Two-track retail landscape

The retail landscape in Europe is becoming increasingly polarized overall, not least as a result of the numerous crises in recent years. On the one hand, the low-price segment is showing very robust development, which is leading to discount stores continuously capturing market share and space from other market players in virtually all sectors.

On the other hand, the high-end segment, which addresses the actual target group of outlet centers, is also pushing ever more strongly forward. Here, higher-value branded products are experiencing a strong increase, which is driving the expansion of factory outlet centers in parallel. Within the apparel retail sector, outlet centers are in any case proving to be the only sector with high momentum, while other forms of retail are definitely under pressure, especially due to the outflow to the Internet. Despite the increasing spread of factory outlet centers over the years, the market shares of outlet malls are marginal everywhere, amounting to less than 1%, and this development varies greatly from region to region.

Genuine shopping experience

Factory outlet centers serve the international megatrend towards branded products, have an agglomeration advantage due to the accumulation of branded products that cannot be found anywhere else in stationery stores, and have a clear marketing strategy (“30 – 70% cheaper”). The former image of faulty or old merchandise has long since been discarded, as have the supposedly cheap store fittings. The often romanticizing architecture and complementary offers in gastronomy and leisure create a shopping experience for broad customer groups – including tourists.

Leading operators of the European outlet market can also confirm the great market environment of outlet centers:

Otto Ambagtsheer, VIA Outlets’ CEO, says, “Our experience is entirely in line with Regio Data’s findings. Brand sales, footfall and spend per visit across our pan-European portfolio are all up on 2022 (which was a record-breaking year for VIA Outlets) demonstrating the resilience of the outlet model even during tough economic times. Demand for space from new and existing brands is such that we are expanding Seville Fashion Outlet and examining further expansion opportunities across the portfolio.” For him the reasons are clear, “First, the fashion outlet experience has become a journey of discovery for guests. Our 3-R strategy of remodeling, remerchandising and remarketing is delivering a constantly evolving line-up of quality brands at attractive prices alongside a wide variety of F&B options, making a visit to our outlets more than just a shopping trip. Second, the future of retail is the omnichannel approach, as consumers increasingly expect a seamless and consistent shopping experience across various channels (i.e. physical full-price stores, outlets, websites, social media, ..) brands want to meet these expectations by providing a cohesive experience, regardless of the channel customers choose. And as Regio Data’s findings show, demand from both brands and consumers for the outlet experience looks set to continue to grow.”

“ROS currently operates 12 premium outlet shopping destinations in Europe and we are very pleased with the good performance in 2023. In the first half year, we saw sales increase by +20% compared to 2022 and by 29% compared to 2019, pre-pandemic level, across our portfolio. While e-commerce was particularly boosted in the pandemic by lockdowns and retail restrictions, it is now clear that customers are looking for the real shopping experience, explains Thomas Reichenauer, Co-Founder and Managing Director of ROS Retail Outlet Shopping.

“And outlet centers that are run by professional management companies are proving again that they perform very well, especially in uncertain times and with rising inflation. Outlet centers already did that in the financial crisis of 2008/9. Great brands at low prices with a good shopping experience and excellent customer service and retail standards convince customers and brand partners alike.”

Great Britain – the home of outlet centers

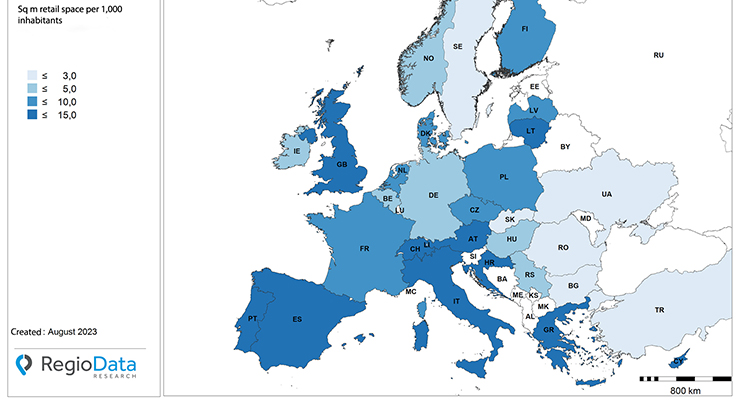

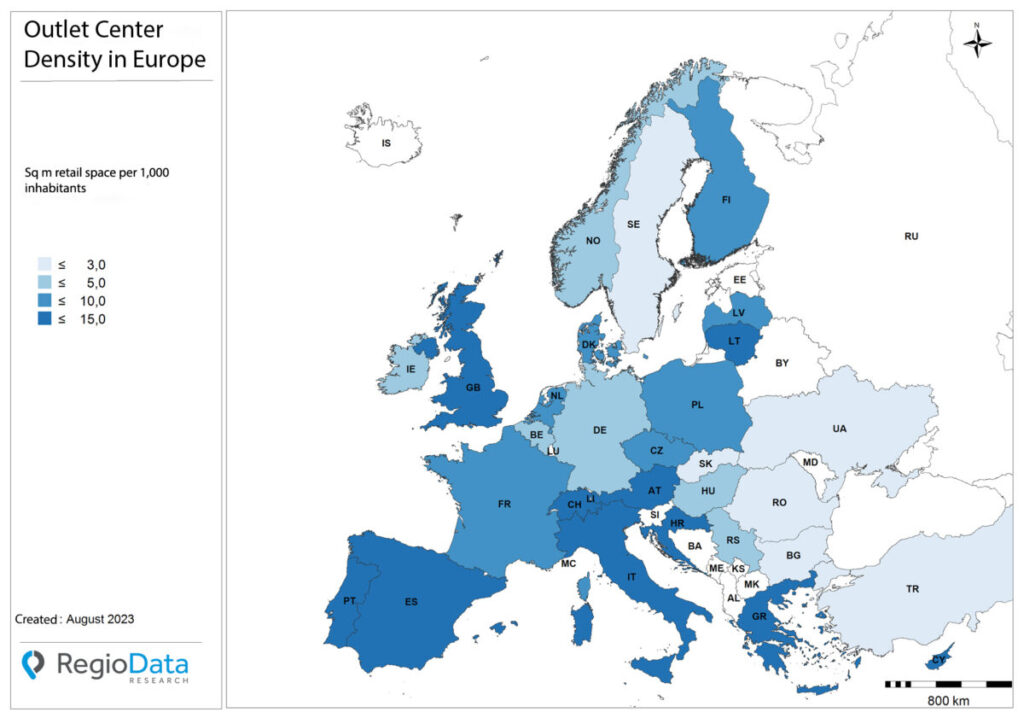

Although the first outlet center in Europe was opened in France, this form of retailing has always been deeply rooted in Great Britain. In the past 10 years alone, the area of outlet centers in the UK has expanded by an impressive 77% to a current total of 721,000 sq m. At present, the UK achieves a remarkable sales area density of 10.8 sq m per thousand inhabitants.

In addition to the UK, Austria and Switzerland also have a considerable number of outlets, achieving densities of around 11.0 and 10.0 sq m respectively. In some parts of Southern Europe, there is also a significant concentration of outlet centers, with densities ranging between 10.0 and 12.0 sq m per thousand inhabitants. This is also related to the fact that these are tourist hotspots and tourists are a very significant target group for factory outlet centers.

The lowest density of retail space ranges from 0.5 to 3.0 sq m and is found in countries such as Romania, Bulgaria, Turkey and Ukraine. Although Sweden has the highest density of shopping centers, it is among the bottom performers in Europe in the context of outlet malls.

The main operators in Europe

Among the more than 180 sites, McArthurGlen is the largest operator in Europe, with 24 locations and more than 3,000 brands. The British group has established designer outlets in various countries including Italy, France, the United Kingdom, Germany, Spain, Austria and the Netherlands. Close behind in second place is the Spanish group Neinver, founded back in 1969. ROS Retail Outlet Shopping, based in Vienna, is the third largest operator in Europe. The company was founded in 2011 and operates mainly in Central Europe and parts of Southern Europe. Another major operator is Via Outlets, with 11 outlet centers each in Europe.

Future projects: Outlet expansion in the starting blocks

The future of factory outlet centers promises exciting developments. Germany, which has long brought up the rear in Western Europe, is planning expansions totaling around 69,000 sq m by 2024. With an expected expansion of around 87,500 sq m by 2024, the largest outlet center growth to date is planned in the UK. This reflects the continued popularity of outlet shopping in the UK retail landscape. France is also set for expansion, with an additional 59,400 sq m planned by 2024. These plans illustrate that factory outlet centers will continue to play a significant role in the retail sector and respond to the growing demand for versatile shopping experiences.

ROS Retail Outlet Shopping can also confirm the positive performance of its centers: “ROS currently operates 12 premium outlet shopping destinations in Europe and we are very pleased with the good performance in 2023. In the first half year, we saw sales increase by +20% compared to 2022 and by 29% compared to 2019, pre-pandemic level, across our portfolio. While e-commerce was particularly boosted in the pandemic by lockdowns and retail restrictions, it is now clear that customers are looking for the real shopping experience, explains Thomas Reichenauer, Co-Founder and Managing Director of ROS Retail Outlet Shopping.

“And outlet centers that are run by professional management companies are proving again that they perform very well, especially in uncertain times and with rising inflation. Outlet centers already did that in the financial crisis of 2008/9. Great brands at low prices with a good shopping experience and excellent customer service and retail standards convince customers and brand partners alike.”