Innovation has become the central force reshaping Europe’s outlet center landscape as brand growth decelerates, according to the newly released Ken Gunn European Outlet Industry Review 2025/26, unveiled at MAPIC.

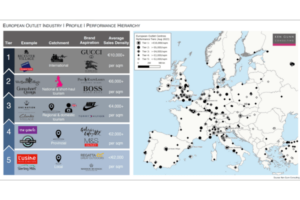

The report identifies 206 major outlet destinations across 30 countries, together comprising 4.2 million sq m GLA, and notes that the sector is becoming more distinctly structured along clearly defined quality tiers.

Despite a cooling in brand expansion, Europe’s outlet market is expected to post 7.2% turnover growth in 2025. According to Ken Gunn, whose annual benchmarking is closely watched by retailers, developers, and investors assessing locations, acquisitions, extensions, and portfolio strategies, “Brand growth has effectively flatlined, yet the total number of trading stores still edged up by 0.5% to reach a record 15,741 units.”

This year’s most active brands include Jack & Jones, Crocs, and Only, with notable first-time entrants such as Miu Miu and Kapten & Son. Bestseller Group stands out for expanding its outlet footprint by nearly one-third to 227 stores. Jack & Jones alone added 16 stores in 2025, followed by Only (+11), Name-It (+10), Only & Sons (+7), Vero Moda (+5), and Vila (+3).

Top Centers Stable, but Momentum Builds Lower in the Rankings

With Europe’s prime assets operating at full occupancy and with limited opportunities for expansion, the continent’s top ten outlet centers remain broadly unchanged. However, the middle tier is experiencing intensified remerchandising activity, leading to significant uplift at destinations such as Scalo Milano, The Village, Las Rozas Village, and Franciacorta Village.

Gunn notes distinct national contrasts: “Development activity in the UK, Poland, and Italy has supported store growth, while portfolio expansion, repositioning, and consolidation are strongest in Poland, Italy, and Germany. France and Russia, by contrast, are seeing comparatively subdued brand demand.”

Although market leaders McArthurGlen, Value Retail, and VIA Outlets still control 20 of Europe’s top 30 centers, they operate only five of the most improved assets in 2025. Instead, accelerated value growth is emerging from agile operators of smaller schemes, such as Neinver, Arcus, ROS, and Promos.

Smaller, Smarter, Faster: Emerging Leaders Among Europe’s Most Improved Centers

The most improved centers of the year—Torino Outlet Village, Santangelo Outlet Village, Amsterdam The Style Outlets, and Getafe The Style Outlets—have become key targets for brands seeking to optimise or grow their outlet portfolios. Leading movers include Jack & Jones, Crocs, Rituals, Skechers, and Under Armour.

Gunn sums up the shifting dynamics:

“With the top 30 centers averaging 32,000 sq m— over 60% larger than the European average— it is increasingly challenging for the most mature assets to deliver the strongest growth. Smaller schemes and agile operators are leveraging innovation in location strategy, concepting, formats, technology, and even financing. These assets are poised to become the sector’s true growth engines in the years ahead.”

The 2025/26 EOIR, featuring detailed breakdowns and rankings by brand mass and quality, is now available for £1,450 + VAT at: www.kengunn.co.uk.