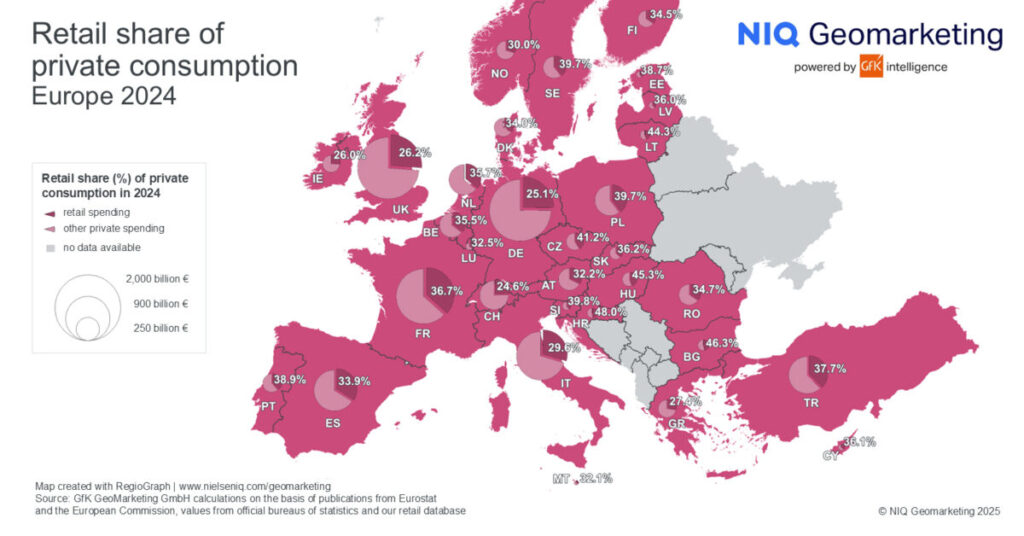

Although purchasing power and retail turnover are rising across Europe, the proportion of consumer spending directed toward retail has been steadily declining for the past three years. In 2024, retail accounted for just 32.6 percent of total private consumption, underscoring this ongoing trend. However, regional differences remain significant. Consumers in Eastern European countries, in particular, allocate a considerably larger share of their purchasing power to retail.

Among the 27 EU member states, Croatia leads with a retail share of 48.0 percent, marking a 0.5 percentage point increase compared to the previous year. Bulgaria (46.3 percent) and Hungary (45.3 percent) follow, although both recorded slight year-on-year declines. This is attributed to rising purchasing power, which enabled consumers to allocate more funds to savings or non-retail expenditures. At the other end of the spectrum, Germany reported the lowest retail share in the EU. Only one out of four euros was used for retail purchases, with just 25.1 percent of private consumption spent in retail.

In the free European retail study, NIQ Geomarketing examined the key indicators of the European retail sector for the year 2024. The study offers trend analyses for numerous European countries, offering a valuable point of reference for retailers, investors, and project developers.

Additional key results of the study at a glance

Purchasing power: In 2024, purchasing power across Europe continued to grow, albeit at a noticeably slower pace than in the two previous years. The average per capita purchasing power in the EU reached 21,008 euros, representing a nominal increase of 3.0 percent compared to revised 2023 figures. In total, residents of the 27 member states had approximately 9.5 trillion euros at their disposal for expenses such as food, retail purchases, housing, services, energy costs, private pensions, insurance, vacations, and mobility.

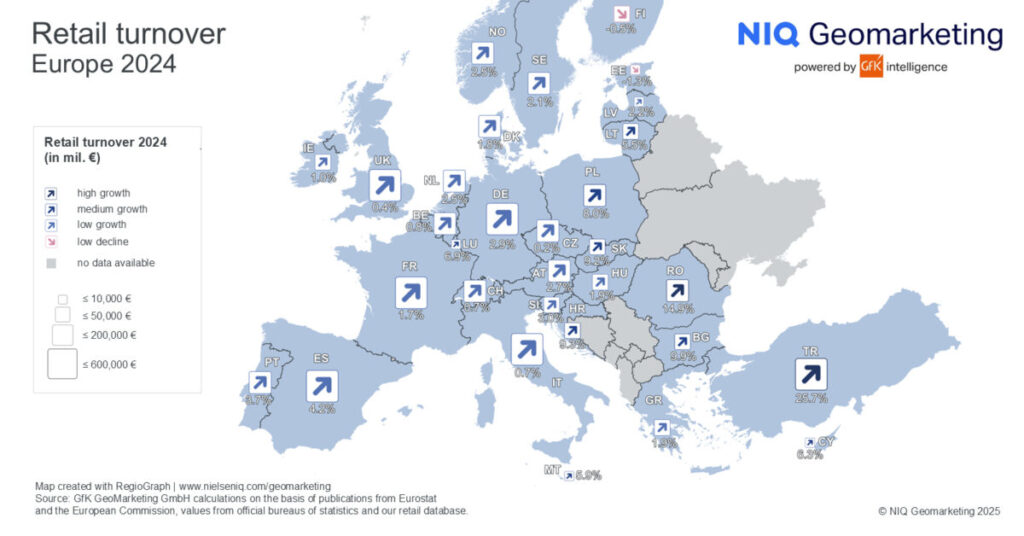

Retail turnover: After a robust 5.5 percent increase in 2023, the growth rate of retail turnover in the EU moderated to just 3.0 percent in 2024, reflecting a broader normalization of consumer behavior and market dynamics following the post-pandemic recovery. The strongest gains were recorded in Eastern Europe, led by Romania (+14.9 percent), followed by Bulgaria (+9.9 percent), Croatia (+9.3 percent), and Slovakia (+9.2 percent). In contrast, Estonia saw a 1.3 percent decline, largely due to political uncertainty and rising consumer skepticism.

Inflation: After sharp price increases in recent years, inflation across the EU showed further signs of stabilization in 2024, averaging 2.6 percent. The highest rate was recorded in Romania (5.8 percent), followed by Belgium (4.3 percent) and Hungary (4.0 percent). At the other end of the spectrum, Lithuania reported the lowest inflation, at just 0.9 percent. The 2025 forecast for the EU is 2.3 percent.

How generations shop: Across Europe, generational differences in consumer behavior can be observed. Generation X (ages 44–59) holds the highest purchasing power and is relatively open to trying new products – more so than Baby Boomers (60+), but less than Millennials (28–43). Millennials favor at-home experiences such as cooking and entertainment, reinforced by the pandemic. Generation Z (under 28) is highly convenience-driven and frequently purchases food-to-go. Boomers remain the most cautious, opting for private labels, focusing on essentials, and making purchase decisions based on promotions to save money.

You can download the GfK study here: