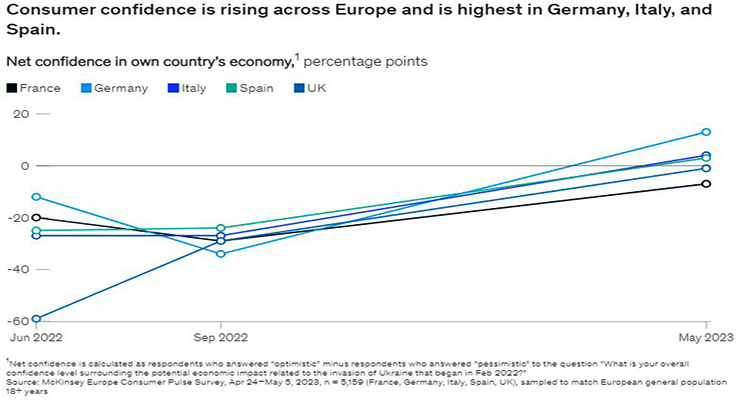

The report analyzed five European states´ (France, Germany, Italy, Spain, UK) consumer confidence between June 2022 and May 2023, and shows an improving outlook in the region.

German consumers show the highest increase in net confidence, at 13 percentage points (up from –34 in September 2022), as well as the highest level of optimism — 31 percent of respondents say they expect their country’s economy to rebound within two to three months and grow just as strong or stronger than it was before the conflict in Ukraine began.

Meanwhile, French consumers report being the least optimistic, with 29 percent believing that the current crisis will have a lasting impact on the economy, with the possibility of a lengthy recession. (Across the continent, approximately one in five consumers expect the economic situation in their country to worsen.)

As has been true for the past two years, younger consumers and higher-income consumers report the highest confidence in a rapid economic recovery.

Consumers monitor expenses carefully, with a third saying they have to dip into savings and a fourth struggling to cover food costs.

Consumers are coping with continuing price increases. Eight out of ten European consumers say they are taking actions to alleviate the ongoing pressure on household income. One in three consumers say they track their expenses more carefully, while just under a third say they are reducing their savings rate and dipping into their savings to cover expenses. This behavior is not only present among low-income consumers but also higher-income consumers, as they are adjusting their spending habits, too.

European consumers continue to reduce spend on nonessential items, in particular items in the home, fashion, and eating out categories.

European consumers say they’re spending less on all categories. Shoppers are buying fewer items and purchasing lower-priced alternatives. Given persistent inflation, however, their total spending may remain the same, even when making fewer purchases. Older consumers are most likely to reduce their spend across categories.

Consumers are reducing their spending the most in nonessential categories such as fashion, home decor, and dining out, while largely maintaining their spending on groceries, baby supplies, personal care, and pet supplies.

More than a third of consumers report they are likely to splurge and intend to spend their money on travel, dining out, and fashion.

Among the roughly one-third of European consumers who plan to splurge, they express the highest intent to splurge on experiences, such as travel and dining out, and on fashion—the same categories in which they say they’re looking to save money. This indicates a strong intent to “save up” to splurge, meaning consumers might be spending less on those things daily so they can treat themselves to spend more later on.

While the largest European economies show improvements in their average consumer confidence, other countries, such as Czechia, appear to be less optimistic.

According to Trading Economics, the consumer confidence in the Czech Republic dropped to -20,40 in June 2023 from -19,60 in the previous month, as the number of consumers expecting a deterioration in the overall economic situation in the next twelve months increased significantly. However, compared to a year ago, the consumer confidence rose from -29,90.

Meanwhile, the number of households that fear a worsening of their own financial situation over the next twelve months has slightly diminished, while the share of respondents who do not find the current time suitable for making large purchases remained unchanged.

See the full report of ConsumerWise here, and Trading Economics´ statistic on Czechia´s consumer confidence here.