The wind is blowing alternately from all directions. Leading to sales increases, sales slumps, and sales shifts in the double-digit percentage range. The ex- tent of these changes, both positive and negative, is high- ly unusual for an industry that is normally so cyclically sta- ble, such as the consumer-oriented food retail sector. Companies that are particularly hard hit are set back ten or more years in their development, while Covid-winners are catapulted into new sales dimensions.

Disruption & uncertainty are, not without reason, the key words to describe this unique phenomenon. “Disruption & Uncertainty” is the title of the recent McKinsey and Euro- Commerce report on the “State of Grocery Retail 2021.”

“We see a new level of disruption both in the rapid chang- es in consumer behavior and in the industry’s responses to them,” says McKinsey senior partner Tobias Wachinger. Strong impulses for change are coming from the demand side (consumer demand) as well as the supply side (disrup- tions in the supply chain) of the markets.

For retail management, disruption means that Covid-19 is reshuffling the competitive cards. The pandemic as a massive gamechanger that can do it all: Trend accelerations and trend delays, trend reversals, and trend blocking. In the end, however, there is a threat of further polarization in the economy as well as in society. Big and strong versus small and flexible is the name of the game. A surge in concentra- tion in the European food retail sector can be expected in 2021 and beyond. A lot of work awaits the competition au- thorities in Brussels.

As of April 2021, the total extent of the disruption Corona will cause in food markets for years to come cannot yet be estimated. For retail managers, this is a paradoxical situa- tion: as advocates of a digitally driven economy who have learned to make their decisions based on data analytics, they are sitting on a mountain of numbers that are rapidly decaying into data garbage due to the disruptive effects of the pandemic.

However, waiting until the fog lifts and the vaccination of the population puts an end to the Corona craze is not an option for the managers. And the virus has not yet been de- feated. Resilience is therefore still very much needed. The ability to react flexibly to unforeseen developments while remaining true to one’s own corporate culture. This re- quires an analysis of market events that provides orienta- tion and thus enables the company to act, even if based on an uncertain factual foundation. This analysis is primarily about deciphering the economic consequences of Corona as a complex, multi-causal system.

The following five theses are an attempt to outline the main strands of change facing the European food trade in the staccato of government-imposed lockdowns since the out- break of the pandemic.

FIVE THESES:

THIS IS HOW THE PANDEMIC CHANGED THE BUSINESS OF EUROPEAN FOOD RETAILERS

1. Growth surge. Covid-19 gave food retailers a historic, and in some cases irreversible, boost in sales in 2020. The wholesale food sector, on the other hand, will lose out mas- sively. The main driver of this sales shift is the increase in in-home consumption at the expense of out-of-home con- sumption, caused by lockdowns in the restaurant industry.

2. Predatory competition. Heads are spinning in the boardrooms of the retail giants. Sales opportunities need to be exploited, earnings slumps cushioned, diversification strategies developed in line with the crisis, and expansion plans for the future must be forged. Following the sales tur- bulence of 19/20, the year 21/22 will see fiercer price competition between discounters, supermarkets, hyper- markets, and online retailers.

3. Regionalization. Consumer fears, fueled by Covid, gen- erate a hype for regionality assortments, especially for fresh food. This trend influences global and national supply chains and, at the same time, controls the shopper jour- neys. The results are one-stop shopping and shop-shifting.

4. Digitization. Covid-19 is fueling digitization processes in food retailing. Smart stores are countering the offensive pure online retail sector with connected retail. However, e- food is still struggling with considerable teething problems in countries with a high density of food retail stores, espe- cially in the GSA region. IT investments, still restrained in 2020, will pick up speed in 2021.

5. Sustainability. Health claim meets climate responsibil- ity. Food retailers are responding to the demand from LO- HAS shoppers for healthy, organic, and climate-neutral foods, which has been driven further by Covid. Organic su- permarkets and traditional full-range stores are competing fiercely with each other and their rapidly growing premium private-label programs.

THESIS 1: THE 19/20 COVID GROWTH SURGE IN EUROPEAN FOOD RETAILING HAS HISTORIC PROPORTIONS

Covid-19 resulted in a historic, and in some cases irreversible, boost in sales for food retailers in 2020. Catering wholesalers, on the other hand, lost out massively. The main driver of this sales shift is the increased in-home con- sumption at the expense of out-of-home consumption, caused by lockdowns in the restaurant industry.

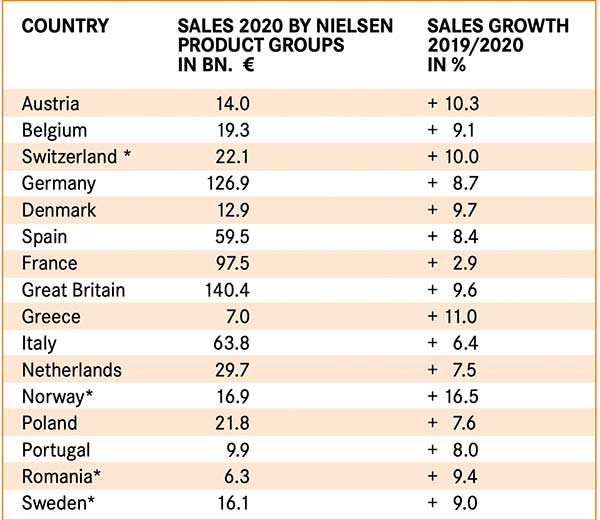

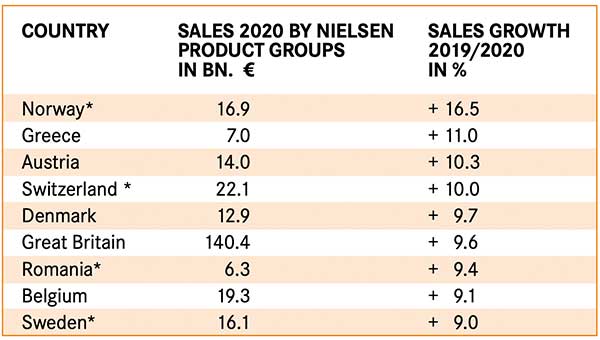

As reported by the world’s leading retail market research institute NielsenIQ (see table), the 19/20 growth rates of the food retail sector in the individual countries were large- ly in a range between eight and ten percent. This includes large markets such as Spain (+8.4%), Germany (+8.7%), and the UK (+9.6%). The outlier on the upside was Norway with +16.5%, while the lowest growth was recorded by the food retail sector in France with +2.9%. The food retail sec- tor in Italy also underperformed the market with +6.4%.

It should be noted in this context that the Nielsen panel very clearly maps trends in individual FMCG merchandise groups, but does not reflect a country’s entire food retail market. Nielsen collects sales via checkout scanner data reported by retail centers. But not all retailers participate. For example, the Nielsen figures for the markets in Nor- way, Sweden, Romania, and Switzerland do not include the sales of the hard discounters. Also excluded is the entire impulse sector (convenience stores, gas station stores, kiosks), the outlets of food retailers (bakeries, butchers) and online retail.

The example of Germany shows how “soft” the data basis is for assessing the impact of Covid on sales in food retail- ing: NielsenIQ shows a 19/20 growth rate of 8.7% for the economically strongest EU country, while the McKinsey report for 2020 shows a sales increase of 12.6%.

FOODSERVICE WHOLESALE LOSES UP TO 28%

By contrast, the Corona-induced shift in sales from food- service wholesale to food retail can be quantified fairly ac- curately. For more than a year, restaurants in many coun- tries have remained closed for months at a time, causing food and beverage consumption to shift away from restau- rants to households. Additionally, in-home consumption is being spurred by working and learning from home.

The market research institute Gastro Data has surveyed the sales losses of the foodservice wholesale trade (C&C markets and delivery services) in the GSA region in 2020. The sales volume of the foodservice wholesale market in Germany shrank in 2020 by 27.3%, in Austria by 27, 9%, in Switzerland this minus was “only” 23.2%. Wholesalers, such as the Coop Switzerland subsidiary Transgourmet, which have been pushing the gastro-delivery business for years, are more strongly affected by this Corona related sales blockade than those where distribution via cash & carry markets generates a higher sales performance. If restaurateurs are lost as customers, some of the lost sales can be offset by B2B sales to retailers and other commer- cial customers. (See also Metro’s statement).

The shift from out-of-home to in-home consumption also has a notable macroeconomic aspect. A household that prepares its food at home instead of dining at a restaurant saves a lot of money, because the meat and vegetables from the supermarket are a lot cheaper than the finished dish in the restaurant. In this way, food value creation moves from the economy to private households. Even if the retailer makes more sales the economy, as a whole, shrinks. This development costs jobs and reduces the state’s tax revenues.

STRONGEST GROWTH IN NORWAY, FRANCE AT THE BOTTOM OF THE LIST

Sales performance 2019/2020 of the food retail sector in the respective European country, in the FMCG product groups compiled by NielsenIQ.

* food retail market, excluding hard discounters

Sorted by sales growth

THESIS 2: COVID FIRES UP COMPETITION AMONG EUROPE’S RETAILERS RETAILING HAS HISTORIC PRO- PORTIONS

Heads are spinning in the boardrooms of retail giants. Sales opportunities need to be seized, earnings slumps cushioned, diversification strategies developed in line with the crisis, and expansion plans for the future must be forged. Following the sales turbulence of 19/20, the year 21/22 will see fiercer price competition between discounters, supermarkets, hypermarkets, and online retailers.

Most of the big players are still keeping a low profile with regard to their sales and earnings performance in 19/20. Aldi and Lidl, the family-owned German discount giants, have a tradition of secrecy anyway. Which is all the more remarkable given that both occupy top ten positions in the ranking of the world’s strongest retailers in terms of sales. In the Deloitte Report 2020, which is based on 2018 sales, the Schwarz Group (Lidl and Kaufland) has fought its way up to fourth place (behind Wal-Mart, Costco, and Amazon), with Aldi (Süd and Nord) defending its eighth place. In Europe, the Schwarz Group remains the clear number one in 2020 with estimated sales of around 110 billion euros. Quite unimpressed by the Corona turbulence, the Neckar- sulm-based company is maintaining its brisk pace of ex- pansion. In Romania, Kaufland and Lidl are even aiming for market leadership. In the UK, Lidl and Aldi are giving the “local heroes” Tesco and Sainsbury a run for their money.

Cooperatives such as Migros and Coop Switzerland are naturally more forthcoming when it comes to concrete sales data. Both companies have already presented their annual balance sheets as of December 31, 2020. The comparison allows an initial analysis of the consequences of Corona, backed up by hard facts: Migros increased its to- tal sales by 4.4% in the 19/20 comparison. Discounter Denner achieved disproportionate growth (+15%), as did online retail (+31%). The core business with supermarkets (+7.4%) performed below average. The sale of the Globus department stores to the Signa Group injected more than 700 million Swiss francs into Migros’ coffers.

Local rival Coop is ahead of Migros with its total sales of 30.2 billion Swiss francs, but recorded a slight decline of 0.2% in sales compared to 2019. The corona shift from out- of-home to in-home consumption is clearly reflected when looking at the sales of the individual sales lines. With an increase of 14.3%, Coop supermarkets grew significantly more strongly than the M-formats. By contrast, the subsidiary Transgourmet (present in Germany, Switzerland, Austria, and France), which specializes in foodservice wholesale, suffered a lockdown-related decline of 13.3%. By the way, how does a PR department sell an embarrass- ing drop in sales? Coop has a clever solution: Transgour- met’s sales show an index value (!) of 86.7% compared to the previous year, the report says. In terms of online sales, Coop did better than the competition with an increase of 45.4%. Calculated in “Fränkli”, however, Migros is ahead in e-commerce.

Now the industry is looking eagerly at the Rewe Group in Cologne. CEO Lionel Souque intends to present the balance sheet for the last financial year, which ended on February 28, before the end of April. This reporting date is particularly interesting this year because the balance sheet data provides information on a Corona-period of eleven and a half months, therefore it will reflect the economic pandemic effect fairly accurately. Souque has already at- tracted attention with a sensational announcement. At the end of February, it was announced that they expect the takeover of Lekkerland (sales volume: 12 billion euros) to push Rewe Group’s revenues above the 70-billion-euro mark in 2020, thereby moving it up to second place in the European rankings, overtaking Aldi and Carrefour.

It is only a short journey from Cologne to Düsseldorf, but the strategies of the retailer cooperative Rewe and the C&C veteran Metro could not be more different. While Rewe withdrew from foodservice wholesale more than ten years ago when it terminated its joint venture with Coop CH, Metro gradually separated itself from all retail formats and currently presents itself as a flawless 360-degree wholesale company with gastronomy as its main target group. The statement of the Metro communications department shows how the Metro headquarters assesses the Corona problem.

The last major step of the Metro structural reform, name- ly the sale of the Real hypermarkets, bears the signature of the new Metro major shareholder Daniel Kretinsky. At year-end 2020, the Czech investor announced that his EP Global Commerce already owned more than 40% of Metro’s common shares. The German competition author- ity had a say in the allocation of Real locations to the pro- spective buyers. In the end, Kaufland was awarded the largest and Edeka the second-largest package of locations, but smaller potential buyers such as Globus stores also had a chance.

One thing can already be said: in the Corona year 2020, German supermarket and discount retailers have per- formed better in the Champions League of their sector than their market competitors from France (Carrefour, Auchan) and Great Britain (Tesco, Sainsbury). Tesco with- drew from Poland, while Carrefour landed an acquisition coup in South America at the beginning of the year. The Ahold Delhaize Group, the market leader in the Nether- lands, recently performed very well and made substantial gains in its online business due to the tailwind caused by Covid.

The second insight is that when some companies are ex- panding at a rapid pace and competitors are doggedly de- fending their market shares, price competition, which was relatively moderate in 2020, will inevitably intensify. The discounters in particular, who suffered from weak custom- er footfall in 2020 as a result of the Corona crisis, will rely in 2021 on the increased influx of those consumer groups who, as victims of the crisis, have to make do with lower incomes. When the discount wave rolls in, the promotion and private label waves will follow on its heels. This will also happen in the online retail sector.

THESIS 3: THE CORONA MESSAGE: REGIONALIZATION MEANS TO GO BACK TO THE ROOTS

Consumer fears, fueled by Covid, are generating hype of regionality assort- ments especially in fresh food. This trend is influencing global and national supply chains and, at the same time, it controls shopper journeys. The results are one-stop shopping and shop-shifting.

Ciao, globalization, welcome regionalization! Since the out- break of the pandemic, this slogan has found favor with farmers throughout Europe, but also with a growing crowd of consumers. The major grocery chains have stepped up to implement this 2020 megatrend. Purchasing competen- cies are migrating from national headquarters to regional logistics operations so that local buyers can source fresh produce specifically from regional suppliers. At the POS, origin-branded private labels (previously a no-go!), region- al shelves, and promotions with regional specialties com- pete for the shopper’s favor.

There are very different motives driving the regionality hype at consumer and producer levels. Anyone who leaves the home office to quickly buy essential goods for them- selves and their family automatically becomes a local sup- ply freak, and doubly so. People go to the nearest super- market, which is well-stocked with fresh produce, and prefer to buy products from their own region. Because spa- tial proximity stands for greater freshness, because region- al cuisine and regionally produced food–voila!–form a taste alliance, because the short transport routes protect the climate and every patriotic person strives to make a con- tribution to securing the existence of “our farmers”.

For food producers, on the other hand, an awareness of regionality that is firmly anchored in consumers’ minds functions as a kind of emotionally based territorial protec- tion. A border that keeps foreign competition out of their own sales market. It is easy to argue for in terms of eco- nomic policy: Higher domestic food production stands for higher supply security for the domestic population when Corona or a shipping accident in the Suez Canal block and interrupt global food supply chains. And anyway: garlic that smells like home is definitely preferable to the competing product from the Middle Kingdom!

Incidentally, touting regional origin as a flavor plus is an old trick of the branded goods industry. Just think of the famous Piedmont cherry in Ferrero’s Mon Cheri, cham- pagne, Scotch whisky, or Tyrolean bacon.

When a consistent regionality mindset from stable to table, from pork to fork spreads across Europe’s food scene, it is all too understandable that a broad consumer base follows this maxim when planning the route of their shopper jour- ney. In Corona times, the regionality-programmed navigation system issues a clear order: Once a week at the nearby su- perstore to meet the demand for local food and beverages. Market research speaks of one-stop shopping. This saves time, gas money, and greenhouse gas emissions.

One-stop shopping intervenes in the competition between retail formats and shopping places, especially in regions where many employees commute between rural homes and big-city workplaces. In pre-Corona times, people did their weekly shopping at convenience stores on the outskirts of town on Fridays after work on their way home. Now that they are working from home, this practice is becoming obsolete, which is why retail research is talking about store shifting, a shift of food sales to shopping locations close to home and regional shopping centers.

THESIS 4: COVID-19 FIRES UP DIGITIZATION PROCESSES IN FOOD RETAILING

Are the virus and online retail two allies? Smart stores are countering the Amazon offensive with connected retail. However, e-food is still struggling with considerable teething problems in countries with a high density of food retail stores, especially in the GSA region. IT investments, still restrained in 2020, will pick up speed from 2022.

The birthday of digitization in the food retailing can be pre- cisely determined. At 8:01am in the small town of Troy in the U.S. state of Ohio, supermarket cashier Sharon Buchan- an slid a barcoded pack of Wrigley Fruity Juice gum over a barcode scanner that had been installed in the checkout counter the day before. The device beeped and told the price: 69 cents.

That beep was the charming big bang that ushered in the age of digitization in food retailing around the globe. And, incidentally, it also heralded a new era in logistics and marketing cooperation between big branded companies and retail giants. Efficient Consumer Response, or ECR for short, was the name of the alliance that the CEOs of Procter and Wal-Mart agreed on during a joint canoe trip in the 1980s.

Amazon, the rising star of online retailing since the mid- 1990s, landed its first big success by selling books global- ly, but in the last decade it has set its sights on another group of goods with its digital sales machinery: groceries, arguably the most important consumer good of mankind. Amazon acquired the U.S. organic supermarket chain Whole Foods Market in 2017. In doing so, it created the prototype of connected food retail, the interweaving of offline and online food sales. In the U.S., in addition to Whole Foods, the number of Amazon Fresh stores is growing, offering customers a 360-degree supply of fresh food. In the first quarter of 2021, Amazon Fresh launched with two stores.

This offensive set alarm bells ringing among European supermarket chains. The alternatives were to fight back or fraternize. The supermarket chain Morrisons in the UK, the German regional chain Tegut (which has been owned by the Swiss company Migros for several years), the casino subsidiary Monoprix in France, and Dia in Spain opted for a partnership with the US digital giant. The most vehement opponent of Amazon Fresh was the Rewe Group in Germa- ny, which invested massively in the expansion of its e-food service. The Austrian subsidiary of the Cologne-based com- pany is also working on establishing an Amazon Fresh de- fense front and already opened a fulfillment center in the south of Vienna in 2019 for the delivery of fresh food or- dered online.

Corona is fueling households’ grocery shopping and giving online shopping a growth surge at the same time. The busi- ness media are currently abuzz with reports of rapidly grow- ing e-food sales. But hard facts from market research tell a different story. In the German-speaking countries, Internet sales of food reached a market share of just two to three percent in 2020. GfK, for example, reported an online mar- ket share of 2.3% for the FMCG sector (Food & Drug) in Aus- tria in 2020. Food online achieves significantly higher sales shares in Great Britain, France, and the Netherlands.

However, online sales is only one of many digitally powered innovation fields in retail. Year after year, the European Retail Institute (EHI) in Cologne documents the growing importance of IT in offline and online retail. Margins are particularly low in food retailing, which is due to the high density of stores and the continuing advance of discount stores “made in Germany”. This requires meticulous amor- tization calculations for IT investments. Funds for the acqui- sition of self-checkouts, shelf-edge labels, AI-controlled replenishment and the introduction of checkout-free smart stores of the Amazon Go type are still flowing at a sluggish pace this year due to the crisis. But research and planning are already underway because the sales race between the U.S. digital giants and the Euro discount fighters will contin- ue to shape Europe’s food retail scene in the coming years.

THESIS 5: CORONA AND CLIMATE PRO- TECTION: A TOAST TO THE HEALTH OF MOTHER EARTH AND ITS INHABITANTS

Health claim meets climate responsibility. Food retailers are responding to the demand from LOHAS shoppers for healthy, organic, and climate-neutral foods, which has been driven further by Covid. Organic supermarkets and traditional full-range stores are competing fiercely with each other and their rapidly growing premium private-label programs.

Even and especially in Corona times, consumer demand for ecologically sustainable foods is increasing. This con- viction has taken root in consumers’ minds: Sustainable food is also healthy food. Even if this assessment has a hint of esoteric mysticism, it is still a viable working hy- pothesis for food marketing. Since its “discovery” in 2000 by the U.S. sociologist Paul Ray, the LOHAS-type of shop- per, committed to a lifestyle of health and sustainability, has asserted itself as a viable tool for target group seg- mentation, especially in the food business.

Only eco-fundamentalists see LOHAS as an attempt to put a moral cloak around the enjoyment of high-quality food. According to consumer researchers, more than 20% of consumers in Western Europe belong to this group. And Corona is making a lasting contribution to increasing its membership. The LOHAS community is described as an urban, predominantly female, financially well-off target group. Increasingly, seniors who want to stay young are joining the LOHAS convoy. LOHAS and Corona fears are also an ideal match because natural science states a closeconnection between the ecological fall from grace of the Asian wet markets and the outbreak of the murderous pandemic.

Organic foods are proving to be the perfect match for LO- HAS quality demands, especially in times of Corona. The organic boom is being pioneered on the one hand by the now sprawling assortments of organic private labels in large supermarket and discount chains, and on the other hand by independent-store type of organic supermarkets, one of whose best-known representatives is the Amazon subsidiary Whole Foods. Organic is no longer exclusively available at the premium price level; affordable organic products in the mid-price range are opening up a promis- ing market niche. It is remarkable that the organic market derives its dynamism neither from agriculture, nor from in- dustry or consumers, but primarily from the food retail sec- tor, which has fought for a degree of independence from the branded companies with its own organic brands.

Recently, the eco-megatrend has spawned other sustain- able food ranges that go far beyond organic. Should Coro- na one day be defeated, or at least contained, climate change remains the major challenge facing humanity in the coming decades. That’s why the supply of climate-neutral food has swelled into big business in a very short time. Again, the food retailing is setting the pace. Aldi, and Lidl, Edeka and Rewe are outbidding each other with climate protection initiatives, programs that also include the purchase of greenhouse gas certificates. Also on the agenda is the expansion of the range of animal welfare products, vegetarian meat substitutes, as well as sugar-free and palm oil-free foods.

Dynamism in food assortments is therefore guaranteed. Innovative startups are constantly discovering new nich- es. Full-range retailers and organic specialty stores are competing for competence leadership, but store designs are becoming more and more similar.

Food that protects against Corona will probably remain a pipe dream in the future. But food that is healthy for peo- ple and healthy for the environment also has its significant value and helps to better endure the adversities of Corona.