By Moritz Felix Lück

The published opinion in Germany, and presumably elsewhere, appears unanimous in the belief that the end of present-day mobility concepts is near. This future scenario has guided us for years, sometimes more, sometimes less loudly posited. Driven by the climate debate, by climate activists, and, most importantly, by EU regulations on pollutant emissions, there is increasing political will to replace internal combustion engines with alternative drives.

Electric drives are currently at the forefront of discussion, and in some countries, such as Norway, they are already being massively promoted and have successfully established themselves. In Germany, it has become increasingly apparent that there is an agenda driven by politics as well as by automobile manufacturers to focus on e-mobility as a model for the future. If this development were to actually happen, electricity would become the new oil and would, therefore, become the focus of public interest.

This would open up opportunities for retail real estate. The combination of shopping and refueling has been established for decades, particularly in the retail park segment, as many of the locations have a filling station as a tenant. In the future, the “Shop & Charge” model will offer excellent opportunities to continue the concept and provide consumers with additional benefits.

Charging times for batteries are much longer than the traditional process of filling up with gasoline or diesel, and this is not likely to change in the near future. In contrast, the power grids are not technically designed to equip all households with charging boxes, especially not with fast chargers. As a result, there will be a need for public charging points where charging time can be used sensibly and efficiently. Shopping centers are precisely such places. Retail real estate, which is used to supply goods for daily needs, offers a particularly good side activity when charging a car, which customers will likely appreciate as it saves time.

Claims are Staked Today

In the last two to three years, specialized providers of e-charging infrastructure have set out to secure space for selected retail properties. The primary focus has been on locations situated close to motorways. So far, both the major energy suppliers and the local utilities have been rather reserved. However, the more apparent it becomes that e-mobility is politically desirable, the more providers of charging infrastructure will appear on the stage.

Real estate owners are usually offered the option of setting up and operating charging infrastructure free of charge. Depending on the provider, those who negotiate also receive a small fixed rent or a share of the turnover from the electricity sold – usually only above a certain threshold value. Some crafty providers sell the charging infrastructure to the property owners, claiming that it will pay off faster thanks to a higher participation in turnover. Other providers install and operate systems for the owner free of charge, but do not pay rent on the grounds that the additional footfall also generates extra revenue for retailers and restaurateurs. A large number of the nationally active suppliers who have equipped locations as part of this wave have done so in order to take advantage of EU subsidies. With the expiry of EU subsidies, the expansion of charging infrastructure has declined once again. This is not particularly profitable for property owners. The next wave in the installation of charging infrastructure should be used to benefit their properties.

A Market with Great Potential

As a usual, at the outset of this new economic model, it will be unclear exactly what investors will consider to be reasonable rents. However, it will also be a matter of evaluating the customer loyalty effect and the possibility of acquiring genuinely new customers. There are numerous business models for providers of charging infrastructure.

In any event, for a charging infrastructure of, for example, eight charging points, an average 4-digit amount per year is possible as a fixed rental fee, plus a share of the turnover from the first kilowatt hour sold. Revenue share will not be particularly appealing over the next few years, but if the market picks up, good earnings can be achieved. This will distribute risks as well as opportunities. A few figures concerning the market potential.

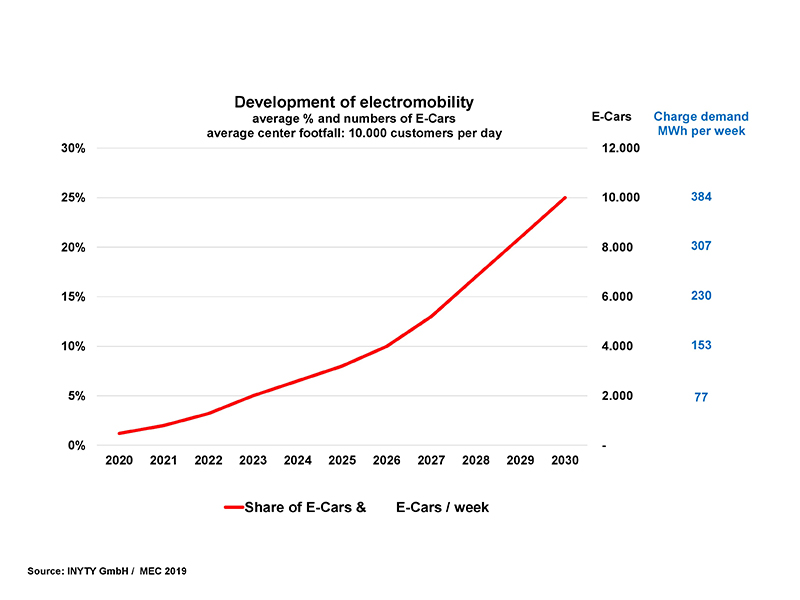

Retail parks tend to be traditional motorist locations. Based on estimates provided by the Federal Motor Transport Authority, the graph shows how the proportion of e-cars at a retail park that attracts an average of 10,000 visitors a day might develop. According to the graph, by 2030, the share of e-cars will be 10,000 e-cars per week, which corresponds to a share of 25 percent. On the far right, the total charging requirement that all e-cars would have at the location can be seen.

An electric car with a mileage of 12,500 km per year requires approximately 2,000 kWh of electricity per year. 1,000 electric cars, in other words, require 2,000 MWh per year or 38 MWh per week. This illustrates, among other things, what demand would exist for customers who do not have home loading facilities.

Owners of retail properties should, therefore, not be

deceived by claim or location hunters in the emerging market of charging

infrastructure. Retail parks and other retail locations that are used to serve

periodic demand and where customers have longer stays can benefit enormously in

the medium term if e-mobility flourishes.

Strengthening Locations through Photovoltaics

Prior to the full unfolding of the financial potential, a strengthening effect on the trading locations will emerge, as they will attract and retain the owners of e-cars when the charging infrastructure is put into operation. The more widespread that e-cars become, the greater the chances of attracting new customers and retaining existing ones more closely in the long term. Customer loyalty will become of particular significance if charging infrastructure operators can also obtain electricity from photovoltaics (PV) on site.

Such providers install and operate the PV systems free of charge on behalf of the property owner, and an additional rental fee is also included. On sunny days, they will sell PV electricity to customers at a cost-effective price, e.g., from a retail park. The resulting effect on customer loyalty and the acquisition of new customers will be substantial.

This represents a particularly interesting model, especially in the area of retail parks as their customers are very price-sensitive. It is not for nothing that, for a number of years now, there has been an official app that shows the prices per liter charged at filling stations nationwide. In the case of fuel, it only takes a few cents for customers to switch filling stations. How high will the effect be if charging electricity is then offered more cheaply, with significant price differences? Combined with the national incentive program, it will make charging infrastructure in conjunction with PV systems attractive. This will be particularly true if it is a model in which the property owners do not have to pay commercial tax, as they have nothing to do with this. They simply lease the space. The perceived ecologically-friendly image that a location also earns will be the cherry on top.