- GRAI up twelve points year-on-year in the first quarter of 2022

- War in Ukraine causes sentiment among consumers and retailers resulting in a slump from March onwards

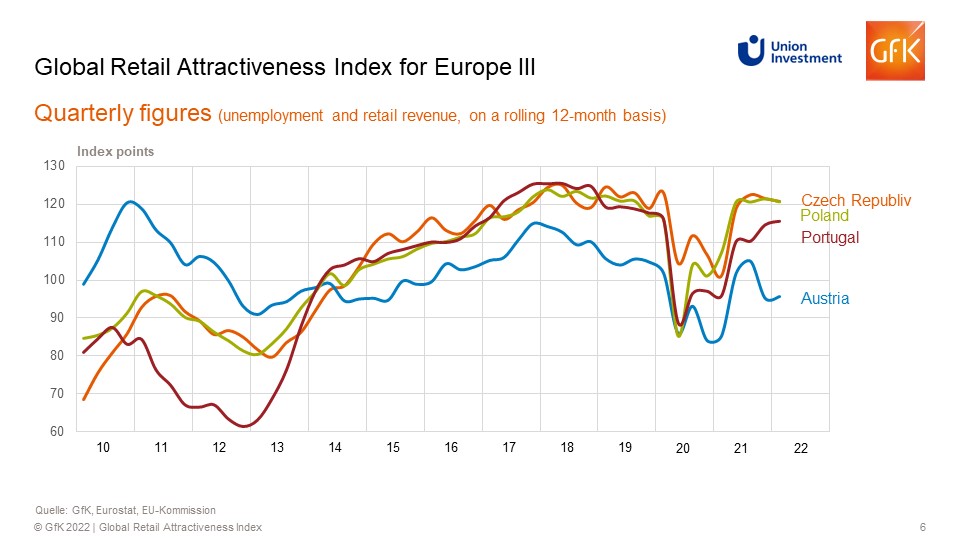

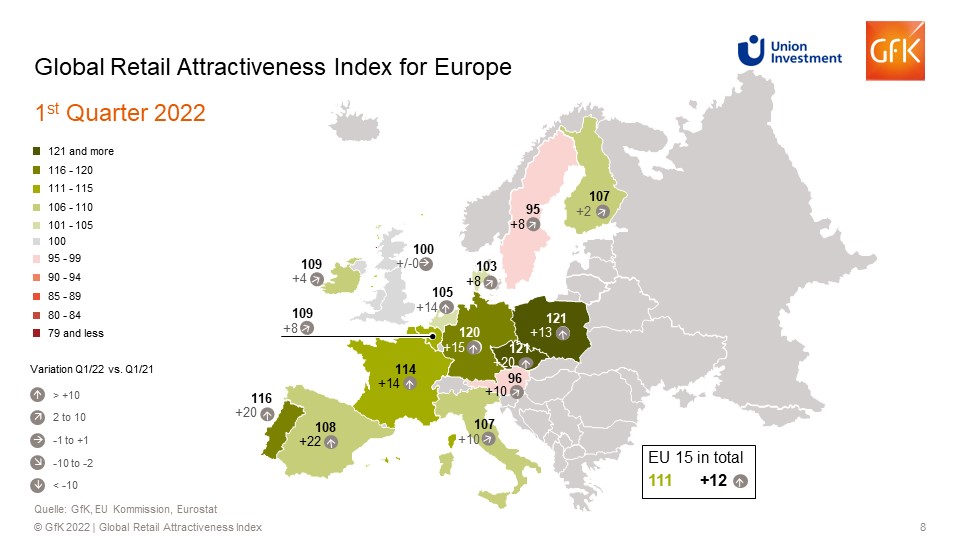

- Czech Republic, Poland, and Germany form the new top trio on the index

- South Korea and Canada with the strongest overseas performance

GRAI continues searching for its course. The war in Ukraine has massively slowed down the recovery of European retail markets, which was felt everywhere after the end of the lockdowns, from March onwards. However, due to the strong interim recovery in January and February, the Global Attractiveness Retail Index secured its comparatively good level in the first quarter of 2022.

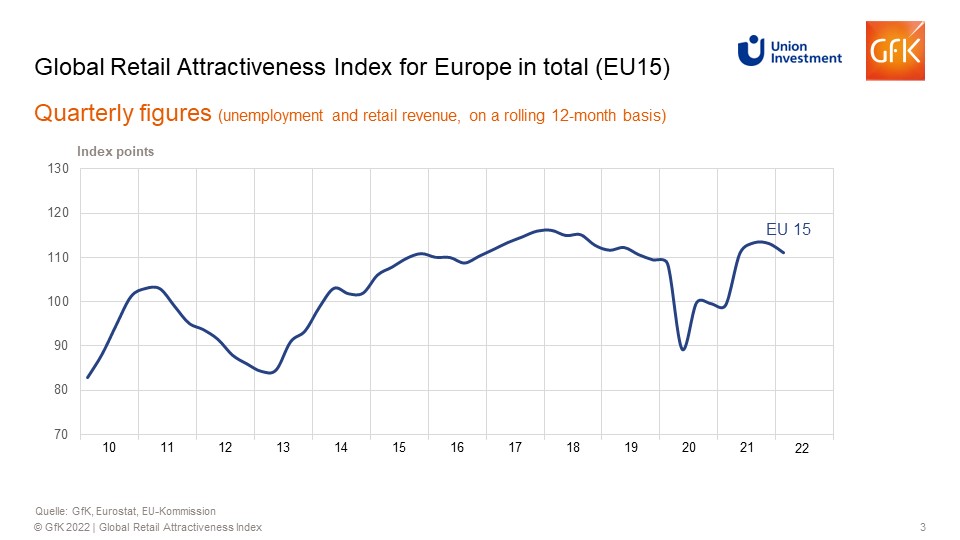

The slight decline in the first quarter brings the Retail Index down slightly to 111 points (previously 113 points). Compared with the corresponding period of the previous year; however, the index calculated by Union Investment and GfK is significantly up by twelve points.

“The good news is that, compared with the previous year, the trend is upward in all 15 European countries covered by the index, without exception”, says Olaf Janßen, Head of Real Estate Research at Union Investment. “It can be assumed that a much more heterogeneous picture will emerge in the European retail landscape and in the Retail Index in the second quarter, when inflation, supply bottlenecks, and further consequences of the war in Ukraine have a stronger impact on sentiment among retailers and consumers.”

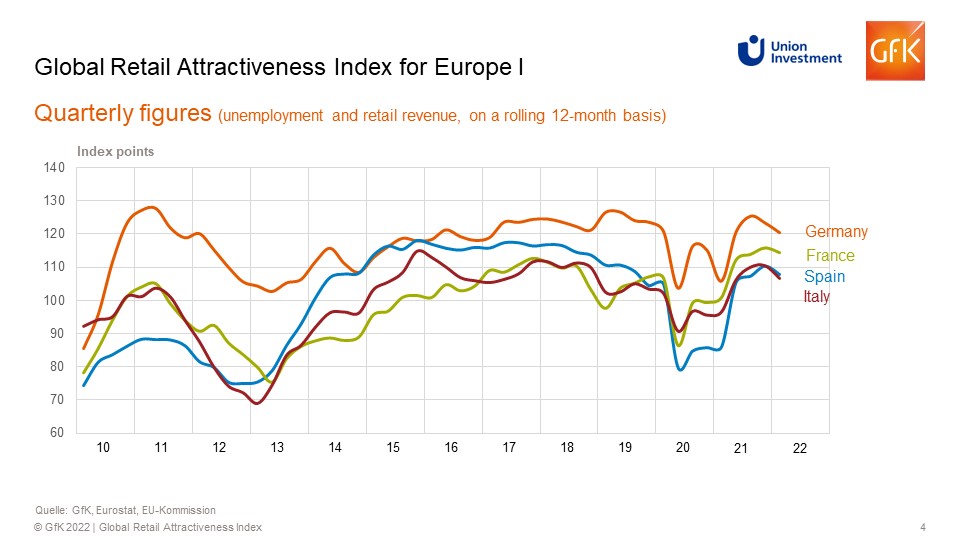

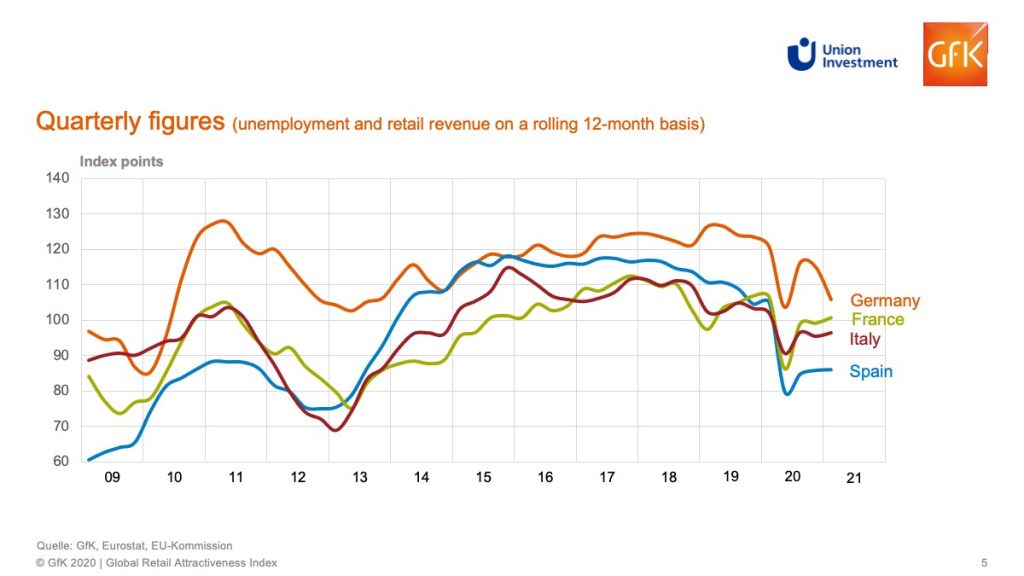

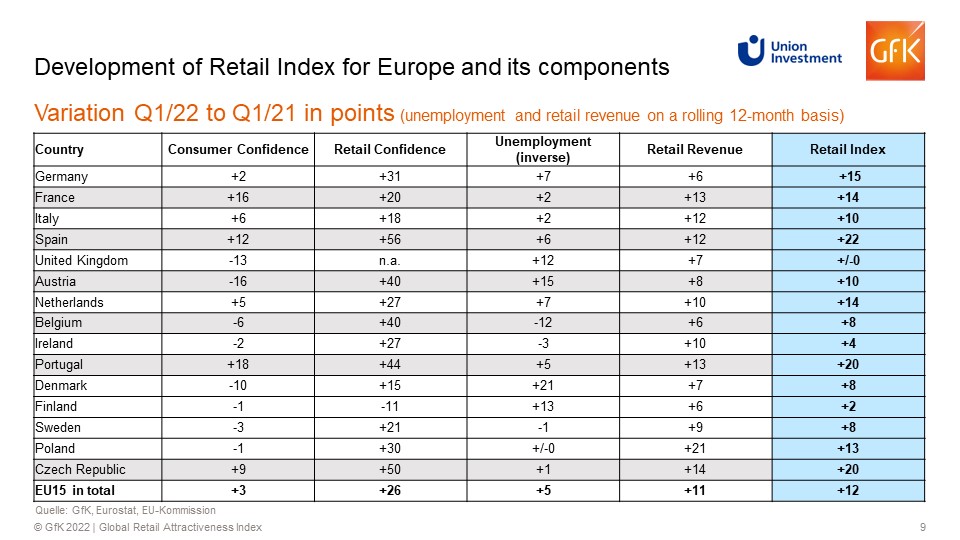

Stronger growth in Spain, Poland, and France

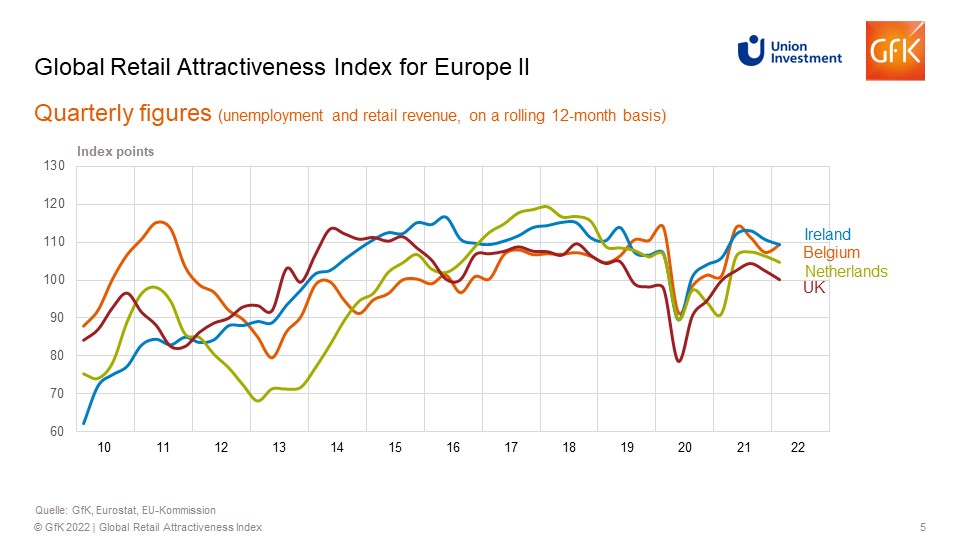

The year-on-year gains in Spain, with an increase of 22 points, and in the UK, Portugal and France, with plus 14 points, are particularly significant. As far as the level of the Retail Index is concerned, the Czech Republic and Poland now form the top duo with 121 points each, followed by Germany (120 points), and Portugal (116 points). Sweden is bringing up the rear with 95 points at the end of the first quarter of 2022.

“The significant year-on-year improvement in retail sentiment is primarily responsible for the interim high of the GRAI in Europe,” says Olaf Janßen. Retail sentiment increased by 26 points over the course of the year to currently 107 points. Despite the corona pandemic, retail sales (123 points), up 11 points over the course of the year, and the healthy labor market (127 points, +5) also made strong contributions to the positive development of the index. Significantly weaker impetus came from the consumer sentiment, which had already deteriorated compared with the start of the year, but nevertheless increased slightly year-on-year (92 points, +3).

EU-15 index continues to outperform indices in America and Asia

As in Europe, the Retail Index also improved year-on-year in the two overseas regions. Despite the war in Ukraine, the EU-15 index (111 points) continues to outperform the indices in North America (103) and Asia Pacific (98). In North America, the GRAI is eight points up year-on-year in the first quarter, and eleven points in Asia-Pacific. In Asia-Pacific, performance is still slightly below average despite its gains.

Just like in Europe, the relatively good level in North America is based on strong gains from retail sales and on the labor market. However, retailer and consumer sentiment indicators have already weakened significantly. The leader among the monitored overseas countries is currently South Korea with 109 points and an increase of 17 points, followed by Canada (105 points, +25), and the USA (102 points, +6). The weakest development was once again seen in the Japanese retail market. Despite an increase of eleven points, a score of 93 remains the lowest of all 20 values included in the GRAI.

Key Facts

The Retail Index for Europe (EU 15) suffered a slight decline in the first quarter of 2022, falling to 111 points. This is 12 points more than in the corresponding period of the previous year. This means that the index is still at a comparatively good level.

This increase is mainly attributable to the mood in the retail sector and its development. Retail sentiment (107 points) increased by 26 points and retail sales (123 points) rose by 11 points over the course of the year. The labor market (127 points, +5) and consumer sentiment (92 points, +3) made only a below-average contribution to the rise in the Retail Index.

In terms of the level of the Retail Index, the Czech Republic and Polandcurrently lead the field at country level with 121 points each, followed by Germany (120 points) and Portugal (116 points). France takes fifth place in the first quarter of 2022 with 114 points.

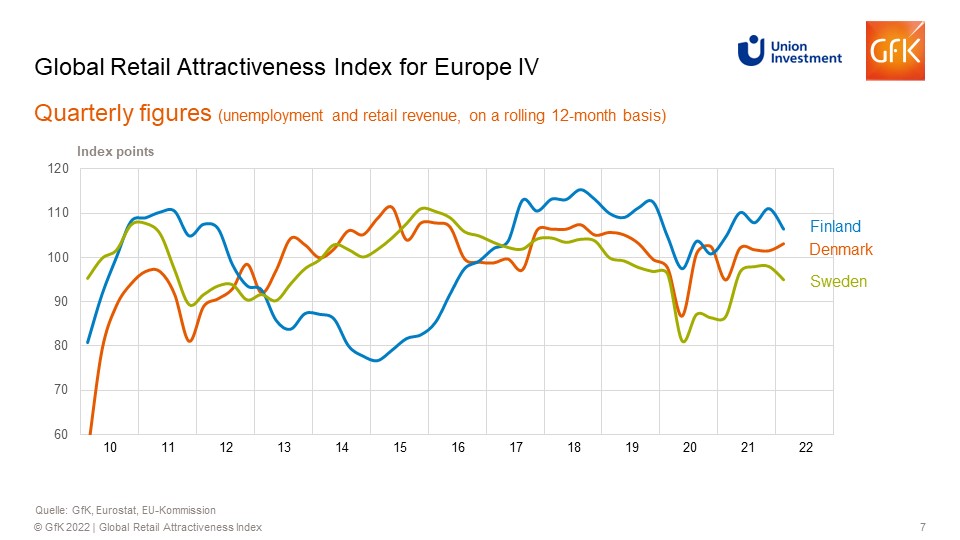

At the bottom of the list is Sweden with 95 points. It is followed by Austria with 96 points and the UK (100 points).

The encouraging news is that compared with the corresponding period of the previous year, not a single country in the EU suffered losses. The strongest gains were seen in Spain with an increase of 23 points, Poland with plus 17 points, and France (+15 points). They are followed by the UK and Portugal, each with an increase of 14 points.

The weakest year-on-year increases in the first quarter of 2022 come from the UK with +/-0 as well as Finland with +2 and Ireland with +4 points.

Methodology

Union Investment’s Global Retail Attractiveness Index (GRAI) measures the attractiveness of retail markets across a total of 20 countries in Europe, North America and the Asia-Pacific region. An index value of 100 points represents average performance. The Europe index combines the indexes for the following 15 countries, weighted according to their respective population size: Denmark, Finland, Germany, France, Italy, Spain, Sweden, the United Kingdom, Austria, the Netherlands, Belgium, Ireland, Portugal, Poland and the Czech Republic. The North America index comprises the US and Canada, while the Asia-Pacific index covers Japan, South Korea and Australia.

Compiled every six months by market research company GfK, the Global Retail Attractiveness Index consists of two sentiment indicators and two data-based indicators. All four factors are weighted equally in the index, at 25 per cent each. The index reflects consumer confidence as well as business retail confidence. As quantitative input factors, the GRAI incorporates changes in the unemployment rate and retail sales performance (rolling 12 months). After standardization and transformation, each input factor has an average value of 100 points and a possible value range of 0 to 200 points. The index is based on the latest data from GfK, the European Commission, the OECD, Trading Economics, Eurostat and the respective national statistical offices. The changes indicated refer to the corresponding prior-year period (Q3 2020).