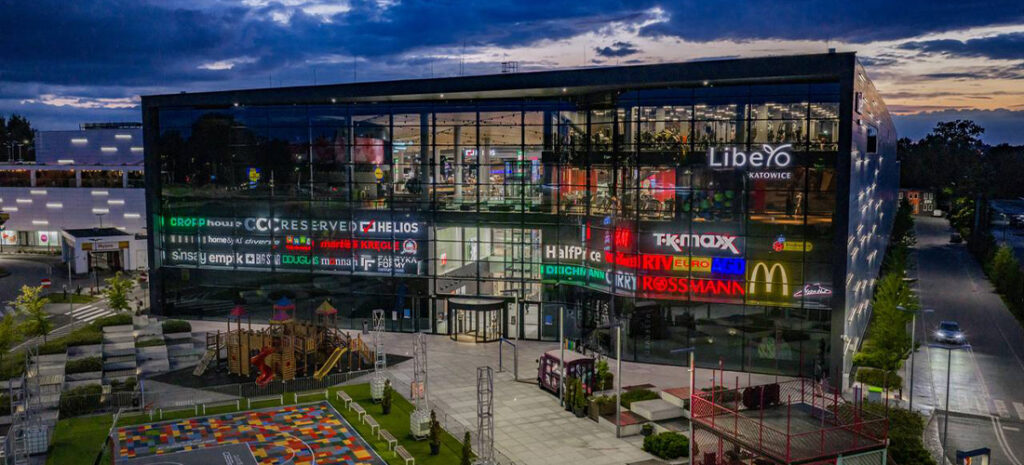

Libero Katowice encompasses around 45,000 square meters of leasable space and features more than 150 retail outlets. Visitors can enjoy a wide selection of restaurants and cafés, as well as leisure options including a fitness club, bowling lanes, and a modern cinema. Completed in 2018 and designed by the architectural studio MOFO Architekci, the centre maintains an impressive occupancy rate close to full capacity and welcomes nearly six million guests each year.

Situated in Katowice, the heart of the Silesian region, Libero serves as a lively social hub, frequently organizing cultural performances, family-friendly gatherings, educational programs, and marketing events. Continuously evolving, the complex enhances its facilities and attractions to meet the changing expectations of its customers.

Certified Sustainability

At the moment, Libero Katowice boasts as one of the highest BREEAM In-Use certified retail buildings located in Poland. The shopping destination makes conscious sustainability efforts, which include renovation and improvements of the building management system (BMS), the heating system based on heat pumps, electricity from solar panels located on its roof, to the use of rainwater from an underground retention reservoir.

Statements on the Transaction

“The deal is already the second successful transaction between Echo Investment and Summus Capital since the sale of Łódź-based React office building last year. It confirms that we have created a thriving retail asset that stands out with its attractive tenant mix, strong footfall performance and growing turnover. The sale of Libero Katowice is yet another step in our growth strategy of divesting mature projects while continuing to focus on new investments and the interests of our stakeholders”

Rafal Mazurczak, COO of Echo Investment.

“Libero Katowice is a strong and well-positioned retail asset with well-known tenants and long-term potential. This acquisition reflects our long-term strategy to strengthen Summus Capital’s presence in Poland, which we perceive as one of the most dynamic real estate markets in the region, and to maintain the retail segment at approximately half of our portfolio to ensure continued value growth”

Hannes Pihl, board member of Summus Capital and managing partner of Zenith Family Office, the strategic asset and investment management partner of Summus.