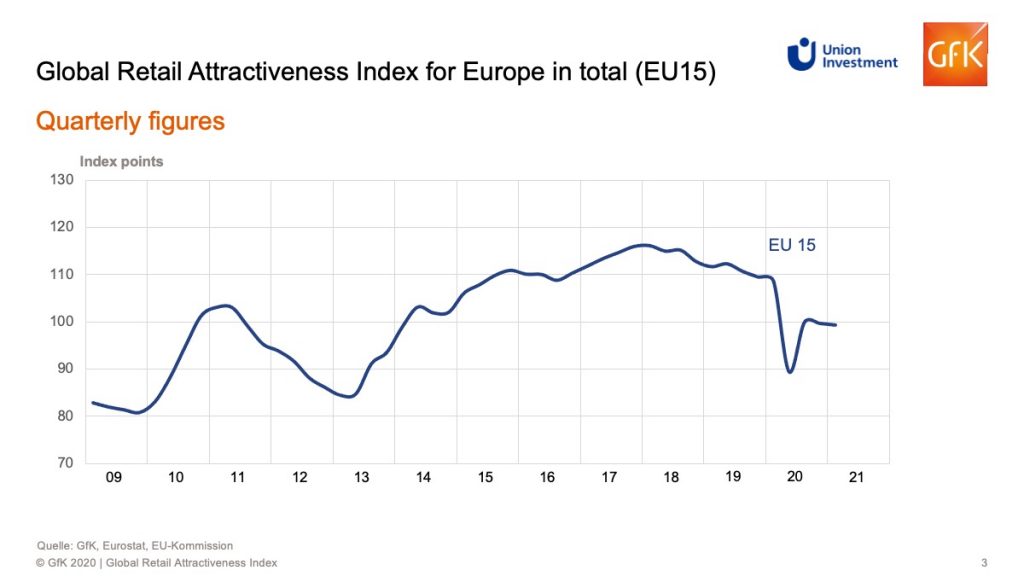

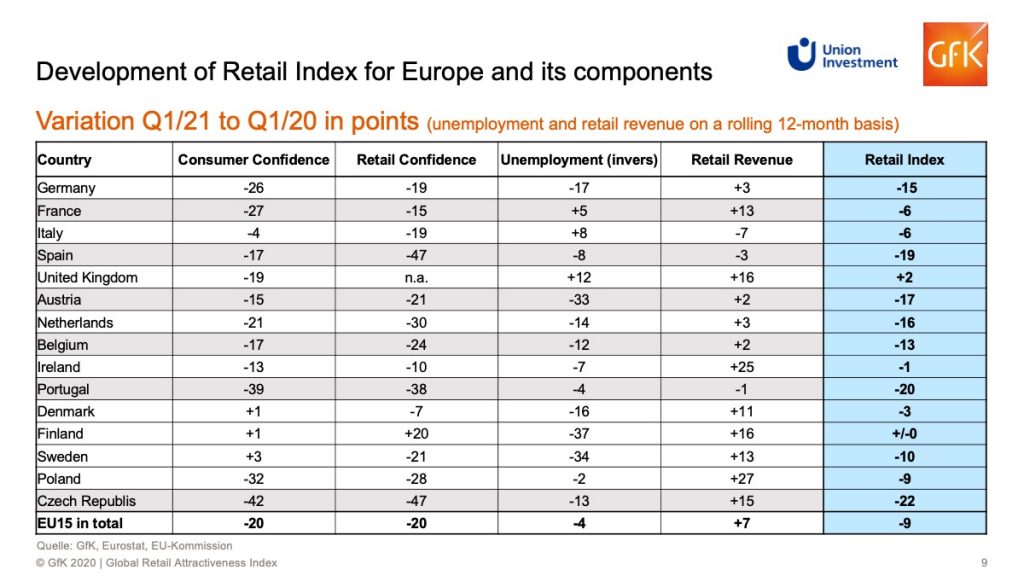

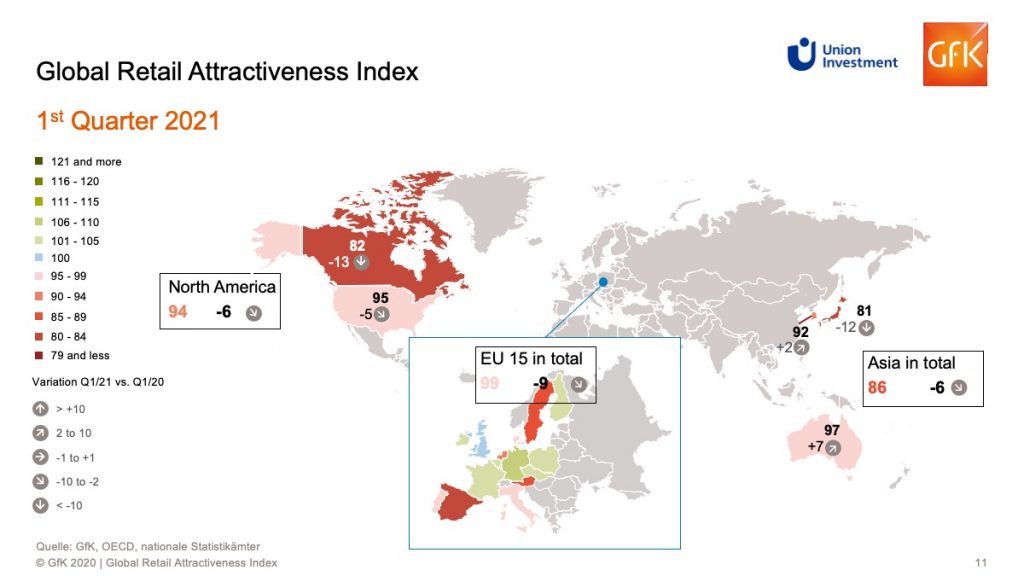

The pandemic continued to grip the European retail markets in the first quarter of 2021. The Global Retail Attractiveness Index (GRAI) for the 15 key markets, which is compiled jointly by Union Investment and GfK, fell by a further nine points compared to the previous year (Q1 2020). At 99 points, the index reading is now below average, largely due to “mood variables”. Having dropped sharply in the second quarter of 2020 to 89 points, the index then recovered comparatively quickly to hit 100 points. The subsequent stagnation reflects the fact that consumer and retailer confidence took a sustained hit during the lockdowns. At 89 and 82 points respectively, both consumer and retailer sentiment plummeted by 20 points year-on-year. The index was supported in the first quarter by the labour market (122 points; minus four points) and retail sales (109 points; plus seven points).

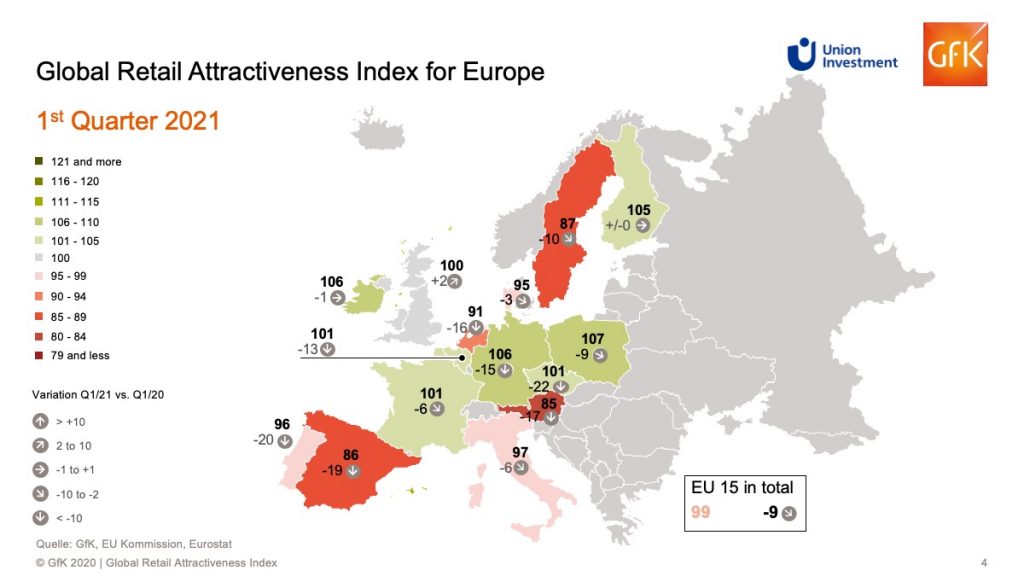

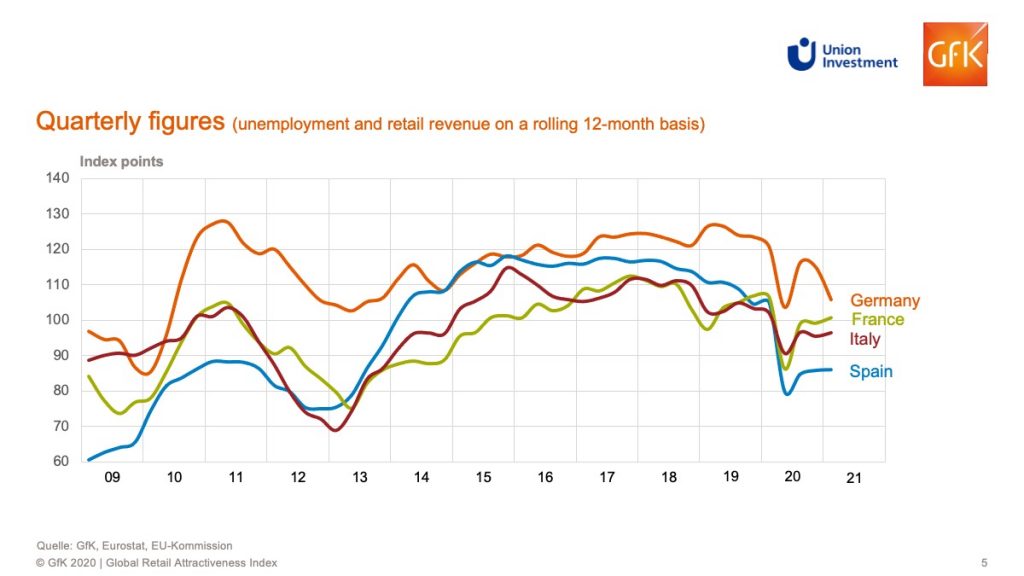

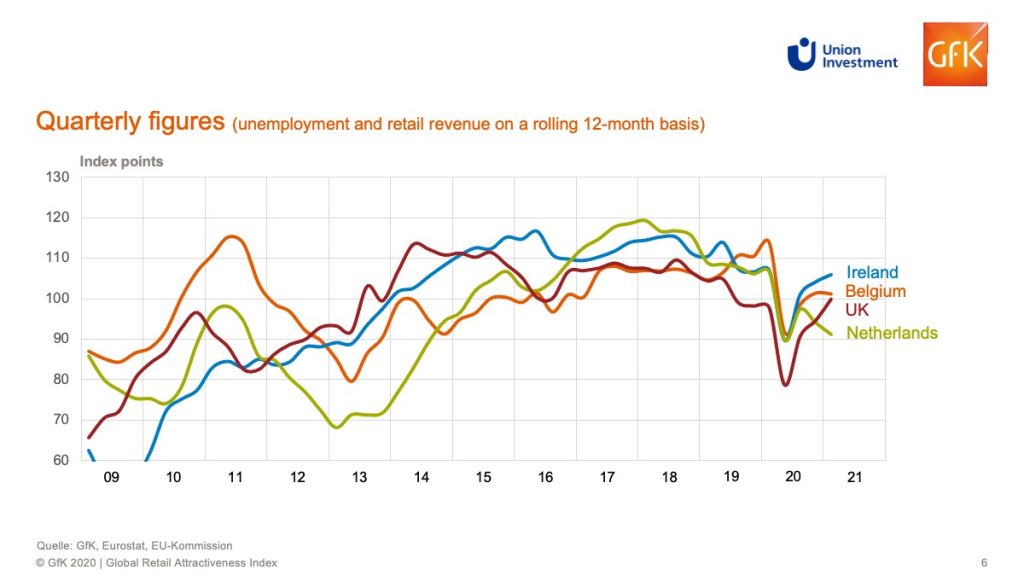

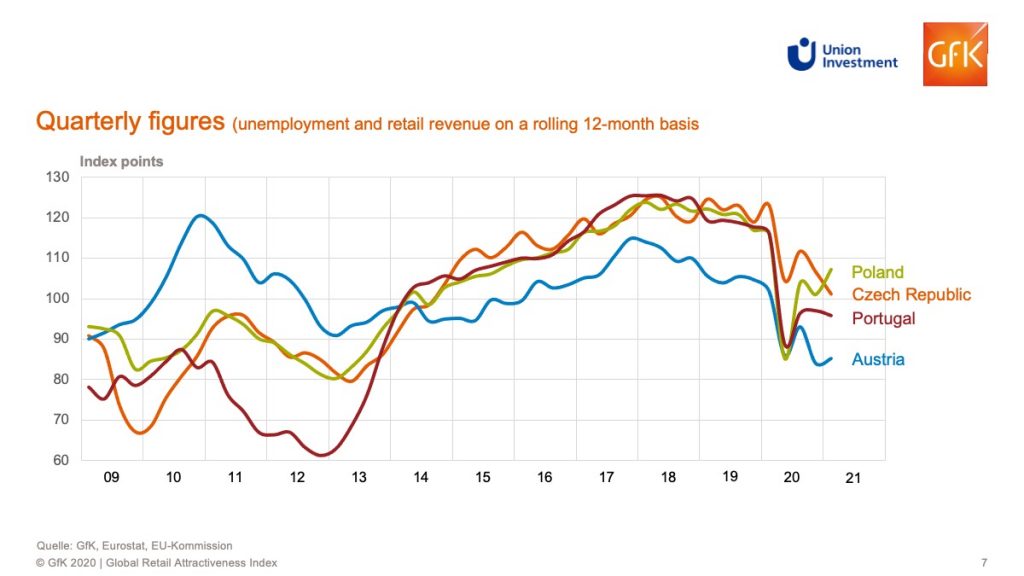

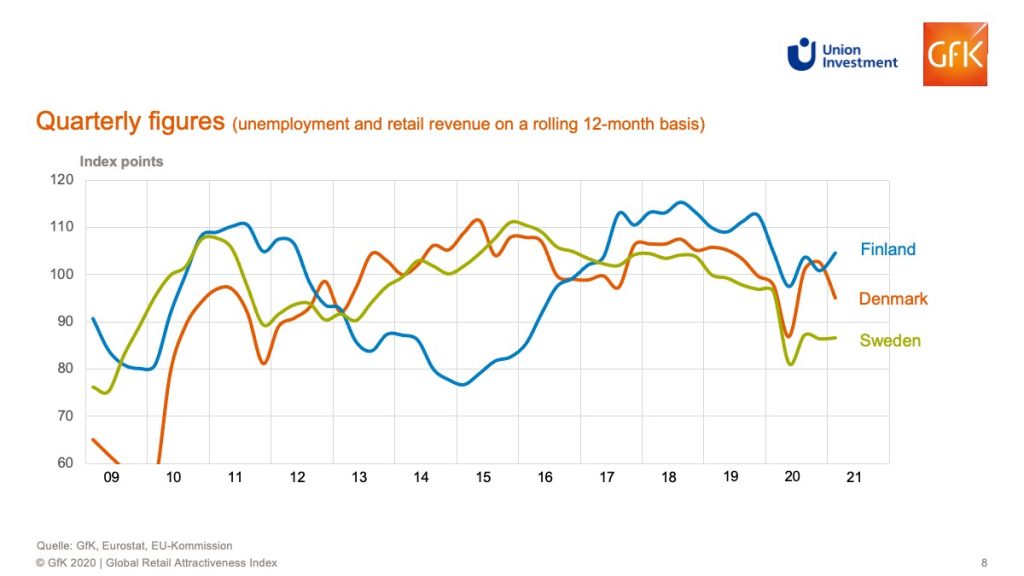

Almost all European countries saw a decline in the retail index in Q1. Only the United Kingdom experienced a slight improvement on the first quarter of 2020 (100 points; plus two points). The top country is currently Poland with 107 points, closely followed by Germany and Ireland, each on 106 points. Finland ranks in fourth place, with 105 points. France also made an above-average contribution to the EU-15 index, coming in at 101 points. Austria was the worst performer in the first quarter, on 85 points. Marginally ahead are Spain and Sweden, with 86 and 87 points respectively. The biggest falls were recorded by the Czech Republic and Portugal, which were down 22 and 20 points, respectively.

As in Europe, the index is underperforming in both overseas regions. The gap between the EU-15 index and the index in North America (94 points; minus six points) shrank to five points, while Asia-Pacific continues to lag further behind the EU-15 index (86 points; minus six points). In North America and Asia-Pacific, retail sales and business retail confidence are still making a positive contribution to the retail index. By contrast, consumer confidence and the labour market are weighing on the index in both regions. Particularly notable in North America are the slumps in consumer confidence (minus 27 points) and in the labour market (minus 42 points). Australia (97 points; plus seven points) is currently the frontrunner among the overseas countries in the survey, followed by the US (95 points; minus five points), Korea (92 points; plus two points) and Canada (82 points; minus 13 points). Performance is weakest in the Japanese retail market at present, where sharp losses of twelve points pushed the index down to just 81.

Key Facts

After the Retail Index slumped to 89 points in the second quarter of 2020, it recovered quickly to 100 points.

In the first quarter of 2021, the Retail Index for Europe stagnated at 99 points. Compared to the previous year (Q1/20), it loses 9 points.

Sentiment variables are primarily responsible for this poor performance they are currently at 89 and 82 points respectively, losing 20 points each over the year. In contrast, both the labor market (122 points, -4) and retail sales (109 points, +7) supported the Retail Index in Europe in the first quarter.

The labor market is clearly a lagging indicator. In the event of a prolonged recession, unemployment figures could increase again more strongly and weigh on the Retail Index.

Poland currently leads with 107 points, followed by Germany and Ireland with 106 points each. Finland is currently in fourth place with 105 points. France makes an above-average contribution with 101 points.

At the bottom of the list is Austria with 85 points, followed by Spain and Sweden with 86 and 87 points respectively.

Almost all European countries have to accept losses. Only the UK was able to improve slightly (+2). Finland remains unchanged.

The losers are the Czech Republic and Portugal with a drop of 22 and 20 points respectively, followed by Spain (-19), Austria (-17), and the Netherlands (-16).

Methodology

Union Investment’s Global Retail Attractiveness Index (GRAI) measures the attractiveness of retail markets across a total of 20 countries in Europe, North America and the Asia-Pacific region. An index value of 100 points represents average performance. The EU-15 index combines the indexes for the following EU countries, weighted according to their respective population size: Denmark, Finland, Germany, France, Italy, Spain, Sweden, the United Kingdom, Austria, the Netherlands, Belgium, Ireland, Portugal, Poland and the Czech Republic. The North America index comprises the US and Canada, while the Asia-Pacific index covers Japan, South Korea and Australia.

Compiled every six months by market research company GfK, the Global Retail Attractiveness Index consists of two sentiment indicators and two data-based indicators. All four factors are weighted equally in the index, at 25 per cent each. The index reflects consumer confidence as well as business retail confidence. As quantitative input factors, the GRAI incorporates changes in the unemployment rate and retail sales performance (rolling 12 months). After standardisation and transformation, each input factor has an average value of 100 points and a possible value range of 0 to 200 points. The index is based on the latest data from GfK, the European Commission, the OECD, Trading Economics, Eurostat and the respective national statistical offices. The changes indicated refer to the corresponding prior-year period (Q1 2020).