By Romina Jenei

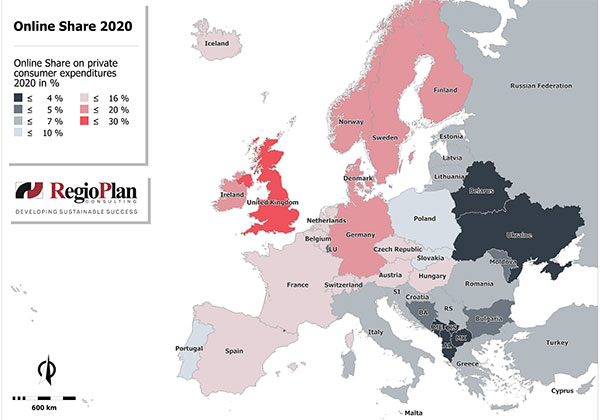

The coronavirus pandemic has accelerated many existing (consumer) trends, and, as a result, the trend toward online shopping. Across Europe, new target groups have discovered the convenience of online shopping, at times simply due to a lack of an alternative. Statistically speaking, the pandemic and the resulting lockdowns have boosted online retail across Europe to levels that were not expected to be reached for another two years. Nevertheless, in terms of online share and expenditure, there are significant differences not only between countries, but between regions as well.

The online share represents the sum of a consumer’s purchasing power spent online, regardless of the location of the online store or the country in which taxes are levied on such purchases. Private consumers’ online purchases in each country serve as the basis. The main drivers of online retailing tend to be young and urban population groups with at least average purchasing power. The online share rises sharply wherever they are located.

Unexpected Results

A north-west/south-east divide has existed since the early days of online shopping. That was also the case during the “Year of the Coronavirus”. Within the individual countries, however, major differences can be found with respect to online affinity. Again, one would expect online affinity to be higher in rural areas, which are often poorly supplied in terms of stationary retail, but the opposite is true: In densely populated urban regions, the level of affinity for online shopping is around 15% to 20% higher than the national average.

The online share in a given country directly correlates to the sales area density of that country. One would expect that the smaller the retail space available, in other words, the more difficult it is for consumers to find and buy goods, the higher the online share. However, the opposite is true: In areas in which the density of sales space is low, for example in Spain, Portugal, Italy and Greece, the online share is also low. In Scandinavia, where the sales area density is particularly high, the online share is also high.

On the whole, online shares still appear to be relatively low, but when looked at by industry, there are considerable differences. In some countries, clothing, shoes, electronics, books, etc. have attained online shares of 35%. One reason for the overall low online share is that the food retail sector, which generally accounts for around a third of the total retail volume, is not online-savvy yet. As a result, the low online share in the food retail sector of 0.5% to 3% lowers the overall online share. Great Britain, where the online share in the food retail sector comprises around 8%, is an exception. Accordingly, the overall online share in the UK is high and is, by far, the highest in Europe.

In economies with low purchasing power, ones that tend to be agriculturally oriented and do not have distinctive metropolitan regions, the online share is still low at present (for example, Bosnia and Albania) and will continue to show lower growth rates. In general, online shares are not expected to increase significantly in 2021 compared to 2020, but they will return to the “normal” pace of +1% to +2% of retail volume.

In order to get an idea of where things are headed, it is certainly worth taking a look at Asia: China’s online share is more than 40%, and South Korea’s is over 30%. Remarkably, the traditionally technology-savvy countries do not appear to be leading the way in terms of online shares: Japan’s share is less than 10%, and the USA’s is approximately 16%.

Conclusion: Where Are Things Heading?

Yes, online retail will flourish in the future and our high streets, shopping malls, and city centers will inevitably change. They have to change. The need for change or action was evident before 2020, and it is only now that everyone has begun to realize the true impact of online retail. Urban centers can benefit from a less mono-functional mix as well as from true urbanity – with infrastructure, educational and healthcare facilities, and small specialty stores tailored to individual target groups. Individuality, an important megatrend, is also what cities, as well as retail zones, need. That will not be enough to stop the online shopping trend, but it can mitigate the associated disadvantages and make our cities more livable.