Against this backdrop, GfK’s Geomarketing solution area evaluated key market indicators in their study on European retail in 2020 and 2021. The coronavirus pandemic initiated or accelerated many developments that will also shape chain store retail in the long term. We will look at these in more detail below. For example, the chapter on retail relating to technical consumer goods shows that omnichannel retailers are growing more rapidly than online-only retailers. In addition, retail in city centers needs to adapt even more to keep up, as evidenced by the chapter on retail turnover development in 2020, and it is also shown in the section on the development of visitor frequencies in city centers in this year’s focus country, Germany. Furthermore, using Austria and the United Kingdom as examples, we can see in which regions online retail, benefiting from the coronavirus, is already particularly strong today.

In addition, the chapters on purchasing power, consumer price development, and consumer spending provide a framework in which the retail sector must compete with in the post-coronavirus era.

Overview of the study’s most important insights

Purchasing power: Among the 27 EU countries, Spain, Italy, and Cyprus recorded the largest declines in income, as the long lockdown periods and also the economy’s dependence on tourism hit especially hard here. Hungary, where significant income gains had been reported in previous years, also saw large declines in 2020, with the weak development of the Hungarian forint playing a key role.

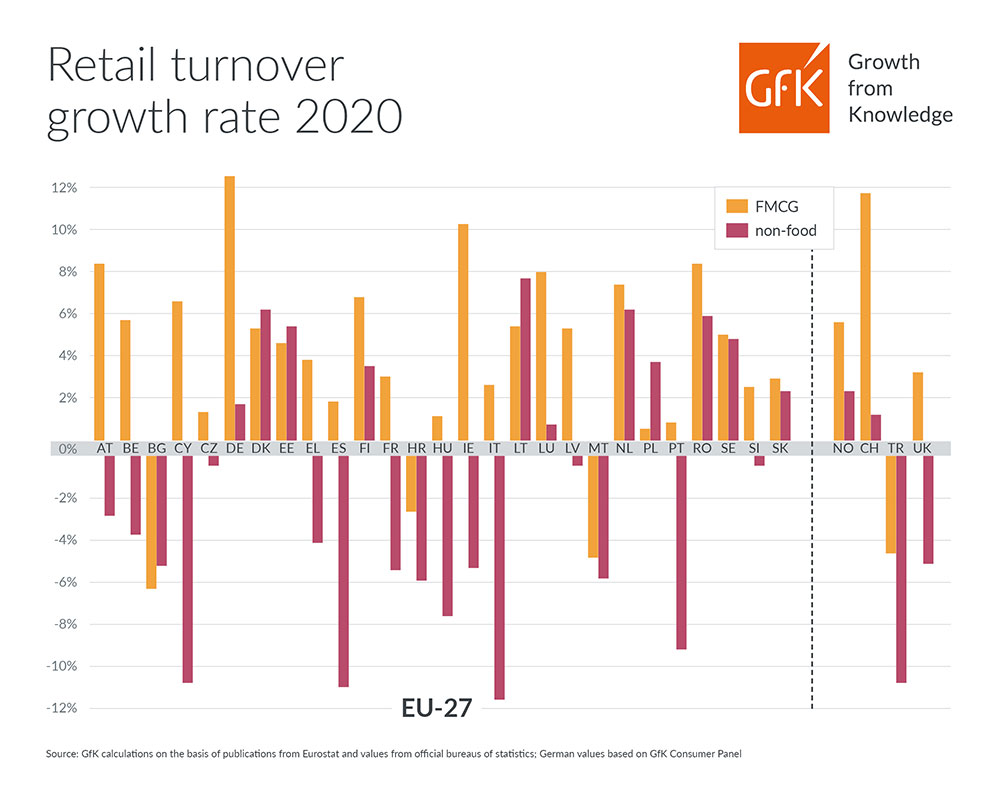

Retail turnover: FMCG retail sales in the EU-27 countries grew by 5.5 percent in 2020. This is due in part to food consumption being shifted to private homes due to closed canteens, restaurants and general curfews. The strongest increases were in Germany (+12.4 percent), Ireland (+10.3 percent), Austria (+8.4 percent), and Luxembourg (+8.0 percent). By contrast, non-food retail sales fell by 3.0 percent across the EU.

Retail turnover share of private consumption: Contrary to the previous long-term trend, the retail turnover share of private consumption in the 27 EU countries increased significantly in 2020. On average, EU residents spend 35.5 percent of their consumer spending in the retail sector. The retail sector continues to account for the highest shares of consumer spending in Croatia (50.9 percent) and Hungary (53.3 percent).

Inflation: As inflation was just 0.7 percent in 2020, due in part to the sharp drop in oil prices, the inflation rate is expected to rise to 1.9 percent in 2021. The rise in inflation is expected to be particularly pronounced in Germany, where the temporary reduction in value-added tax expired at the beginning of the year. Here, prices are expected to rise by 2.4 percent in 2021, compared to 0.4 percent in the previous year.

Retail of technical consumer goods: In twelve Western European countries, almost 40 percent of sales of technical consumer goods were made online in 2020. The biggest winners were click-and-mortar retailers. They increased their online sales by +60 percent – much more than pure online retailers (+36 percent) – and now account for over 50 percent of all online sales for the first time.