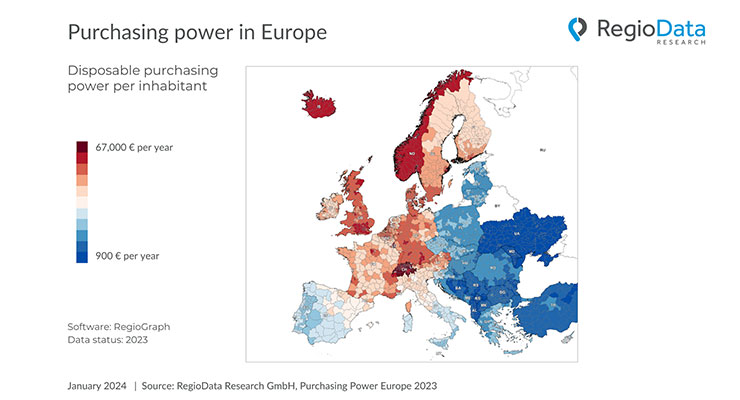

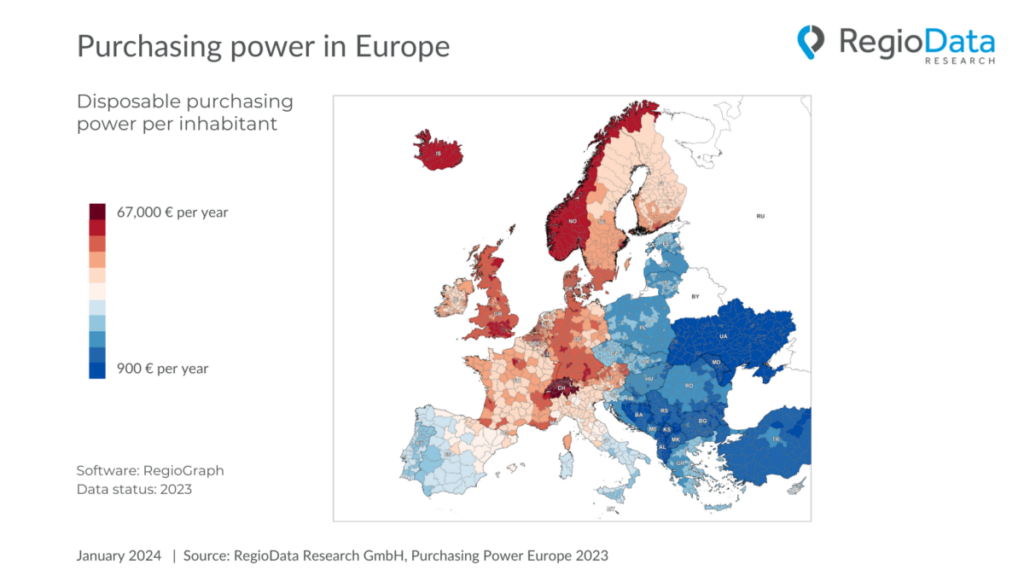

In Europe, the year 2023 was marked by a renewed increase in purchasing power. Compared to the previous year, per capita purchasing power in many countries rose by 10% or more, although this is partly attributable to inflation. However, there hasn’t been much change in the country rankings: Liechtenstein, Switzerland, Luxembourg, Iceland, and Norway remain the countries with by far the wealthiest population. The bottom-ranking countries also remain the same: Republic of Moldova, Kosovo, Albania, and Bosnia and Herzegovina. The difference between Switzerland and the Republic of Moldova, for example, has continued to rise sharply and is now 27 times higher.

The wealthy countries are becoming richer rapidly

While in the Republic of Moldova, the average purchasing power has only doubled with an increase of around 1,000 Euro per capita per year over the last 10 years, during the same period in Switzerland, it has risen by approximately 17,000 Euro per capita per year. Switzerland, alongside Iceland, has experienced by far the highest leap in purchasing power during this time. The lowest performance in terms of the population’s prosperity level was achieved in Turkey, Kosovo, and the Republic of Moldova (all figures converted to euros).

Regional disparities are gradually increasing

In addition to the overall positive trend in purchasing power per capita in Europe, it is also evident that regional differences within individual countries are either increasing or at least not significantly decreasing. In countries with traditionally large disparities, such as Italy and Spain, the gap between the affluent north and the impoverished south has not narrowed over the past 10 years. This is despite substantial transfer payments, which are known to contribute to significant tendencies of separation on the part of wealthy regions. Despite 35 years of reunification, the noticeable disparities in prosperity between East and West Germany are only slowly diminishing. In Croatia, where significant differences exist between the affluent coastal region and the impoverished hinterland, there is only gradual convergence. In the United Kingdom, the disparity between England, particularly the London region, and the poorer parts in Wales and Scotland has even slightly increased.

Increasing disparities within population groups

At the national level, the differences between rich and poor have not changed significantly over the past 10 years. While countries like Slovakia, Slovenia, Iceland, and the Czech Republic exhibit relatively stable income distribution (with Gini coefficients consistently below 25 points), the largest – and continually increasing – inequalities persist in Kosovo (Gini coefficient of 44 points), Turkey, and Bulgaria. Some countries, particularly in former Eastern European regions and Turkey, benefit from a strong diaspora. Greater income inequalities can be mitigated to some extent through remittances and transfer payments to the home country.

Long-term trends clearly show that, across all countries in Europe, urban regions are gaining significant purchasing power while peripheral areas are losing ground. The importance of rural areas continues to decline as more young people move to cities, motivated by better education and career opportunities. A relatively new development, however, is that cities themselves are losing relative purchasing power and often fall below the national average, while the so-called “suburbs” or “peripheral areas” are gaining significantly. Examples of this trend can be observed in cities like Paris, Vienna, or Istanbul. The reasons for this may lie in the influx of population groups with lower purchasing power, which can drag down the overall average.

*note: The term “purchasing power” is defined as the sum of all types of income, including wages, self-employed income, capital assets, rentals, agriculture, pensions, subsidies, etc. Deducted from this are compulsory payments, namely taxes and social security contributions. Purchasing power thus refers to the income that is freely available.

The RegioData purchasing power indices present the regional prosperity level of a country in a clear manner. Purchasing power is understood as the ability of an individual or household to acquire goods, services, and rights within a specific period with the available financial resources. The index indicates deviations from the respective national average prosperity level (fixed at 100).

The study “Purchasing Power Europe – Edition 2023” is available for each country starting from €800 (plus 20% VAT) at RegioData. For more information, please visit www.regiodata.eu.