Wtitten by

Peter Sempelmann

For decades, European shopping centers were defined primarily by retail consumption. Today, that model is under pressure. Structural shifts – from e-commerce to changing consumer expectations – have forced landlords and asset managers to rethink the role of physical retail. Increasingly, the answer lies not in selling more products, but in offering more services.

Fitness, healthcare, and wellness (FHW) occupiers sit at the heart of this transition. As a new research by CBRE shows, appetite for gyms, clinics, and wellness concepts in retail environments is intensifying across Europe, redefining how consumers interact with shopping centers. These uses are service-led, visit-driven, and deeply embedded in daily routines – exactly the qualities landlords now seek.

The integration of FHW is not about replacing retail, but about complementing it. By anchoring schemes in health, wellbeing, and community value, shopping centers can become destinations people visit several times a week, rather than several times a year.

Powerful Demand Drivers: Ageing, Urbanization, and Prevention

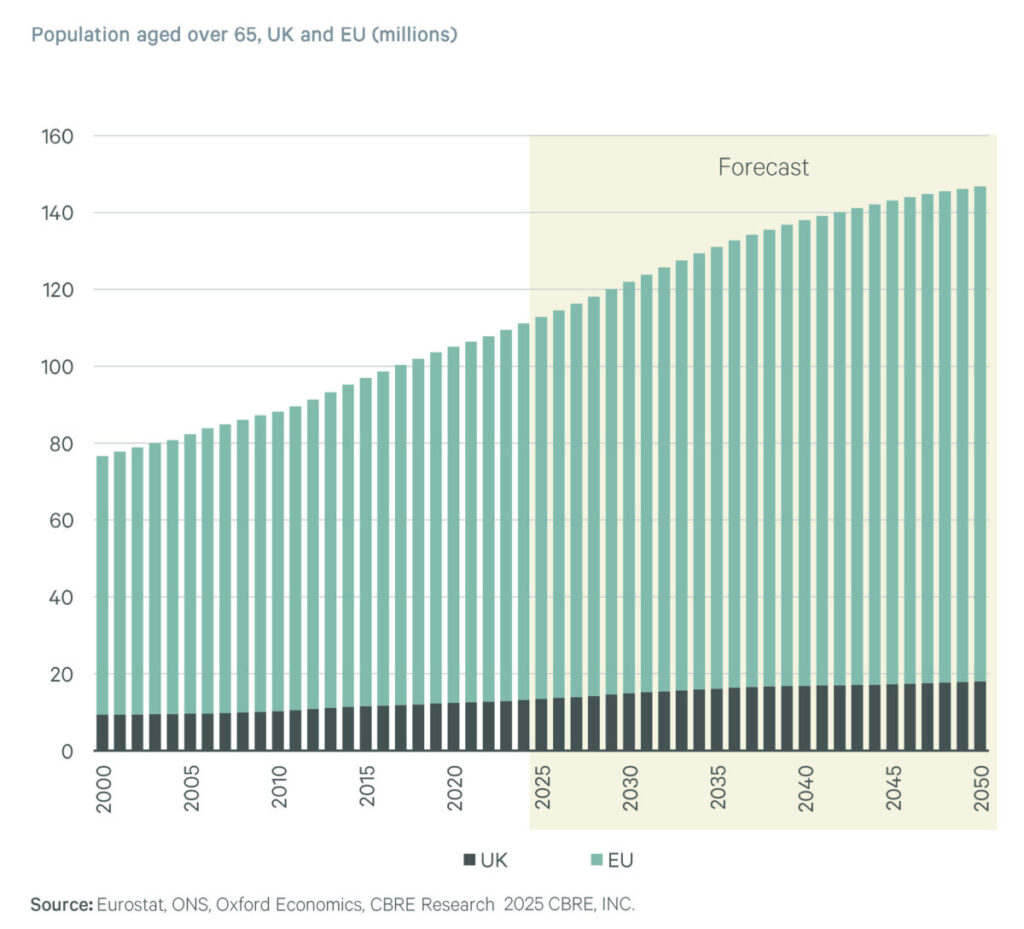

The long-term fundamentals for FHW integration are compelling. Europe’s population is ageing rapidly. Between 2025 and 2050, the number of people aged over 65 is forecast to rise by around 34 million across the EU and the UK. This demographic shift will significantly increase demand for accessible healthcare services, as well as for fitness and wellness concepts tailored to older consumers.

Matt Gillson, Senior Director in CBRE’s Retail team:

“The ageing population will only increase demand for such facilities further. In the UK specifically, the shift to community-based services creates an opening for retail schemes to host health centres and clinics, supporting the Fit for the Future initiative across the country.”

At the same time, Europe is becoming increasingly urban. Already, around three quarters of the population live in cities, a share that is set to rise further. Larger retail destinations located in or near urban centers are particularly well positioned to benefit from this trend. They offer the accessibility, scale, and infrastructure required for fitness clubs, medical clinics, and wellness operators.

Overlaying both trends is the rise of preventative health. Consumers are no longer passive users of healthcare systems; they are proactive managers of their own wellbeing. Wearables, digital health tools, fitness apps, and wellness subscriptions are now mainstream. This cultural shift fuels demand for physical places where prevention, diagnosis, treatment, and recovery intersect – places shopping centers are increasingly able to provide.

Ageing population in UK and EU

Uneven Market Maturity Creates Opportunity

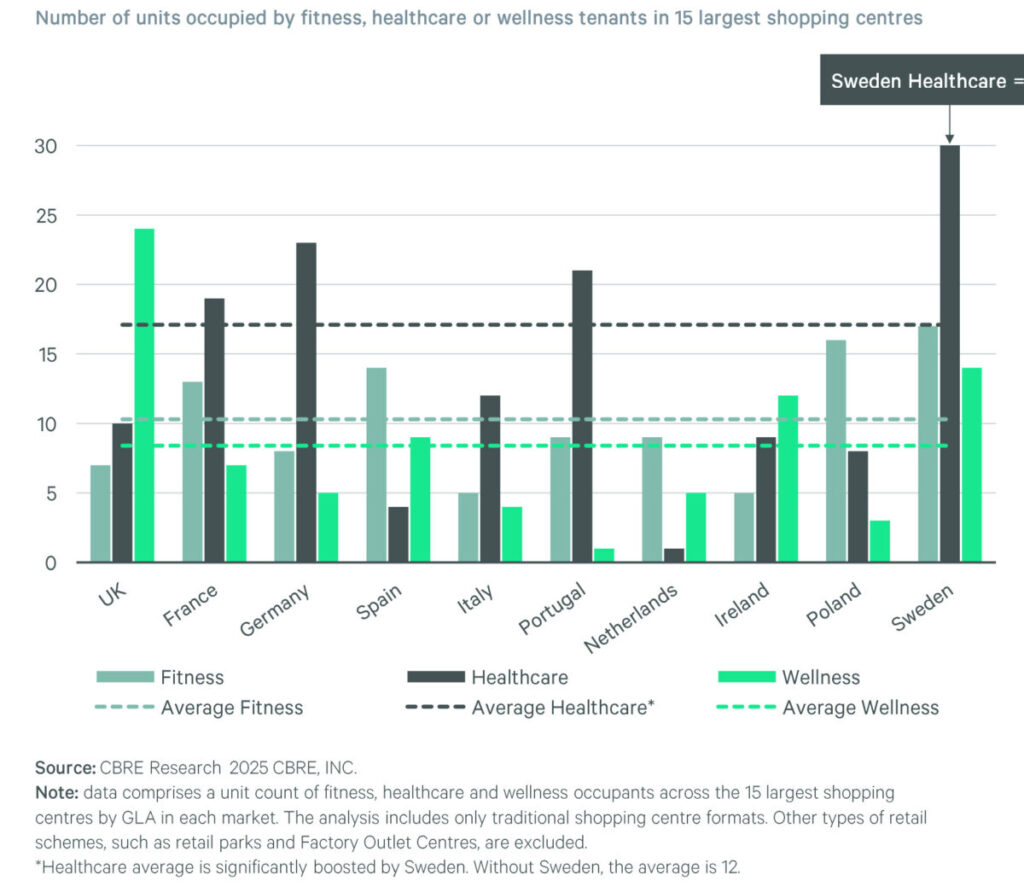

“Maturity levels are mixed across the region, with some markets in an embryonic phase of mixed-use development and healthcare provisions in their tenant mix,” notes Gillson.

While demand is pan-European, the maturity of FHW integration varies significantly by market. This uneven landscape creates both benchmarks and opportunities.

Sweden stands out as the most advanced market for healthcare integration in retail. Its shopping centers host a high number of medical occupiers, including family health clinics, physiotherapy practices, and vaccination centers. This is partly driven by the structure of Sweden’s healthcare system, which allows private providers to operate alongside public services and encourages decentralized, community-based delivery.

In contrast, other major markets remain underserved. Italy and the Netherlands score below the European average across fitness, healthcare, and wellness provision in leading shopping centers. Spain, despite strong fitness penetration, has comparatively low levels of healthcare integration. These gaps suggest significant potential for growth – particularly as pressure on public healthcare systems increases.

The UK presents a different profile. It is Europe’s most developed wellness market, driven in part by large flagship schemes and the flexibility introduced by the Class E planning use category. This regulatory environment has made it easier to convert traditional retail units into medical or wellness uses, accelerating adoption.

Comparison of selected European markets

Performance Matters: FHW as a Value Driver

Beyond structural demand, CBRE’s performance data provides strong evidence that FHW integration supports asset resilience. And Gillson stresses that landlords and asset managers would be wise to develop thes categories.

Across CBRE’s European Shopping Centers Performance Index, dominant “Experience” assets show the highest concentration of fitness, healthcare, and wellness tenants. More than 80% of these leading centers host at least one FHW occupier, underlining their importance in best-in-class schemes.

“Landlords and asset managers have the opportunity to develop these categories and broaden the appeal of their schemes, taking confidence from the outperformance of those that are already doing so.”

Matt Gillson, CBRE

Crucially, centers with FHW tenants have demonstrated stronger footfall recovery since the pandemic. From early 2024 to mid-2025, assets with fitness, healthcare, or wellness occupiers recorded footfall broadly in line with pre-pandemic levels. Assets without these uses continued to lag behind. While correlation does not prove causation, the pattern is clear: the most successful centers are those that integrate health-related uses into their tenant mix.

Fitness, in particular, has expanded rapidly. Since 2019, the floorspace occupied by fitness tenants in CBRE-managed assets has more than doubled. This growth reflects not only an increase in the number of gyms, but also a trend towards larger, more sophisticated facilities offering classes, recovery zones, and social spaces.

Benefits to Landlords, Occupiers and Consumers

To Landlords

- Increased footfall

- Longer dwell times

- Repeat visits

- Broadening of the tenant mix

- Diversification of income profile

- ESG benefits – social value

To Occupiers

- Drives footfall, dwell time and repeat visits

- Attracts different types of footfall which can

increase spend during non-peak hours - Broader appeal of assets attracts more customers

- Improvements to staff wellbeing

- For fitness, healthcare and wellness tenants,

a presence in major retail schemes boosts

brand visibility

To Consumers

- Ease of access and location

- Creates a multi-destination site

- Improves consumer experience and well

Fitness: From Gym to “Third Place”

The fitness sector illustrates how FHW uses can redefine the social role of shopping centers. Gyms are no longer purely functional spaces; they are increasingly lifestyle destinations.

Consumer data shows strong momentum. A significant share of European consumers plans to increase their gym frequency, especially among younger age groups. For many, fitness has become a routine comparable to grocery shopping – regular, habitual, and non-discretionary.

Operators are responding with increasingly polarized offers. Budget gyms focus on accessibility and scale, while premium concepts integrate wellness, recovery, and community features. Mid-market operators, by contrast, face pressure as consumers trade up or down.

For shopping centers, this evolution is highly attractive. Gyms generate frequent visits, often outside traditional retail hours, smoothing footfall patterns across the week. They also create natural synergies with food, fashion, and wellness retailers. In this sense, fitness operators are emerging as modern anchors – less transactional than supermarkets, but more habitual than fashion.

Healthcare: A Strategic Repurposing Opportunity

Healthcare integration represents one of the most transformative opportunities for European retail real estate.

As healthcare systems grapple with ageing populations, staff shortages, and outdated estates, policymakers are increasingly shifting care delivery away from hospitals and into community-based settings. Retail destinations – accessible, well-connected, and familiar – are natural hosts.

In the UK, this shift is particularly pronounced. Public initiatives such as community diagnostic centers and neighborhood health hubs are actively seeking non-hospital locations. Shopping centers offer space, parking, transport links, and the ability to integrate healthcare visits with everyday errands.

From a landlord perspective, healthcare tenants bring long leases, stable income, and resilience to economic cycles. While conversion costs can be high – medical fit-outs are significantly more expensive than standard retail – the long-term benefits in terms of occupancy, diversification, and footfall can be substantial.

Healthcare also changes the perception of shopping centers. By embedding essential services, schemes become civic infrastructure rather than discretionary destinations, strengthening their relevance to local communities.

Wellness: The Bridge Between Retail and Health

Wellness occupies the space between fitness and healthcare, and its role in shopping centers is evolving.

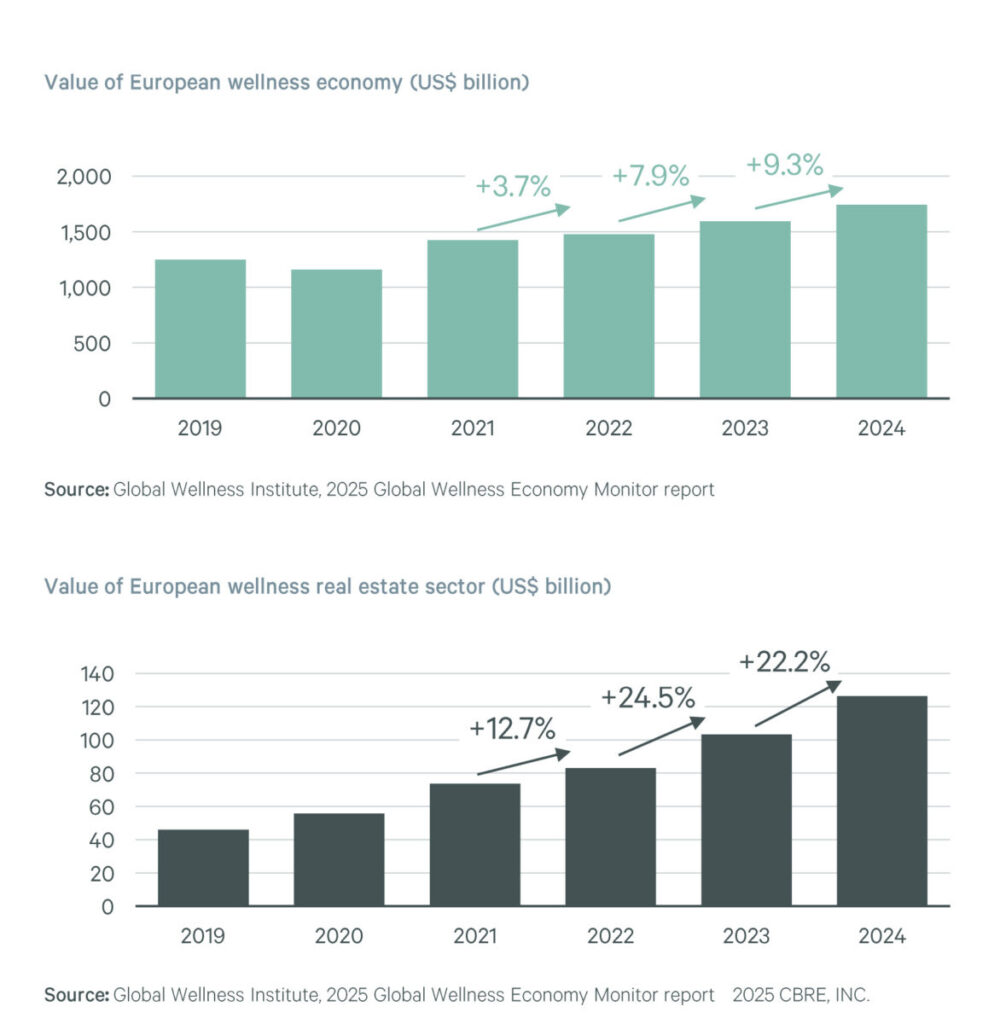

While wellness floorspace in traditional malls has remained relatively stable in recent years, demand for wellbeing services is growing rapidly across Europe. Spas, recovery studios, aesthetic clinics, and holistic health providers are expanding, often seeking locations with strong brand visibility and complementary uses.

For shopping centers, wellness offers a powerful narrative. It aligns with ESG objectives, supports longer dwell times, and attracts consumers who value experience over transaction. Wellness uses also pair naturally with premium fitness concepts and healthcare services, creating clusters of health-oriented tenants.

The challenge lies in economics. Wellness operators can be sensitive to service charges and fit-out costs, making collaboration between landlord and tenant essential. Flexible lease structures, shared investment, and tailored layouts will be key to unlocking further growth.

Value of European wellness economy & real estate

Benefits Beyond Rent: A Broader Value Proposition

The integration of fitness, healthcare, and wellness delivers benefits well beyond direct rental income.

For landlords, FHW uses diversify tenant mix, stabilize cash flow, and support asset valuation. They also improve sustainability credentials, particularly on the social dimension of ESG, by delivering tangible community benefits.

For occupiers, shopping centers provide visibility, accessibility, and a built-in customer base. Co-location with complementary uses drives cross-visitation and brand discovery.

For consumers, the value is convenience and quality of life. Being able to combine a gym session, a medical appointment, and daily shopping in one trip saves time and reinforces loyalty to place.

In effect, FHW integration allows shopping centers to form a new “social contract” with their communities – one based not just on consumption, but on wellbeing.

Fit for the Future

The message from CBRE’s research is clear: fitness, healthcare, and wellness are no longer peripheral to retail real estate strategy. They are central to the future of European shopping centers.

Markets differ in maturity, and challenges remain – particularly around cost, regulation, and operational complexity. But the direction of travel is unmistakable. As Europe’s cities grow older, denser, and more health-conscious, the most successful retail destinations will be those that help people live better, not just shop better.

In that sense, integrating FHW is not simply a response to change – it is a proactive strategy to ensure that shopping centers remain fit for business in the decades ahead.

Download

Click to download the CBRE Report “Fit for Business: Integrating Fitness, Healthcare, and Wellness into European Retail Destinations“. PDF document, 10 MB (publishing date: December 2025)