The results of the latest McKinsey ConsumerWise study show the most important developments among European consumers in the last quarter of the previous year. The decline in optimism towards the end of the year was clearly visible, as was the influence of ESG factors on purchasing behavior. Consumers in France, Germany, Italy, Spain, and the United Kingdom were asked about consumer confidence, spending, savings strategies, willingness to spend money and the importance of ESG on purchasing behavior.

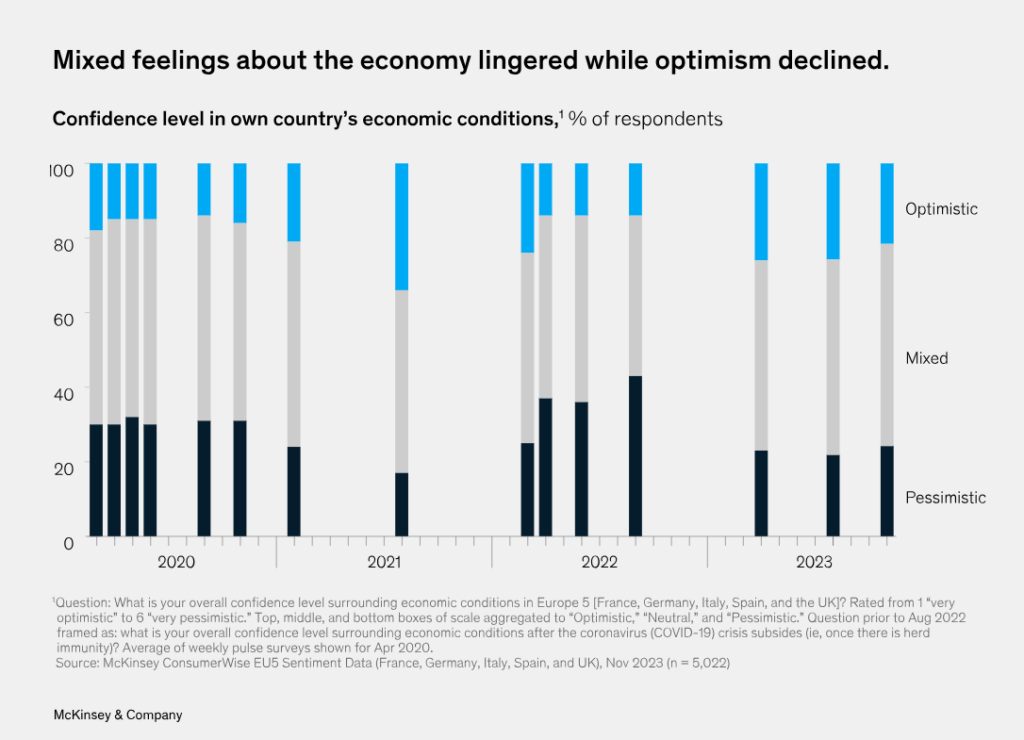

Most consumers surveyed in 2023 had mixed feelings about the economy, with the number of optimistic respondents falling in the last quarter. Inflation was a major issue for more than half. They were also seriously concerned about political polarization and climate change.

Credit: McKinsey & Company

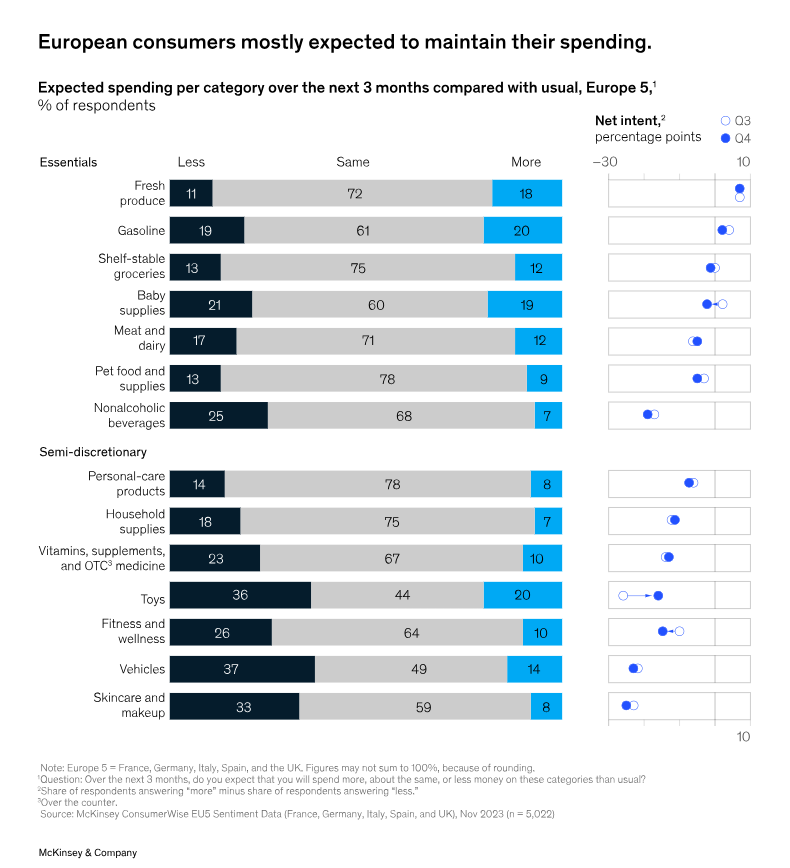

For a third, careful monitoring of spending was on the agenda or saving less of their income. The list of product categories that have increased the most in comparison from Q3/2023 to Q4/2023 is headed by toys. Baby products, fitness & wellness services as well as skincare and makeup have declined. In general, however, expected spending remained stable at the level of the previous quarter.

Credit: McKinsey & Company

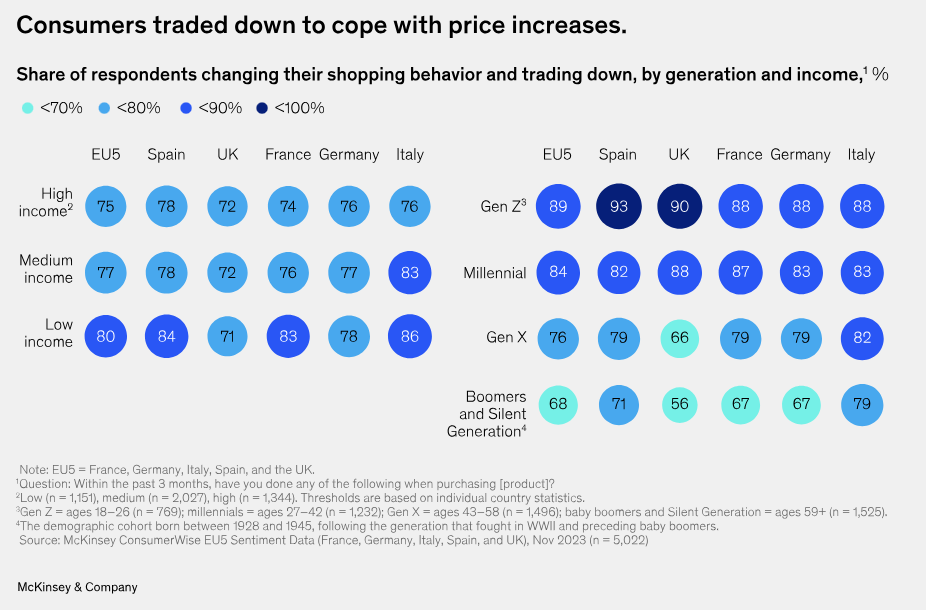

As in the third quarter of 2023, reductions were very popular with European consumers. Almost eight out of ten people stated that they were shopping for cheaper products, going to cheaper retailers or even postponing purchases. The higher percentage of reluctance to buy was noted among younger consumers – but this was the case across all income brackets. The majority of those who stated that they were buying less were mainly reducing the quantity or size. This was particularly evident in Italy. In Spain, consumers switched to retailers with lower prices or discounts – but there was also a tendency towards private labels or cheaper products. In France, on the other hand, purchases were postponed. In general, people shopped less – in Italy and Spain, people tried to act in their own favor. This was not evident to the same extent in Germany and the UK.

Credit: McKinsey & Company

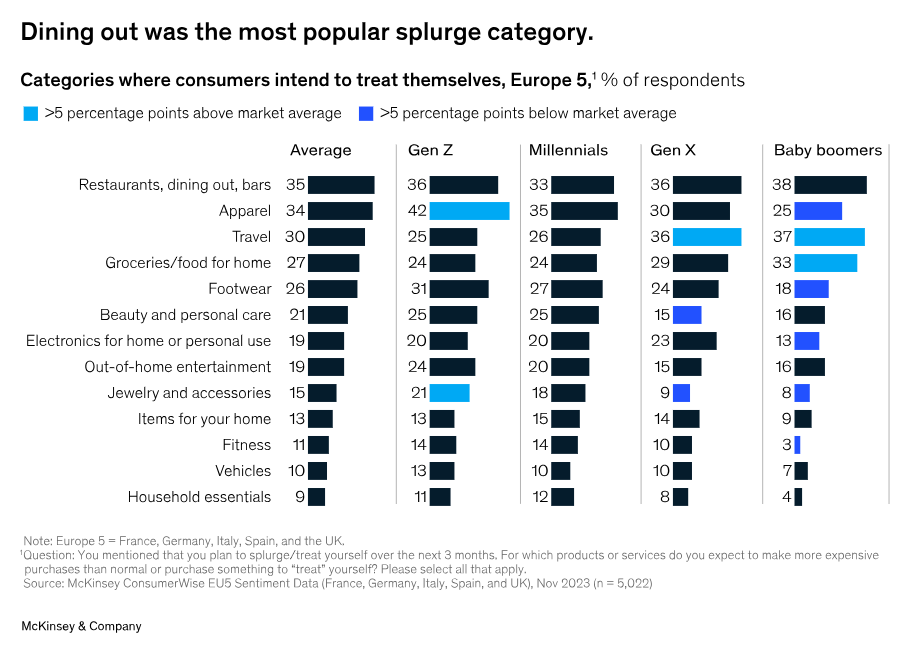

Nevertheless, a lot of money was spent, especially at the end of the year people liked to eat out, buy clothes or use the time to travel. There was a difference between the product groups and the generations: If Gen Z liked to invest in clothes and accessories, Gen X liked to travel, as did the baby boomers. The latter generation also invested in food.

Credit: McKinsey & Company

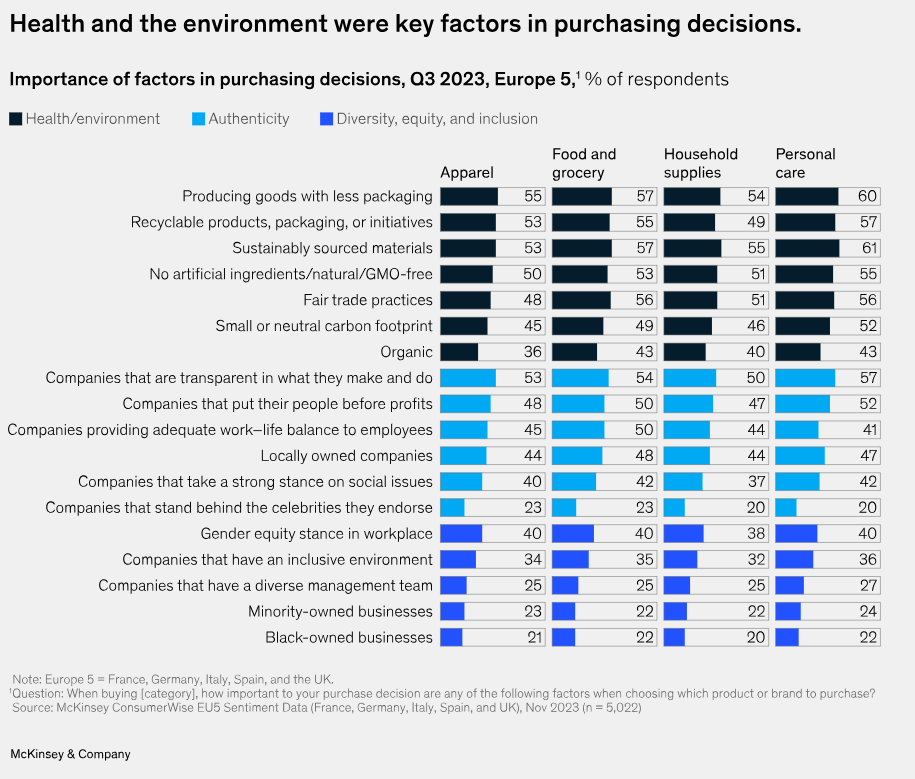

Company transparency and authenticity were particularly important for purchasing decisions – especially among consumers in Italy and the UK. Among the generations, Gen Z was ahead of older consumers. Reusability of products and fair-trade practices were important for more than half of European consumers when buying clothing, food, and household goods. In addition, the avoidance of artificial ingredients when buying food and household items was also important. More than half placed importance on using as little packaging as possible – especially for personal care products. A neutral CO2 footprint was also important alongside health and the environment – fair trade practices and recyclability were less important in clothing purchasing decisions.

Credit: McKinsey & Company