By Jean Carlos Delgado

The traditional playbook—lease space, collect rent, repeat—is becoming as outdated as a flip phone. Today’s most successful property managers aren’t just filling vacant units; they’re creating revenue streams from surfaces that never generated income before. They’re turning navigation into commerce, predictions into profit, and data into euros.

I’ve been tracking this transformation across dozens of properties, from Helsinki’s newest mixed-use developments to Singapore’s most innovative shopping complexes. The pattern is clear: properties that embrace these technological shifts aren’t just surviving the retail apocalypse—they’re thriving in ways that seemed impossible just five years ago.

The winners share something crucial. They’ve stopped thinking like landlords and started operating like technology companies that happen to own buildings. Every visitor interaction becomes a data point. Every empty surface becomes potential revenue. Every predictable problem becomes a preventable loss.

Let’s look at three trends rewriting the revenue playbook.

AI-POWERED REVENUE INTELLIGENCE: PREDICT. PREVENT. PROFIT.

Artificial intelligence in commercial real estate isn’t about replacing people. It’s about giving property managers the kind of real-time foresight that used to be the stuff of fantasy.

AI-powered sales reports and leasing intelligence platforms now analyze hundreds of variables simultaneously: weather patterns, macroeconomic indicators, local event calendars, tourism data, and even geopolitical shifts. The result? Forecasts with uncanny accuracy — and the ability to act before revenue problems become visible.

Imagine this: your AI system flags that a mid-range apparel tenant will see a 14% sales drop next quarter due to supply chain bottlenecks and slowing consumer sentiment. You don’t wait for missed rent payments. Instead, you negotiate temporary rent relief in exchange for an extended lease, or connect them with an in-mall marketing campaign to boost footfall.

The power here isn’t just in defense; it’s in offense. AI identifies not just risks, but high-value opportunities. It can tell you which empty units deserve premium rent based on historical foot traffic, which tenant pairings increase dwell time, or how the opening of a new transit line will shift spending patterns across categories.

And the learning never stops. Every lease renewal, every seasonal spike, every vacancy feeds the system more intelligence. Over time, the AI becomes a tailored decision-making engine for your property — one that can quietly outperform human intuition alone.

As HyperIn CEO Markus Porvari often notes:

“It’s not about automating your job. It’s about automating your competitive advantage.”

So, how do you find your competitive advantage?

- Step 1: Map Your Assets: Not just physical spaces, but your audience, your data sources, your unique location advantages.

- Step 2: Identify Untapped Revenue Paths: Could your parking data predict peak demand for pop-up events? Could underused corridors host seasonal micro-leases?

- Step 3: Train Your AI on Real Outcomes: Feed it the good, the bad, and the missed opportunities. Let it learn what “success” means for your property.

In practice, this means your leasing team might wake up to a daily alert that says: “Offer a 3-day promotional space to Brand X — 72% chance of outperforming last year’s same-week revenue.”

Markus Porvari

CEO of HyperIn

Platforms like HyperIn provide leasing teams with daily insights suggesting optimal timing for specialty retail offers or identifying which prospective tenants have the highest probability of long-term success in specific locations. That’s not replacing human judgment—that’s amplifying it with data driven foresight.

AR MONETIZATION: WHEN EVERY SURFACE BECOMES SELLABLE

Singapore’s commercial real estate sector has become an early laboratory for augmented reality monetization — and the results are rewriting how landlords think about physical space.

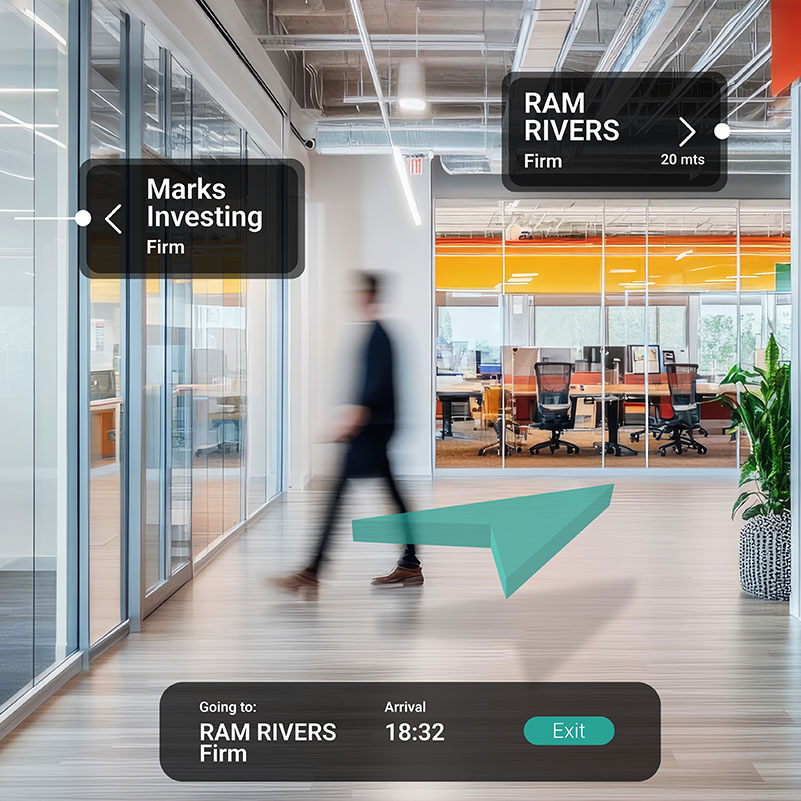

Here’s the premise: any wall, window, or open atrium can become a high-value advertising canvas, visible only through a smartphone or AR glasses. Passersby point their device at a blank wall, and instantly they see dynamic, targeted content — a 3D sneaker display, an interactive restaurant menu, a playable game tied to a brand promotion.

For the property owner, this creates an entirely new category of rentable space. A wall can run coffee ads for the morning commuter crowd and flip to dinner promotions for evening shoppers — no ladders, no print runs, no downtime.

And unlike traditional signage, AR ads come with precise performance analytics. You know precisely how many people engaged, for how long, and what actions they took. That data makes the space more valuable to advertisers, who can adjust campaigns in real time.

But the real breakthrough? AR wayfinding.

Imagine a shopper points their phone to find the cinema — but along the route, the AR path shows live promotions from stores they’re walking past. Tap on an offer, and it’s connected directly to a one-click payment.

Porvari describes how shopping centers using HyperIn AR wayfinding are taking this further: “When visitors navigate the mall with AR, we can integrate live promotions that link directly to tap-and-pay checkout. Navigation stops being a cost center and becomes a sales driver.” Foot traffic data becomes a monetization map. And the “digital layer” over your property suddenly has its P&L(profit and loss).

Forward-thinking operators are already experimenting with this. By 2025, expect it to be as common as digital billboards. And just like digital billboards, the value of these AR touchpoints will be driven by real-time relevance. Seasonal events, trending products, or even sudden weather changes can instantly trigger new campaigns. A rainy afternoon might prompt every umbrella retailer in the building to push live offers within minutes, turning foot traffic lulls into spontaneous sales spikes.

ONLINE MARKETPLACES: SPECIALTY LEASING BECOMES INSTANT COMMERCE

Specialty leasing, from pop-up stores to short term brand activations, has traditionally been a manual grind: endless emails, clunky contracts, and missed opportunities. But in the past few years, online marketplaces have flipped this model into an on-demand revenue stream.

HyperIn’s marketplace platform shows how powerful this shift can be. Instead of waiting for inbound interest, property managers can proactively showcase available spaces online with dynamic pricing that adjusts to demand, time of year, and even the location’s foot traffic profile.

The entire transaction — from initial inquiry to signed agreement — can happen without a single back-and-forth email. A local coffee roaster could secure a prime weekend kiosk in minutes. A DTC fashion brand could book a two-week space in the highest traffic corridor for their product launch, paying exactly for the days they need.

This automation isn’t just about convenience. Every booking feeds a deeper dataset: which categories perform best in specific zones, what rental durations maximize yield, and how seasonal patterns interact with tenant mix. That intelligence can directly shape long-term leasing strategies, ensuring permanent tenants are supported — not cannibalized — by short term activations.

Mall of Tripla in Helsinki, the largest shopping center in the Nordics and winner of the Best Shopping Center Award in 2022, exemplifies this transformation. Their digital leasing platform allows brands to browse, book, and pay for promotional spaces online.

Media company Bauer Media is also leveraging HyperIn’s online marketplace to promote and lease their promotional spaces, digital screens, and advertising opportunities across their property portfolios, streamlining a previously complex manual process into instant bookings.

The result? Leasing cycles shrink from weeks to hours. A brand can test a product launch in your space over a single weekend, then scale up instantly if it works.

The next evolution will be dynamic pricing:

- High foot traffic days cost more.

- Seasonal events drive premium rates.

- Real-time demand adjusts pricing automatically.

For property owners, this isn’t just extra revenue — it’s a living, responsive marketplace that attracts brands who would have never considered traditional mall leases.

THE FUTURE IS MEASURED IN ROI, NOT “WOW”

All three of these innovations — AI revenue intelligence, AR surface monetization, and online specialty leasing marketplaces — share the same DNA: they transform static, underutilized assets into dynamic, responsive revenue generators.

The commercial real estate players adopting them are no longer simply landlords. They’re operators of fluid, technology-enhanced ecosystems where every square meter can be optimized, every tenant relationship can be data-driven, and every visitor interaction can be monetized.

Jean Carlos Delgado

Brand and Marketing Director at Hyperin

The future isn’t about charging more for the same box of space. It’s about inventing new boxes, new surfaces, new channels — and charging for those, too. The only question left is which property owners will seize that opportunity, and which will be left watching their competitors turn walls into profit and data into foresight.

Because in the new era of commercial real estate, the buildings that make the most money won’t necessarily be the biggest. They’ll be the smartest.

Credit for all images: HyperIn