There is no doubt that shopping centres in Europe still have a lot of catching up to do in terms of sustainability and ecological compatibility. This is especially true when using the guidelines and objectives of the United Nations and the European Union as a benchmark. The demands for environmentally friendly practices and sustainable development are becoming increasingly important in the global agenda. “Green building” is the buzzword here. The analysis of the RegioData Shopping Center Collection now shows to what extent shopping centers are currently fulfilling their responsibility to the environment.

In Europe, there are around 11,000 shopping malls, retail parks, factory outlet centers and hypermarkets with a rentable area starting at 5,000 sq m. For how many of these is sustainable and environmentally friendly construction or operation already an issue? One key indicator of this is international certifications such as BREEAM, LEED, or DGNB, which paint a sobering picture: Less than 3% of all existing and planned centers have such certifications. If you include other certificates or significant environmentally relevant measures without certifications, the proportion rises to a maximum of about 5 to 7% of all properties.

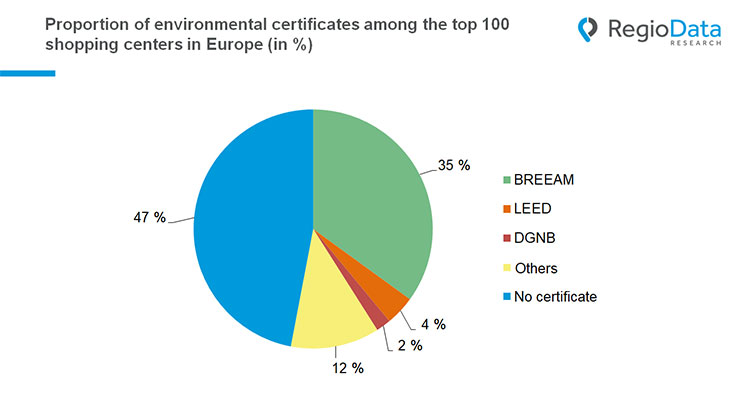

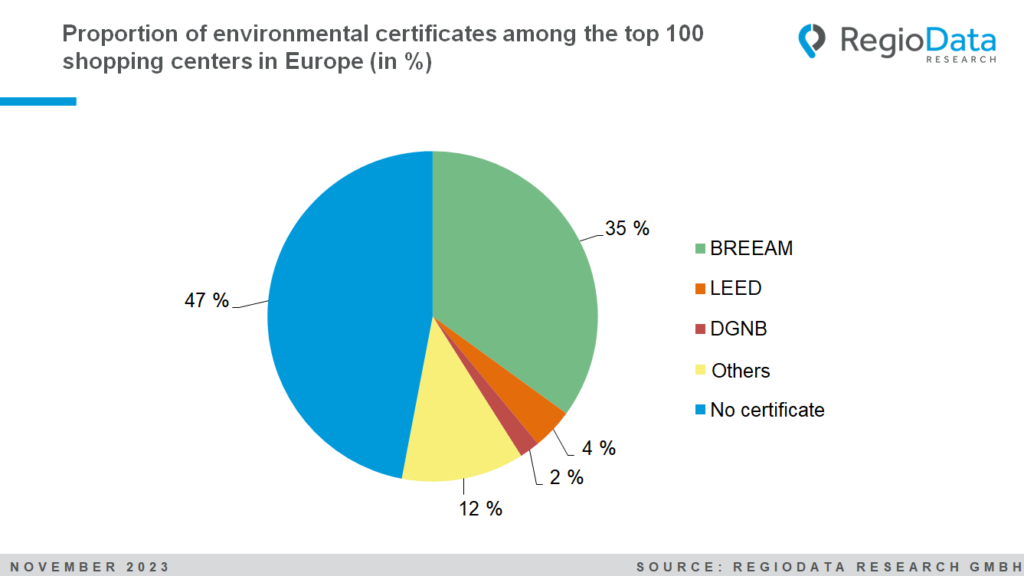

The situation is quite different for the really large centers, however, as 53% of the 100 largest centers (over 90,000 sq m GLA) in Europe already have an environmental certificate. The English environmental assessment system BREEAM is most commonly used for this purpose and is considered a global standard for evaluating the environmental impact of buildings. The assessment is based on various criteria, including energy efficiency, water reduction, CO2 emissions, materials, waste management, user health and well-being and innovation. France and Poland are leading the way in the category of very large centers. The clear laggards are Turkey and Ukraine. Unibail-Rodamco-Westfield holds the most certificates in this size category.

The exemplary practices of the large centers may be attributed to their ownership structure. Institutional and private investors increasingly prefer to invest in environmentally conscious companies. In fact, various funds already have clear guidelines in this regard.

In smaller shopping centers with a total leasable area (GLA) of under 90,000 m2, it is noticeable that especially self-financed and/or older centers apparently show less interest in certifications. In such cases, certifications seem to be more of an exception than the rule.

However, in individual subaspects, there is also active engagement among smaller units. For example, there is currently a strong focus on retrofitting photovoltaic systems to provide alternative energy. Similarly, attention is given to parking lot greening, and in newer centers, there is a concern for more economical use of space. The latter is likely influenced by local regulations and land prices. The currently very popular beehives on the roof of the center, however, seem to have been conceived primarily as a marketing measure. Overall, it can be seen that environmental awareness currently only arises when it is also directly or indirectly financially worthwhile.

The data is sourced from the “RegioData Shopping Center Collection – Europe.” Country-level data on shopping malls, retail parks, hypermarkets, and outlet malls are currently available from €100 (plus 20% VAT) at RegioData. For more information, please visit www.regiodata.eu.