attract new customers.

As wellness continues to evolve from a niche interest into a mainstream lifestyle priority, Gen Z and millennials are setting the pace—reshaping expectations and pushing the boundaries of what wellness means. Other generations, too, are adopting an expanding definition of wellness. To position themselves for success, businesses across consumer subsectors should consider imperatives, such as breaking barriers, emphasizing expertise, and delivering value. Consumers define value in different ways; it is not only about price but also about product quality, value for money, efficacy, and availability. Wellness players should not focus solely on pricing growth but ensure their products serve unmet needs.