Across Europe, generational differences in consumer behavior can be observed. Generations are not only shaped by their age but by their collective experiences and socio-economic conditions as well. Generation X (ages 44–59) currently holds the highest absolute purchasing power in most European countries. In France, however, Baby Boomers (ages 60+) remain the most influential group in terms of spending, which is largely attributed to the economic stagnation during Gen X’s formative years, particularly the impact of the oil crisis, which limited their financial development compared to other regions.

Each generation brings distinct values and consumption habits, shaped by the socio-political and economic environment of their youth. Generation X tends to be more open to trying new products than Boomers, though less so than Millennials (ages 28–43). They are also more willing to pay a premium for early access to innovations, especially when they offer practical benefits, such as time savings or improved performance.

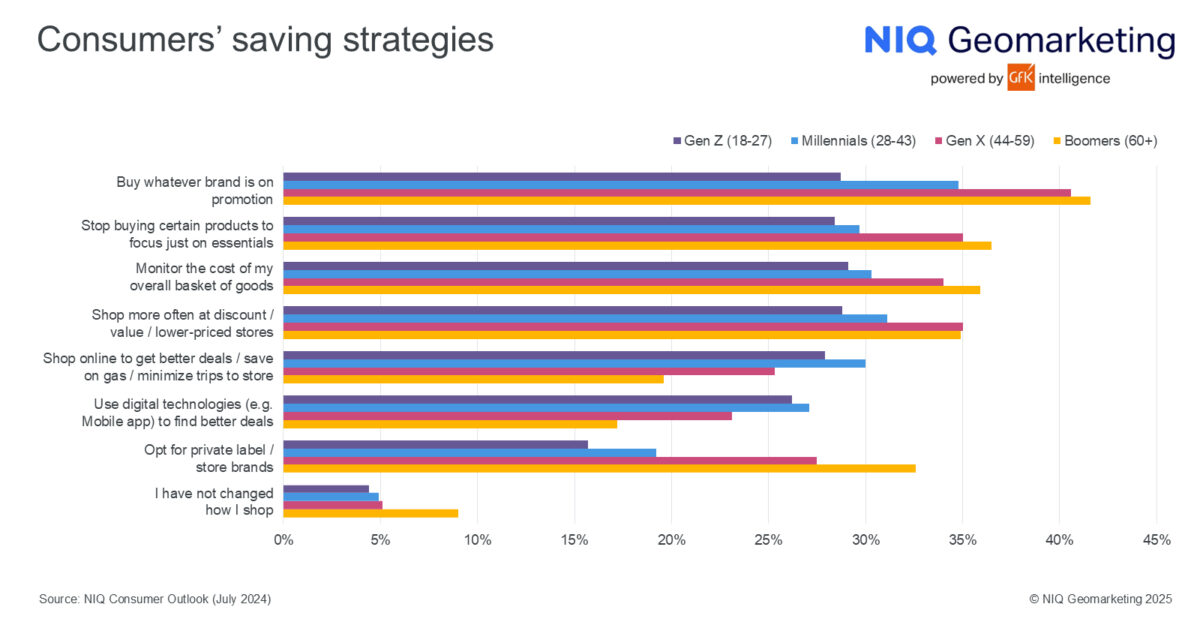

Millennials, on the other hand, are the most willing to invest in durable goods and are highly motivated by sustainability. Their preference for at-home experiences – such as cooking or entertainment – was reinforced by the COVID-19 pandemic, which reshaped their spending priorities. A closer look at generational online shopping behavior reveals that online shopping for better deals, on the other hand, is more reserved for the youth. Millennials go online to get better deals or use mobile apps to find better deals.

Boomers, in contrast, are the most cautious generation in the face of global uncertainty and inflation. They are more likely to switch to private labels, focus on essentials, and make purchasing decisions based on promotions.

While fresh products remain important to them, they are also more likely to reduce consumption of these items if prices rise.

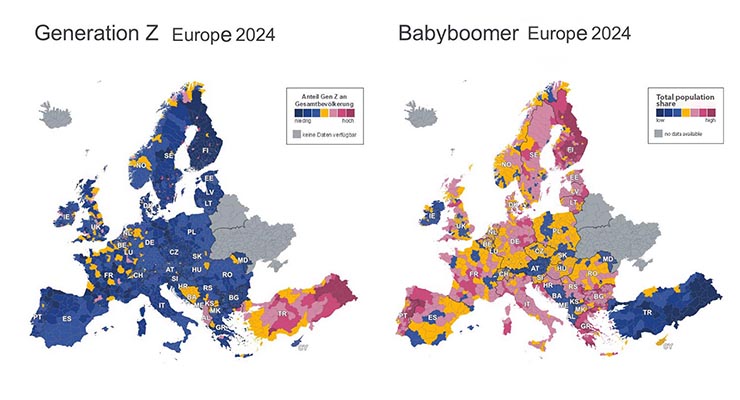

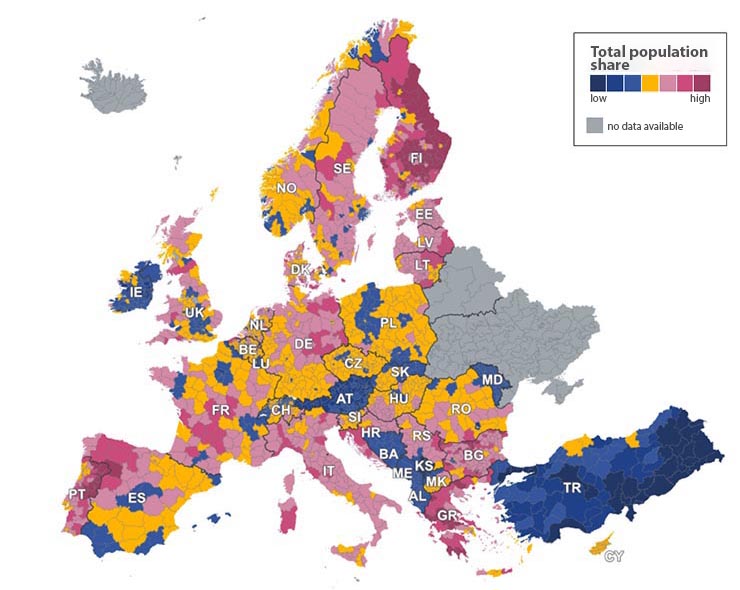

Boomers in Europe 2024

Regional demographic data reveals significant differences in generational distribution across Europe. Scandinavian and Balkan countries have a higher share of Boomers relative to their total population. In Germany, a clear East-West divide is visible, with eastern regions having older populations and fewer children.

Similar demographic dynamics can be observed in countries such as Romania and Bulgaria, where aging populations and lower birth rates also shape the generational landscape. In Spain, the northern regions have a high concentration of Boomers, while the capital, Madrid, has a comparatively lower share.

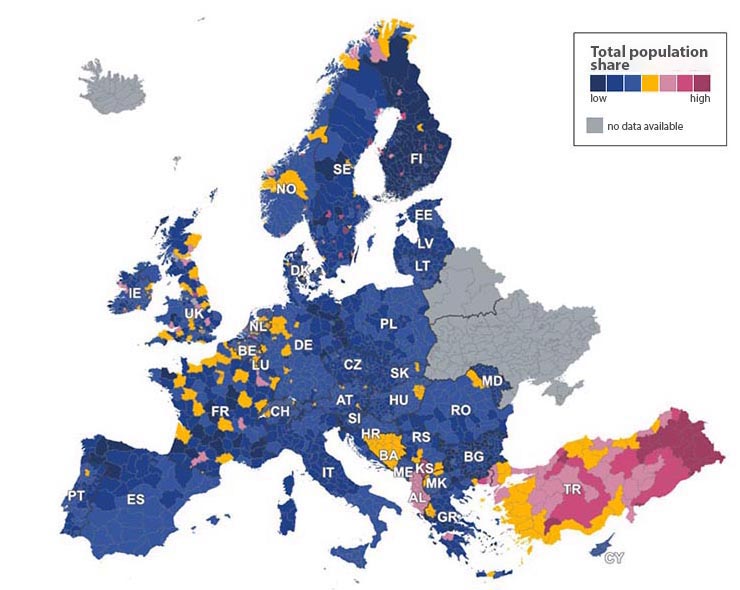

Generation Z in Europe 2024

This regional age distribution strongly correlates with differences in online affinity and online shopping behavior. In Spain, 56 percent of the total population reported having made an online purchase, but a closer look at socio-demographic segments reveals significant disparities. Among individuals with low formal education, only 20 percent reported online purchases in the past three months, compared to 45 percent with medium and 55 percent with high education. These differences become even more pronounced among younger consumers: In the 16–24 age group, 81 percent of those with high formal education reported buying online, while the figures drop to 68 percent for those with medium and 47 percent for those with low education.

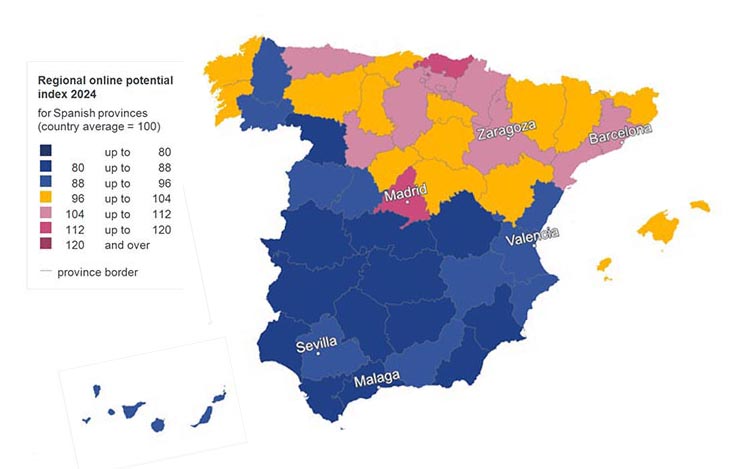

Regional Online Potential Spain

These trends are consistent across Europe and highlight the importance of tailoring digital retail strategies to both generational and educational profiles.

Regional data highlights a strong correlation between younger populations and digital affinity in metropolitan areas. In Spain, the capital stands out with the lowest share of Boomers nationwide and an online affinity approximately 15 percent above the national average. Similarly, Gipuzkoa exceeds the Spanish average by nearly 17 percent.

In Germany, cities like Munich, Duesseldorf, and Regensburg – home to the country’s youngest households – also demonstrate the highest levels of online affinity nationwide.

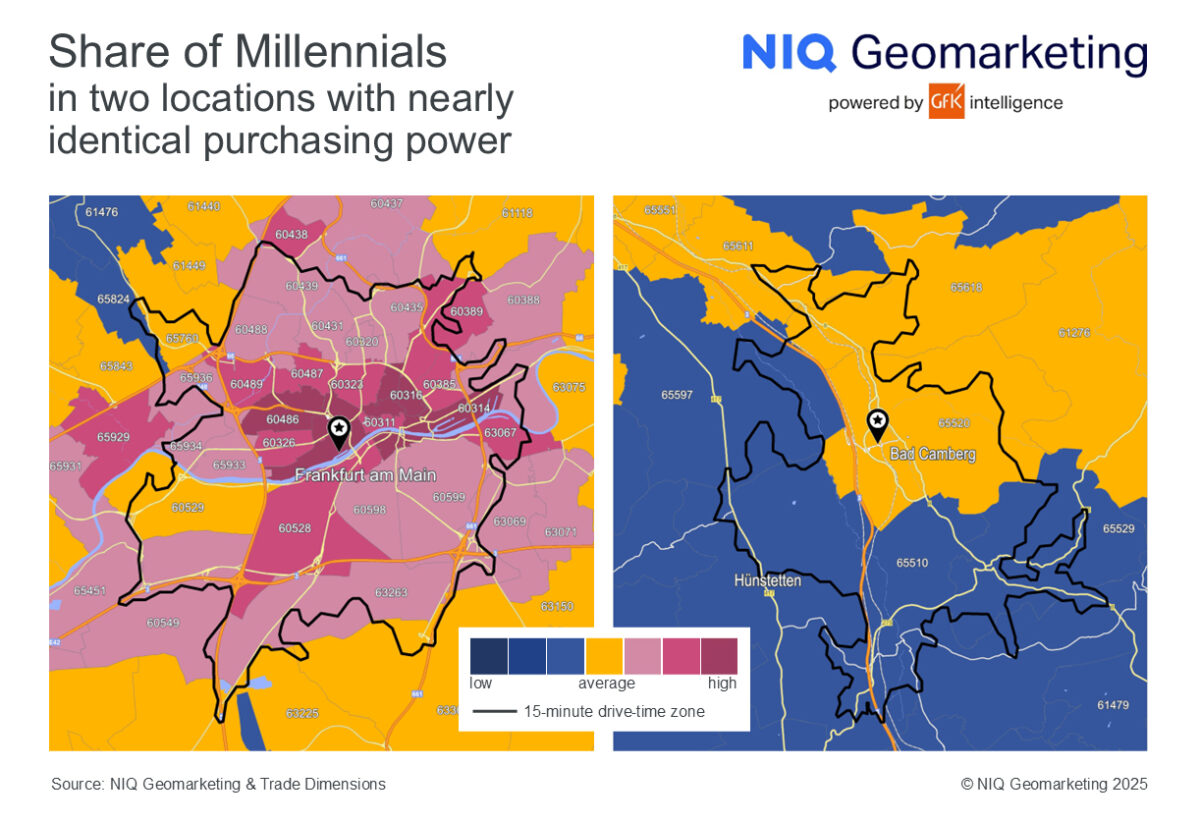

Generational data also provides valuable insights at the store level. For example, a comparison of two German retail locations in the Frankfurt area shows nearly identical purchasing power. Both locations have a purchasing power of 29,133 euros per capita, which is five percent above the national average.

The citycenter store, located in a modern waterfront development, is primarily frequented by Millennials (23 percent) and Gen X (21 percent), making it ideal for innovation-driven product placement and digital engagement. In contrast, the suburban store, where 30 percent of the population is aged 60 and above, is dominated by Boomers. Here, the focus should shift toward price-sensitive assortments and a strong emphasis on fresh product offerings tailored to the preferences of an older, more conservative consumer base.

These generational and regional differences have direct implications for retail strategy.

- Boomers, often living as empty nesters in suburban areas, tend to be more conservative in their spending.

- Millennials and Gen X are typically in active parenting phases, with needs shaped by family life and time constraints.

- Gen Z (under 28) is highly convenience-driven, with 77 percent purchasing food-to-go monthly, compared to just 33 percent of Boomers.

These preferences are also reflected in coping strategies for rising prices: Younger generations are more likely to cut back on discretionary items like alcohol or fresh meat, while Boomers are more likely to reduce their consumption of fresh produce.