Written by

Peter Sempelmann

Something fundamental is changing in how people decide where to shop, dine, meet, and spend their time. Their expectations are shifting. When they visit a physical place today, experience a determining factor, and often the most important factor for satisfaction.

Thus, experience has become the defining currency of successful retail destinations. A central value driver for investments and opportunity for the real estate sector. When traditionally investors asked: “What are the rents? What’s the footfall?” They now should also be asking: “What does the experience feel like? Why would people return?”

High Experience Demand on Real Estate

The recent JLL’s 2025 Consumer Experience Survey, published in October, shows, that experience factors play a key component in development strategies to achieve premium rental values and enhance return on investments.

For corporate occupiers and tenants, experience-led design can support talent attraction, increased footfall and spending, and consumer and employee satisfaction. As experience-led developments become more commonplace, the expectations on existing assets are also rising and experience is emerging as a key factor in obsolescence risks. So, the math is easy: Experience equals resilience.

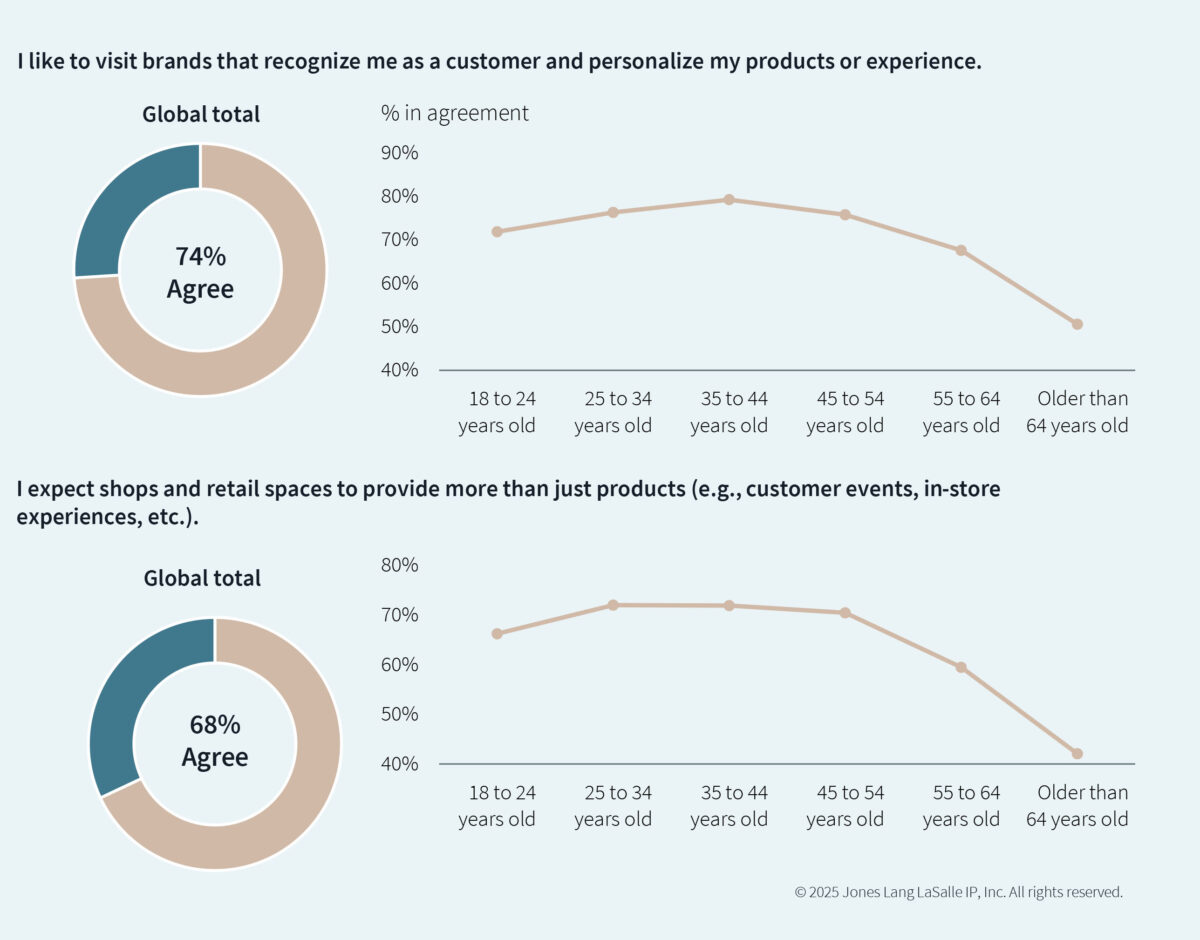

Globally, expectations of experience are high. Assessing combined responses to ‘experience seeking’ indicators shows that over two thirds of people expect experience to be integrated into the places where they like to shop and spend their money.

Consumer willingness to pay premiums for high quality experiences has grown from 65% in 2024 to 68% in 2025, with income and generational factors indicating this will continue.

68% of Consumers are Willing to Pay More for Better Experience

Experience, the Deciding Factor

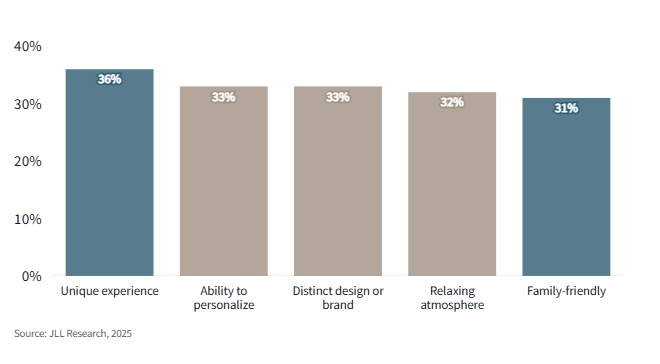

The JLL report also shows that people are increasingly choosing destinations based on the quality of experience rather than convenience alone. People seek more from their built environments. In fact, the JLL research shows that “Unique experience” is the key factor to drive return visits into a retail destination. Even more important than a distinct design or brand, a relaxing atmosphere or a place being family-friendly.

Factors which Drive Return Visits to Retail Destinatioms

Moreover, 64% prefer high-quality experiences over proximity. This highlights a shift from the assumption that “being close” is enough to guarantee footfall. The reality is: if the experience doesn’t justify the visit, people simply won’t go. Experience has moved from nice-to-have to non-negotiable.

And people are not only voting with their feet – they are willing to pay for what they value. 69% of global consumers prepared to spend more for a high-quality experience.

Values Shape Choices as Much as Convenience

One of the most important findings in the survey is how strongly consumers connect experience with personal values. The data shows that 69% look for experiences aligned with their own values, and 68% prefer products that come from their local region. Meanwhile 66% actively support local businesses over international brands. Ecoconsciousness is a growing driver especially among younger generations. Luxury and high-quality experiences remain somewhat a priority, but more important is the increased personalization of products and services.

Together, these preferences show how the idea of “quality” is evolving. It is not only about comfort, design, or entertainment. It is increasingly about whether a place feels responsible, local, and socially rooted. In other words, the emotional and ethical dimension of experience now plays directly into commercial outcomes.

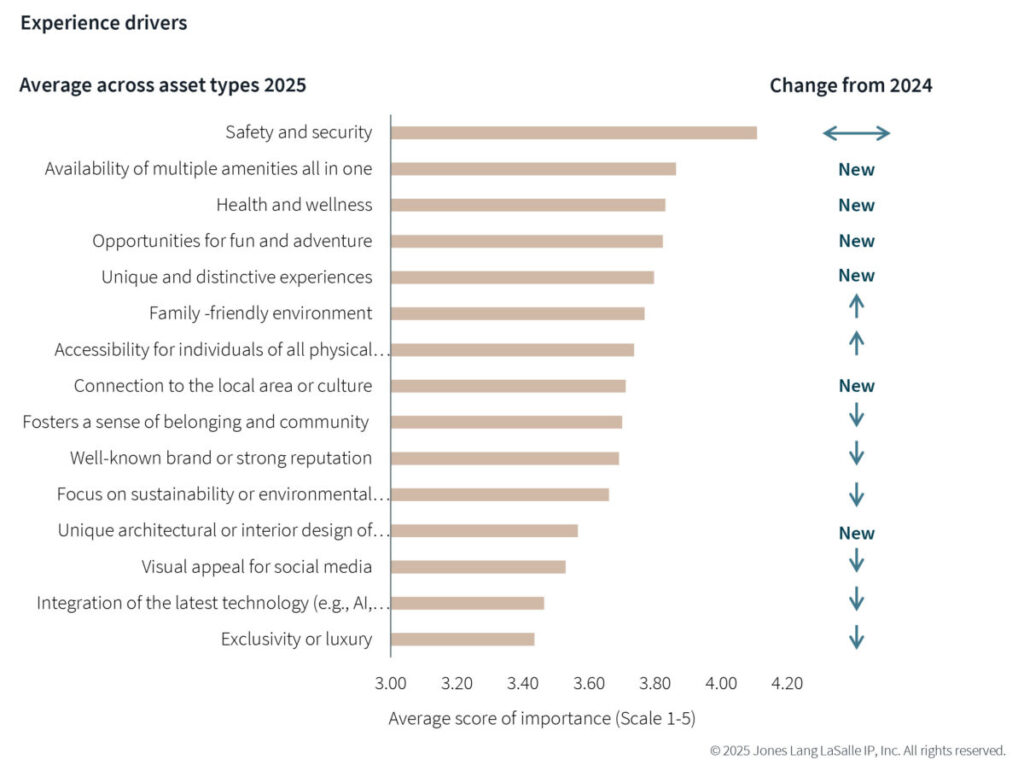

But nevertheless, safety and convenience remain the top ranked experience drivers, together with uniqueness and fun. Highlighting the growing challenges of delivering often competing demands.

Desire for Consitency and Variety

Within the built environment, consumers want to be loyal and benefit from the convenience of mixed-use developments, but they also have expectations of baseline experience factors which need to be delivered consistently.

While 60% of consumers say that they prefer to return to familiar places and 73% prefer to visit multi-purpose destinations, this commitment is not unconditional and requires places and brands to build trust through consistent delivery, accessibility, and meaningful interactions.

Critical value drivers for building trust in developments are personalization (74% prefer brands that remember them), ethical practices (66% value ethical sourcing), and contribution to local community & business ecosystems (72% expect businesses to contribute to local communities).

Experience Drivers

The ranking of experience drivers in 2025 underlines the need to balance both convenience and dynamic experiences. The importance of accessibility and convenience is second only to safety and security, as 69% rate ‘availability of multiple amenities in one place’ as very or extremely important for leisure destinations, and 67% for retail destinations, scoring this second highest in importance across all asset classes.

Following this, the top-rated drivers for experiences are wellness, uniqueness and opportunities for fun, representing the complexity of expectations. Family-friendly and inclusive spaces are also reported higher experience drivers, while traditional differentiators like exclusivity, technology, and social media appeal have declined in importance from 2024 to 2025.

Balancing the varied and sometimes competing experience demands requires developers, occupiers and tenants to consider both design strategies and operational strategies.

Sustainability as a Lived Experience

It is also notable how sustainability influences experience preferences. A majority of respondents link wellbeing, environmental quality, and local identity to the attractiveness of a place. People want more than eco-labels; they want environments where sustainability is tangible.

The survey shows:

- 73% say greenery around workplaces improves their wellbeing,

- 71% want to live in healthy cities, and

- 67% care about ethical sourcing.

These numbers suggest that sustainability has become an experiential category in its own right. Green spaces, natural materials, local supply chains, and ethical operations are not only “ESG features”. Instead, they directly shape whether people enjoy spending time in a destination.

What Successful Destinations Need to Deliver

Because expectations differ by purpose, the survey paints a nuanced picture of what draws people to different types of places:

- Restaurants need to offer atmosphere, relaxation, and a sense of ease.

- Retail environments need to deliver personalization, ethical standards, and convenience.

- Cultural venues need distinctive design and a sense of exploration.

- Entertainment spaces need to minimize friction and maximize enjoyment.

This means the design, operation, and programming of mixed-use destinations must accommodate multiple emotional modes. A single undifferentiated environment won’t succeed. People expect spaces to shift with them throughout the day.

Experience and Value Creation

For landlords and investors, the survey leaves little doubt: experience quality has become a decisive factor in asset performance. Well-designed experiences can drive dwell time, increase spending, strengthen tenant performance, and ultimately raise asset resilience. Conversely, failing to invest in experience widens the “experience gap,” increasing the risk of obsolescence.

The opportunity is equally clear: People are not turning away from physical places. But they are redefining what makes those places worth visiting and what kind of experience they want. This includes strong local identities, authenticity and sustainability.

Many assets were built for older patterns of behavior. Retrofitting them to meet new expectations will require investment, creativity, and operational agility.

Opportunity Areas

- Unlocking value and future-proofing capital investment. Experience strategies provide an opportunity to deliver additional value from investments. Balancing dynamic experience demands within cost efficiency and portfolio optimisation programs requires innovative and data-driven approaches to design and experience strategies but can unlock enhanced value from investment for both new build and existing assets.

- Designing for flexibility and change. More dynamic experience demands require flexible design solutions with potential greater upfront costs. Investing in flexibility should focus on building infrastructure and systems and modular fit-outs to support future reconfigurations. Developers and occupiers should also consider flexible leasing or space programming as part of long-term plans.

- Focus AI investment on enhancing physical spaces. AI in real estate provides greater opportunities to create intelligently integrated environments where technology operates invisibly, balancing digital enablement with authentic experiences. Technology strategies should incorporate the physical and digital and utilise emerging AI solutions to better integrate physical and digital experiences

Research Approach & Methodology

Building on the foundational insights from JLL’s inaugural 2024 Consumer Experience Survey, the 2025 edition captures the evolving aspirations and expectations of consumers within the commercial real estate context, demonstrating that ‘experience’ has solidified its position as a fundamental value driver in real estate decisions. For the 2025 Consumer Experience (CX) Survey, JLL partnered with Oxford Economics to conduct the survey with expanded global research across 19 markets and 64 cities, gathering insights from 12,000 respondents.