By Stefan Wolkowski, Giftify

How a little piece of plastic (or code) reshaped British retail

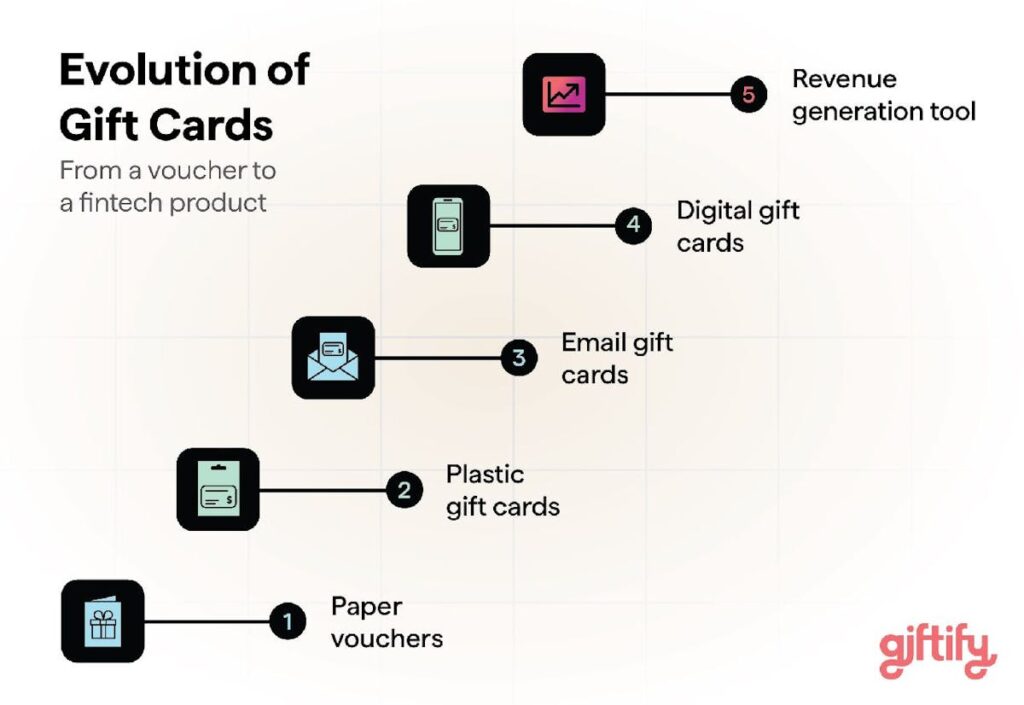

Gift cards may feel like a modern convenience, yet their origins are surprisingly recent. In 1994 Neiman Marcus quietly introduced the first plastic gift card, but it was Blockbuster’s decision to display the cards in-store that popularised them. In the decades since, gift cards have evolved from counterfeit-proof plastic into digital payment instruments embedded in mobile wallets and loyalty programmes.

Britain has embraced this evolution. Market researchers forecast that the UK gift card industry will be worth roughly £8.9 billion in 2024 and will grow to about £11.2 billion by 2028, a compound annual growth rate of around 6%. The sector’s momentum is most visible online: during the first half of 2024 digital gift cards overtook physical cards for the first time, capturing 52 % of total market share.

What does this mean for the UK’s shopping centres and high-street operators? Gift cards are no longer just stocking fillers; they are data-rich, strategic instruments for building loyalty and bridging physical–digital journeys. Below are five trends that will define the next chapter.

1. Omnichannel Gifting: Bridging High Street and Digital

British consumers move fluidly between in-store, online and mobile. In the GCVA’s latest data, digital cards exceeded 50 % of sales and B2B customers—who often purchase online—account for 72 % of gift card volume. This is a watershed moment: gift cards are now the missing link between brick‑and‑mortar shopping centres and digital channels.

For malls and retail parks, integrating gift cards across point-of-sale terminals, e-commerce checkouts and mobile apps allows shoppers to buy a card in person, store it in Apple Pay or Google Wallet, and redeem it later online. This unified experience not only drives footfall but also captures purchase data across channels.

2. Loyalty Programmes: From Points to Real Money

Traditional loyalty schemes in the UK—such as Tesco’s Clubcard or Boots Advantage Card—reward customers with points redeemable for discounts. The next wave uses gift card credit as currency.

Loyalty-linked gift cards feel like real money because they are real money—consumers see the value instantly. For shopping centres, implementing a closed-loop gift card that accrues loyalty credit encourages repeat visits and gives operators visibility over where and when the balance is spent.

3. Corporate Gifting Goes Mainstream

The corporate sector is the powerhouse of the UK gift card market. GCVA data show that B2B sales grew 16.9 % in H1 2024, with employee benefits and incentives driving the surge.

From human‑resources departments offering trivial benefits (up to £50 per employee tax-free) to financial services firms using gift cards as referral incentives, businesses appreciate the flexibility and tax efficiency. Shopping centres can tap into this boom by:

- Creating corporate packages

- Integrating with reward platforms

- Providing analytics

4. Third-party Distribution and White-label Platforms

Distribution is no longer confined to the tills. Gift cards are increasingly sold through aggregated digital marketplaces, multi-brand platforms and white-label APIs. In H1 2024, approximately 50 % of gift card transactions were automated through online portals. This opens new acquisition channels.

5. Data-driven Engagement and AI Personalization

Every gift card transaction generates two customer relationships: the purchaser and the recipient. By analysing load value, redemption timing and spend categories, shopping centres can infer customer preferences and tailor marketing accordingly. The GCVA report notes that digital gift cards create rich data streams, enabling operators to see where customers redeem across the tenant mix.

Looking ahead, artificial intelligence will enable real-time personalisation. Imagine a system that suggests a £25 dining gift card because a customer usually spends £20 on lunch, or designs a bespoke birthday card based on the recipient’s style.

Final Thoughts

For UK shopping centres, gift cards have shifted from impulse buys to strategic levers. The pandemic accelerated a transition to digital formats; now, regulation, corporate adoption and mobile wallets are embedding them in everyday spending. By embracing omnichannel issuance, loyalty-linked credit, corporate partnerships, expansive distribution and data-driven engagement, mall operators can transform gift cards from end-of-aisle novelties into engines of loyalty, footfall and insight.

Retailers who treat gift cards as an afterthought will miss out on this opportunity. Those who invest in smart, consumer-centric programmes will turn a simple piece of plastic (or code) into a powerful bridge between digital innovation and the enduring appeal of the British high street.

Stefan Wolkowski

UK & Ireland Business Manager at Giftify

Credit for all images: Giftify